Kempfield one of NSW’s largest silver deposits after Argent’s significant resource upgrade

Pic: via Getty Images

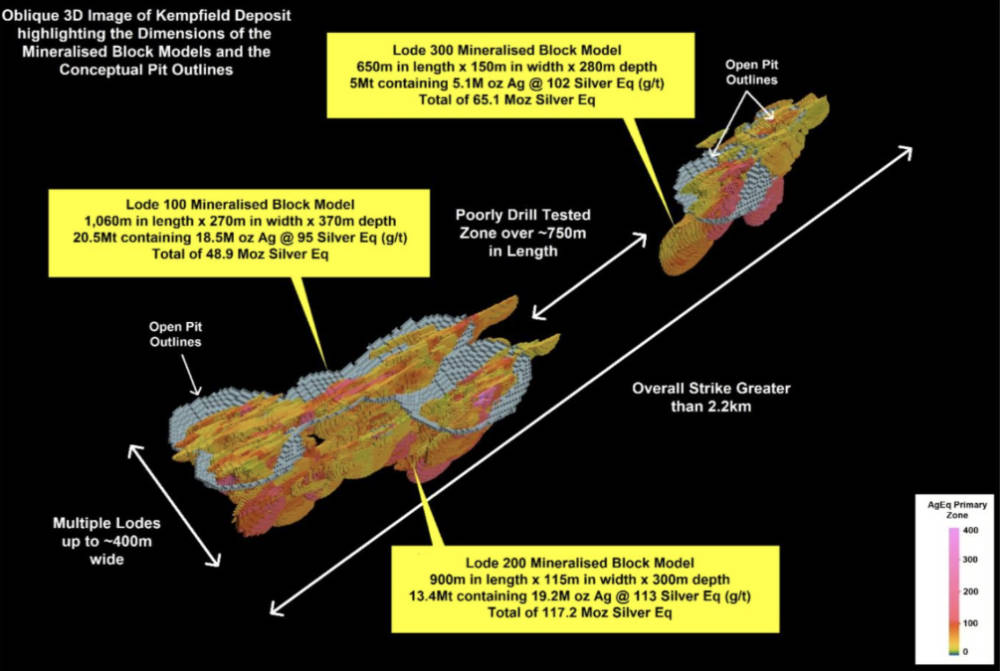

- Kempfield resource upgraded by 28% to 127.5Moz silver equivalent

- Resource is now one of the largest silver deposits in NSW

- Plans are also in place to further extend mineralisation

Argent has well and truly cemented Kempfield as one of NSW’s largest silver deposits after upgrading resources by 28% to 127.5Moz silver equivalent.

Kempfield is a volcanogenic massive sulphide deposit is located within the richly mineralised Lachlan Orogen that extends from northern Queensland, NSW and through Victoria into Tasmania.

It famously hosts Newcrest’s giant +37Moz Cadia Valley gold/copper mine, about 41km to the north of Kempfield.

The region also includes several other world-class copper-gold and gold deposits, such as Northparkes and Cowal.

Argent Minerals’ (ASX:ARD) Kempfield belongs to a peer group of VMS deposits known as the Eastern Australian Palaeozoic VHMS Deposits.

This group includes well-known, rich deposits such as Rosebery, Que River, Hellyer, Mt. Lyell, Sunny Corner, McPhillamys, Woodlawn, Captains Flat and Thalanga, which collectively have been a major source of base metals in Australia for over 100 years.

Reflecting this potential, exploration by the company has identified a growing number of lead, zinc, silver and gold grade trends that position Kempfield as a potential major provider of base and precious metals.

Big resources boost

This potential has now been enhanced further by the company upgrading resources at the project by 28% to 38.9Mt grading 102.4 grams per tonne (g/t) silver equivalent for a contained resource of 127.5Moz silver equivalent.

Adding further interest, most of the resource – 22.5Mt at 109g/t silver equivalent – is contained within the higher confidence Indicated category, which has sufficient data for preliminary mine planning.

Broken down into 42.8Moz of silver, 149,200oz of gold, 181,016t of lead and 426,900t of zinc, this places Kempfield right in the top tier of NSW silver deposits and signals a significant advance towards mine development.

Metallurgical test work has already proven that excellent recoveries of up to 86% and 90% for silver and gold respectively can be achieved using cyanide leach process on ore sourced from the Primary Zone.

Argent notes that the upgraded resource provides a strong foundation for further resource growth through exploration and infilling and extensional resource drilling.

Managing director Pedro Kastellorizos said the exceptional resource estimate upgrade for Kempfield was a major milestone which increases the overall value of the future operations.

There’s more silver where that came from

A data review based on surface and drilling geochemistry along with the interpreted geophysics has also highlighted multiple targets proximal to the Kempfield deposit.

This work has also identified potential feeder structures/faults associated with magnetic highs that are interpreted to potentially control the higher-grade mineralisation within the VMS silver-base metal system.

Argent plans to carry out infill reverse circulation and diamond drilling to test the untested Central Gap Zone area, which has over 750m of strike, with strong soil and rotary air blast drilling results, between the 100 and 300 ore zones.

This zone also includes historical drillhole AKRC169 which returned a 34m intercept grading 36.7g/t silver, 0.6% lead and 1.3% zinc.

Deeper extensional drilling will also target the Central Gap Zone over the 750m strike.

The company adds that the upgraded resource is not closed off and requires further drilling.

Notable targets are the Quarries West, Sugar Loaf, South Conglomerate, Kempfield East and Henry Gold Working zones.

Additionally, high grade extensions in the central and northern areas within Lodes 100 and 300 have been found to run at 250g/t silver equivalent.

This article was developed in collaboration with Argent Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.