Kobada’s oxide-dominant ore could make Toubani the next West African gold producer

Mining

Mining

While gold hopefuls are hardly a rare breed on the ASX, there aren’t many companies that can boast of a prospective project with all the advantages that Toubani’s Kobada project in Mali enjoys.

And the advantages are certainly meaty.

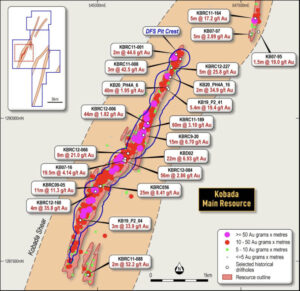

Kobada has already seen some $110m invested by the previous management into exploration, enough to define a resource of 3.1Moz – including 1.71Moz in the higher confidence Measured and Indicated categories, an existing Definitive Feasibility Study outlining low costs, and potential to further grow mineralisation.

But the biggest competitive advantage that the project offers to Toubani Resources (ASX:TRE) is the large inventory of oxide ore which could make it West Africa’s next gold mine.

The depth of oxide mineralisation at the Kobada Main deposit extends to about 65m on average and can reach beyond 120m in some areas of the planned open pit.

Highlighting the value of oxide mineralisation, many significant mines in the region – such as Siguiri, Lefa, Sadiola and Syama – commenced with a successful oxide operation.

The Kobada main resource. Pic: Supplied

Speaking to Stockhead, chief executive officer Phil Russo noted that the large oxide-dominant ore inventory was free digging and very soft rock, which reduces both the capital expenditure and operating expenditure for the project.

Couple that with its relatively large size and location in southern Mali where all the large resource companies and industry are located, and the pieces continue to add up.

“It is permitted, it is very easy to get to site from the capital Bamako and it has had $110m invested in the project to date by the previous management, which had approached the project differently to how the current board and management are approaching its development following Toubani’s listing on the ASX late last year,” he added.

“We have pivoted the strategy and we are full steam ahead trying to implement it with several milestones achieved already this year.”

Mali itself is the fourth largest gold producer in Africa and features a stable and mining friendly jurisdiction with a competitive investment regime.

While more than 150,000m of drilling has been sunk into the project to date, there is still plenty of room for growth as significant gold intercepts run the entire strike length of the project.

Recent exploration drilling highlights this potential, extending the project’s strike extent from 5km to 11km.

“This was reverse circulation drilling, just stepping it out and drilling areas which had never been drilled before to test for new areas of mineralisation,” Russo said.

“So we have been extending out kilometres away from the main resource but the best results of this program were within a kilometre of it with the Kobada West prospect demonstrating continuous mineralisation for 600m, which just shows you the fertility of the ground.”

The exciting Kobada West prospect. Pic: Supplied

Highlighting just how intriguing Kobada West is for the company, drilling delineated continuous, near surface oxide gold mineralisation with notable intersections such as 9m grading 1.72 grams per tonne (g/t) gold including 2m at 6.26g/t gold and 1m at 11.3g/t gold along with 5m at 1.26g/t gold.

It is still early days, but it certainly isn’t hard to envision Kobada West as a potential satellite pit for the Kobada Main deposit.

Russo added that other targets also have the potential to add more ounces with further drilling.

These include the Kobada North 1 and 2 targets that lie directly on the Kobada Shear about 2.3km north from Kobada Main which hosts the current resource.

Initial assays from the company’s drill program have returned results such as 9m at 1.32g/t gold and 14m at 1.02g/t gold at Kobada North 1 and 1m at 8.51g/t gold at Kobada North 2.

While a strong management team is a key ingredient for success in any junior explorer, Russo drew attention to the two most recent additions to its board.

“The first one is Mark Strizek. He’s a geologist who’s known in the industry and was instrumental in Tietto going from IPO to a large gold producer,” he noted.

“He’s joined our board at the same level of enthusiasm.

“And secondly, Scott Perry, who is an ex-World Gold Council member and CEO of large cap mining companies with global operations and multi 100,000 ounce production rates.

“He has a really strong gold pedigree with extensive contacts and network.”

Strizek has more than 27 years of experience in gold, base and technology metals experience across Australia, West Africa, Asia and Europe.

Perry has over 25 years of international senior executive experience with a track record in corporate transactions, project financing and development.

Russo added that the addition of Strizek and Perry to the company highlighted, if nothing else, their belief in the asset.

While Kobada is certainly attractive as it is, Toubani believes that there is significant potential to optimise the project to really take advantage of the oxide-dominant mineralisation and potential to extend existing structures and identify new shear structures.

“Within weeks, we will have an optimisation analysis update due out,” Russo noted.

“We think the project can be positioned bigger and more compelling economically and that’s going to be the first indication that we’re able to talk about that.”

He expects to wrap up exploration soon and feed the results into an update of the DFS by the end of 2023.

“This year and next year, we are going to be finalising the last agreement we have to do with Mali, develop a funding plan and any other exploration spend that we want to undertake before we approach our FID decision in early 2025, if not before” Russo explained.

He added that with all the existing work at the project, the company would seek to deliver these milestones while being as tight with its capital as possible since the deposit is already well drilled out.

“We have changed the board, we delisted from Canada, we have pivoted the strategy, we have bolstered the technical team, we have executed on exploration with new discoveries and now we are optimising the project in the coming weeks,” he concluded.

This article was developed in collaboration with Toubani Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.