Koonenberry does the hard yards to line up another monster NSW gold find

Koonenberry is mapping out two large gold prospects at Prince of Wales, near Gundagai in central NSW. Pic: Getty Images

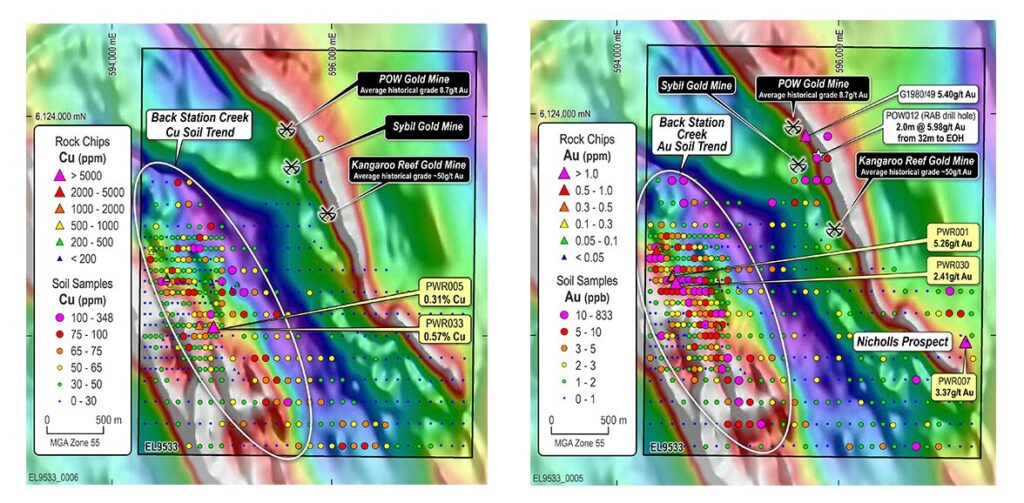

- Soil samples and rock chips have outlined potentially large epithermal and porphyry gold and copper targets at Koonenberry’s Prince of Wales Project, NSW

- Rock chips upwards of 2g/t found at 2.5km-long Back Station Creek

- 800m by 300m anomaly at Sybil, near historic underground shafts

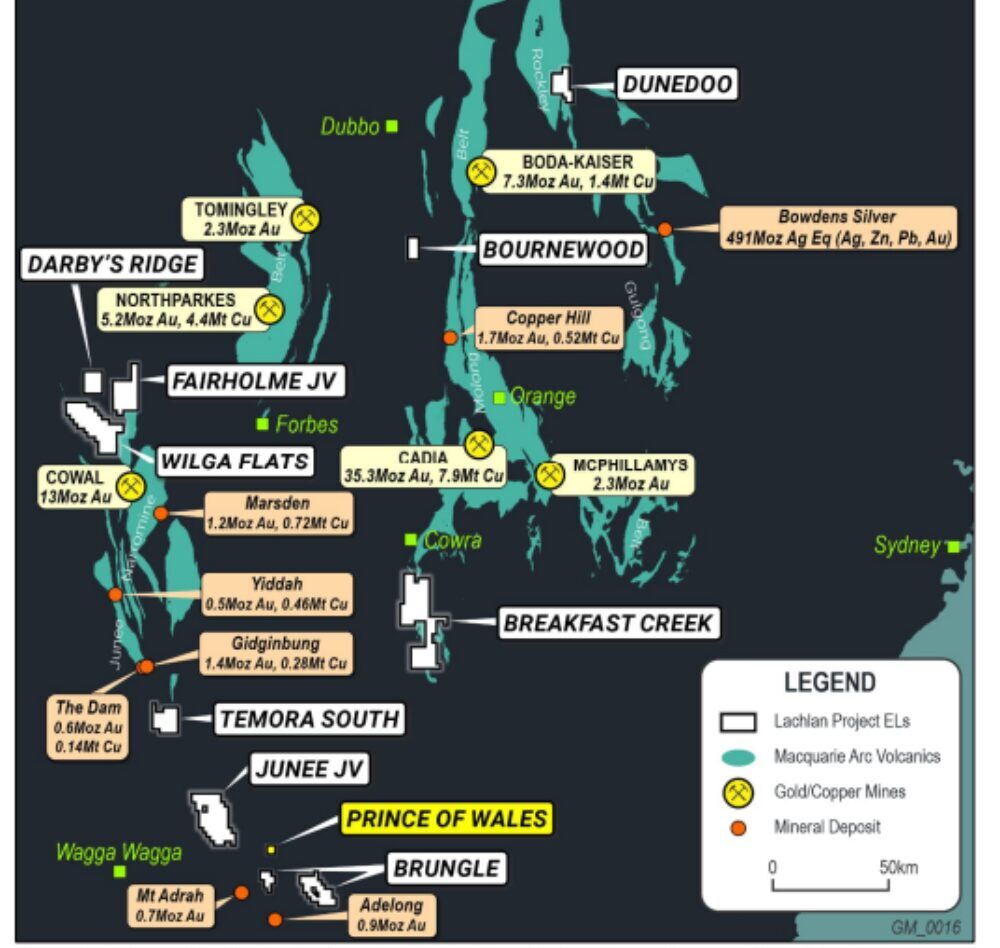

Special Report: Koonenberry Gold has inked a 160% gain year to date on thick, high-grade gold hits at its Sunnyside prospect in New South Wales. But could it be sitting on another potential monster find in the Lachlan Fold Belt?

Geochemical sampling at Koonenberry Gold (ASX:KNB) Prince of Wales project, 5km from Gundagai in NSW’s Lachlan Fold Belt, has uncovered a large +2.5km-long gold in soil anomaly at the Back Station Creek prospect.

