‘Just the beginning’: Hot Chili’s Christian Easterday says the Cortadera copper discovery is just warming up

Pic: John W Banagan / Stone via Getty Images

Special Report: Hot Chili managing director Christian Easterday is bullish about the potential of the Cortadera copper-gold discovery in Chile, which has been the focus of the company’s recent exploration efforts.

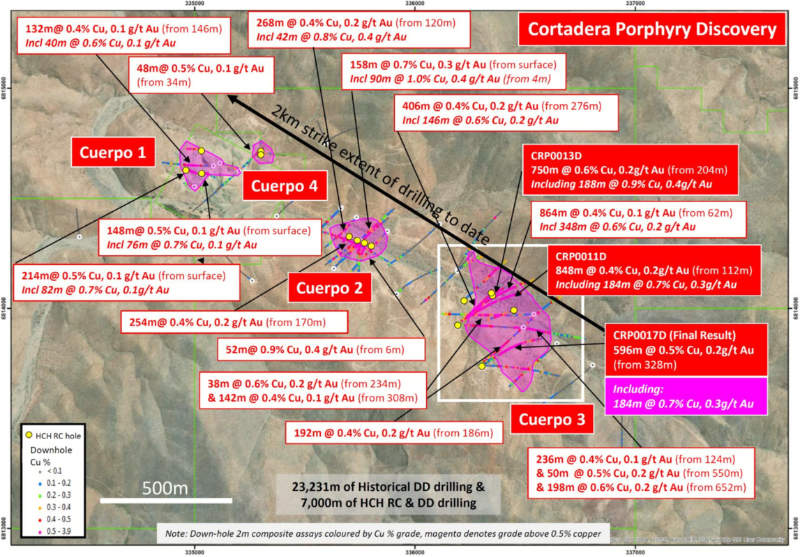

And there is every reason for him to feel upbeat. Hot Chili (ASX:HCH) has so far hit extremely broad, world-class zones of copper and gold mineralisation with each of the three deep holes it has drilled so far at the main Cortadera porphyry, Cuerpo 3.

The initial hole intersected 750m of mineralised porphyry grading 0.6 per cent copper and 0.2 grams per tonne (g/t) gold from a depth of 204m that ended in mineralisation.

Notably, this included a higher grade zone of 188m at 0.9 per cent copper and 0.4g/t gold from 516m.

This was followed up by the second hole that hit a broader 848m intersection at 0.4 per cent copper and 0.2g/t gold from 112m and the third hole that intersected 596m grading 0.5 per cent copper and 0.2g/t gold.

Both of these holes also returned near identical higher-grade zones of 184m at 0.7 per cent copper and 0.3g/t gold from depths of 720m and 430m respectively.

And there might be more great results on the horizon, with assays expected from a fourth hole that has recorded a broad intersection of shallow mineralised porphyry from a depth of 50m to 330m, followed by strongly mineralised porphyry from 494m to 622m depth.

This support act is taking a lead role

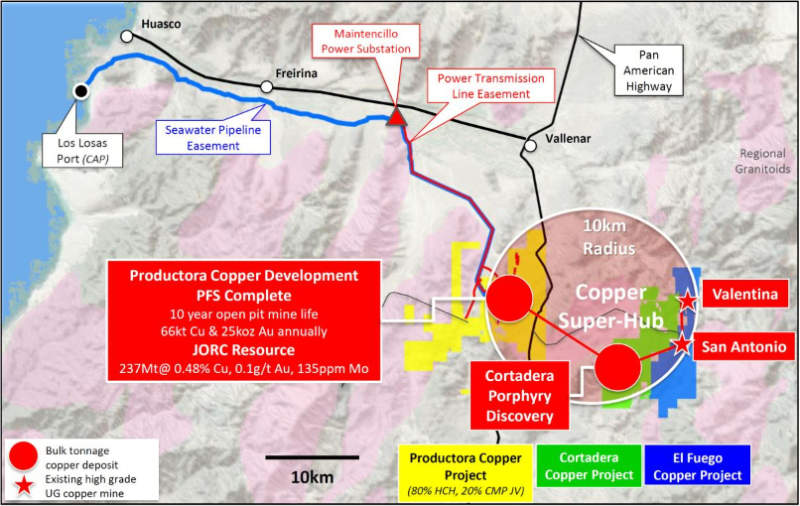

When Hot Chili first acquired Cortadera, the company was looking for a bulk tonnage, open pit mine to complement its production hub development, centred around the nearby Productora copper project.

“Cortadera was one of the centrepieces of our growth strategy in the area around Productora. We had already secured a number of high-grade satellites to add into the mix a year earlier,” managing director Christian Easterday told Stockhead.

“We were focusing for some two years on trying to secure an agreement with the Carola family for Cortadera.”

In February this year, Hot Chili secured a formal option to acquire the project for $US30m, with payments to be made over a 30 month period.

“The original concept was a combined production hub, but with three record drill results in a row, Cortadera has taken on a much greater significance to the company,” Easterday said.

“It has upscaled itself several times in terms of the company’s expectations for it and is certainly shaping up as something pretty unique and a company maker in its own right now.”

Easterday added that while the company had originally conceived Cortadera as a large open pit, it was now considering the potential to add a higher-grade, bulk tonnage underground development should results continue to deliver bulk tonnage higher grades at depth.

More growth on the horizon

“We are also in a very early phase, where we have unwrapped Cortadera and found quite extensive growth potential — both at the deposit itself and around the existing porphyries,” Easterday said.

“Some 400m to the north of Cuerpo 3, we have a geophysical target that was defined by high powered induced polarisation and magnetotellurics – a big coincident anomaly exactly along the northern corridor where the porphyry looks likely to extend.

“We see that as a very large lift up for the growth of the main porphyry and has implications particularly if we start to see that high grade spreading over that kind of distance.

“The very next step change is Cortadera North, which sits about 2km to the north in a subsidiary trend, and similar geophysical and geochemical characteristics to the Cortadera discovery.

“Could Cortadera be the beginning of a much larger porphyry scale discovery? It is certainly showing a lot of signs that the existing discovery on its own is really just the beginning.”

Easterday said that Hot Chili is actively undertaking exploration programmes over these new areas, in preparation for early drilling.

He also noted that while the company has received a lot of interest from potential farm-in partners, it had also received support from the institutional space to retain its ability to acquire 100 per cent of Cortadera.

“This is probably the most value accretive stage that any company can go through when you are looking at world class intercepts and a major discovery unfolding,” Easterday said.

“We are certainly being supported by the market to undertake that next step without the pressure to be doing early funding deals with potential joint venture partners.

“We are focused on the drilling at the moment and adding a lot of growth and value with our now fully funded program.”

>> Now watch: 90 Seconds With… Christian Easterday, Hot Chili.

This story was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.