Averaging more than six parts per billion gold with a peak value of 112ppb, the most recent rock chips from the project have outlined large-scale epithermal or porphyry gold and copper targets that have never been drilled.

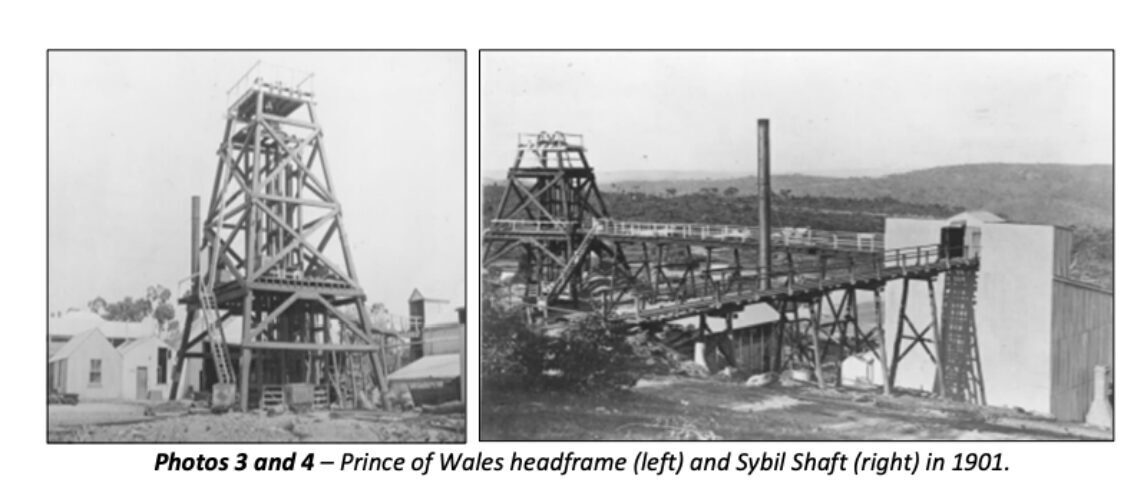

An ~800m by 300m gold-in-soil anomaly above 6ppb with peak gold grades of 349ppb has also been picked up at Sybil, adjacent to the POW and Sybil mines, which delivered 26,600oz at 8.7g/t Au in the early 1900s with workings down to 170m below surface.

“These results highlight the prospectivity of our Prince of Wales Project, where we have now defined two separate trends,” KNB managing director Dan Power said.

“We can see a gold +copper trend at Back Station Creek extending over 2.5km in length and considered prospective for epithermal gold plus base metals as well as copper-gold porphyry systems, and a gold trend at Sybil extending over 800m in length which remains open in multiple directions.

“Despite historic gold production of 26,000oz at 8.7g/t gold, the project has received no systematic or modern exploration.

“We are keen to advance our understanding of this project and will plan work to help refine targets prior to drill testing, with a strong cash balance to enable this work.”

Cashed up and ready to go

Koonenberry’s cash balance is indeed no joke, with $10.35 million cash at bank allowing KNB to focus on drill targets across multiple projects.

Once you include the company’s Junee and Fairholme JVs with Newmont, where the world’s biggest gold miner is spending million on exploration, investors are starting to get massive bang for their buck.

Over at Prince of Wales, KNB has taken 272 soil samples on a 200m by 100m grid and picked up 24 grab, outcrop, float and mullock rock samples from Back Station Creek and Sybil.

The best gold and copper rock chips from Back Station Creek include 2.41g/t and 0.06% copper in sample PWR030, identified in subcrop, with another rock chip from historical workings at Kimo returning 0.57% copper and 0.08g/t gold.

That adds more smoke around a potential fire after previous results of 5.26g/t and 1.86g/t Au from Back Creek.

Phyllic (sericite-quartz-pyrite+/-chlorite-carbonate) hydrothermal alteration assemblages associated with the gold in soil anomaly at Back Station Creek, with disseminated limonite and localised limonite rich veining are also considered consisted with the outer expression of a gold-copper-molybdenum porphyry system.

Rock chips from Kimo, meanwhile, have provided evidence of an intrusive complex, KNB says.

At Sybil, high tenor gold in spoil results of up to 349ppb are paired with strong 8.75ppm tellurium and 3.45ppm bismuth results, pathfinders for gold mineralisation.

“Soil geochemical anomalism is associated with the historical Prince of Wales & Sybil gold mines and may extend to the unsampled Kangaroo Reef gold workings ~350m to the southeast,” KNB said.

The new results compare well with Koonenberry’s previous rock chip sampling of 3.37g/t Au and historical rock chip sampling of 5.4g/t Au.

Based on the gold-tellurium-bismuth geochemical signature, KNB’s geos think Sybil is prospective for high grade orogenic, intrusion related and alkalic epithermal gold deposits.

Only 13 RAB drill holes have been completed at Sybil, as well as down dip and along strike from the historic Prince of Wales and Sybil mines, despite one historic RAB hit of 2m at 5.98g/t Au from 32m to end of hole.

Discovery opportunity

In order to outline drill targets, KNB is looking using induced polarisation geophysics while it continues to plan extensional soil sampling and review surface geochem results.

Its aim is to deliver an inaugural drill program later this year.

At 11km2, Prince of Wales is the smallest of 10 KNB-owned projects in NSW, but the presence of historic shafts and limited drilling makes it one of the most intriguing.

KNB has caught the market’s eye of late with results including 174m at 1.83g/t from 0m and 172m at 2.07g/t from 171m at the emerging Sunnyside gold discovery at the Enmore project in northern New South Wales.

This article was developed in collaboration with Koonenberry Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.