Jurisdiction spotlight: Why ASX explorers are digging deep into Indonesian gold, gas and critical minerals

Far East Gold is one of a handful of ASX companies setting up shop in Indonesia for mineral exploration and development. Pic: Getty Images

- Far East Gold has amassed a portfolio of three Tier-1 assets in Indonesia including a potential company maker with its Idenburg acquisition

- SIH is another goldie searching for treasure in the country

- CRD, BAS and CKA are operating in Indonesia, too

Indonesia has a somewhat troubled past concerning policy and foreign investment, but the country is fast approaching a bold metamorphosis which will strengthen its standing as a centre of global trade.

Already Southeast Asia’s largest economy, the country is looking to tap its rich source of natural resources to boost end-to-end manufacturing including the processing of raw materials into finished products.

To do this, the government has pledged to gradually stop exporting materials to focus instead on developing downstream industries in the hopes that it will attract investment, improve the financial sector and pave the way for economic development.

It’s a game President Jokowi Widodo has arguably won before – Indonesia accounts for nearly half of the world’s nickel production and the policy change, which banned the export of nickel ore in 2020, succeeded in drawing investment from Chinese and other investors hungry for the key input in EVs and stainless steel.

The country is targeting $545b in foreign direct investment (FDI) through to 2040 to develop 21 commodities across key sectors including minerals, oil and natural gas, coal, and many others.

As well as leading the world in nickel production, the archipelago nation is the world’s largest coal producer, third largest bauxite and tin producer, and is home to the Grasburg mine, the largest gold and third-largest copper mine in the world.

Exploration opportunities found nowhere else

Perhaps the primary attraction for ASX companies to operate in Indonesia is the ability to access exploration opportunities that aren’t available anywhere else, Minelife founder and analyst Gavin Wednt tells Stockhead.

“By comparison to Australia, exploration has been a lot less intensive in many locations, providing promising risk-reward situations for companies,” he says.

“The other major attraction is that the cost of operating there can be significantly lower than here, for various reasons including lower labour costs and the benefits of a weaker currency.

“Indonesia is also located within the Pacific Ring of Fire and has been subject to complex tectonic forces, being the meeting point of several tectonic plates,” Wendt says.

This high level of activity creates the right environment for mineralised fluids to form and then accumulate in vast volumes in the right geological setting – which is ripe for Gosowong-style bonanza mineralisation, one of four major high-grade vein deposits in the country.

“There are two styles of mineralisation that have been recognised to date within the Gosowong Goldfields – firstly, low-grade copper-gold porphyry and secondly high-grade gold-silver epithermal veining,” Wendt adds.

“It is this second type of mineralisation that really excites explorers and investors, as it can produce very high grades that can generate outstanding operating margins and profitability, if a commercial deposit can be identified.

“The Gosowong mine itself was discovered by a joint venture headed up by Newcrest Mining, which sold it in 2020, with the pre-mine resource in 1999 stated as 1Mt at a fantastic grade of 24 g/t Au for 24 tonnes of gold.”

Gold explorer on the rise

Far East Gold (ASX:FEG) has assembled an attractive package of three tier-1 copper-gold projects with a war chest of $3.5m following a recent capital raise to fund exploration programs and drive permitting.

With gold and copper prices close to all-time highs, FEG is hoping to replicate the success newly appointed chairman Justin Werner has previously had in Indonesia.

Known for his success as managing director of Nickel Industries (ASX:NIC), a minnow which has morphed over the past decade into a $3.5bn mega miner and one of the world’s largest nickel producers, FEG appointed Werner to drive exploration and development across its Indonesian project portfolio.

In an interview with Stockhead, Werner says he sees similar opportunities in the gold and copper space in Indonesia that he had previously seen in nickel.

“Significant local employee talent within an underexplored region, low exploration costs and very low costs of production,” he says.

For example, Nickel Industries saw all-in-sustaining costs between $7400 – $14000 a tonne last quarter, well below Australian players such as BHP sitting around $22,000 per tonne.

“The mining industry is also welcoming FDI and has tailored its permitting toward a central approval system, away from regional which has stimulated investment due to new clarity across the mining laws and regulations,” FEG CEO Shane Menere tells Stockhead.

READ MORE: FEG raising $3.5m to ramp up exploration at Indonesian gold projects

Idenburg: A project with enormous prospectivity

The newest string to FEG’s gold bow in Indonesia is the Idenburg project in the country’s Papua province, host to some of the world’s largest known copper and gold deposits.

Previous explorers of the 95,280-hectare (952.8km2) landholding include Barrick, Newmont, Newcrest and Placer Dome, which were all unable to move the project through the development pipeline due to forestry restrictions over the main prospect areas.

“Those restrictions have now been dealt with; what excites me the most about Idenburg is the high grades close to surface and the number of prospects open along strike and at depth,” Werner tells investors during the latest investor briefing.

“The prospectivity is enormous and a project of this calibre is an opportunity that is becoming harder and harder to find.”

To date, over US$25m has been spent on historical exploration resulting in an estimated 5,000m of completed drilling with impressive drill hits returning 16m at 2.38 g/t gold from surface, 7.5m at 16 g/t from 21m and 17m at 2.88 g/t from surface at the Sua prospect.

Another tick is the style of gold mineralisation, which is characterised as ‘orogenic gold’ similar to areas like Kalgoorlie and the southeastern Goldfields as well as California’s Mother Lode district.

“Most of the world’s major ‘Bonanza’ gold fields are orogenic in nature and can display large vertical extents,” Werner says.

“It’s an advanced asset, way ahead of where we were with Woyla when we acquired it which didn’t have any previous drilling done on it, and it’s on a sixth-generation contract of work licence which is the preferred tenure of holding in Indonesia.”

The project comes with an exploration target of up to 7.2Moz gold at a grade of up to 6.1 g/t spread across 14 prospect areas, and FEG is now looking to undertake confirmatory drilling to potentially release a maiden resource by the end of the year.

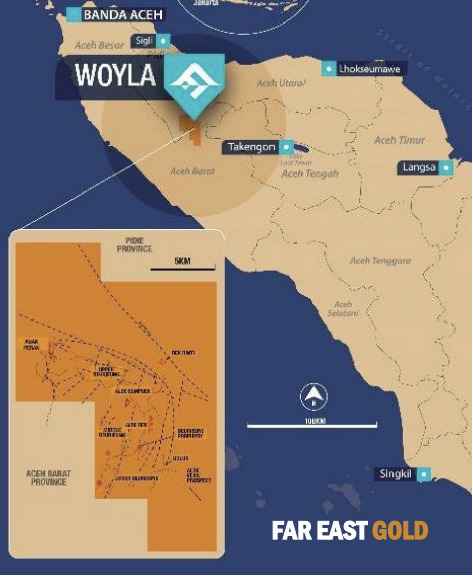

FEG’s Woyla asset is situated right on the tip top of Indonesia in the country’s Aceh region, considered one of the most prospective, undrilled gold properties in South-East Asia.

The explorer picked up the asset in 2014, believing that the pedigree of their management team, deep understanding of the Indonesian mining industry and extensive network would all ow them to succeed where the majors (including Barrick Gold and Newcrest) had failed.

So far, more than 133 holes have been drilled for 20,585m with high-grade gold and wide-zone intersections within the Aloe Rek prosepct returning one of the project’s best cumulative gold metre intercepts, 20m at 7.57 g/t gold from 65.7 – 87.5m.

The company has also been in collaboration with Eurasian Resources Group (ERG) over the evaluation of select priority target areas at the Trenggalek project using structural and magnetic data alongside recent surface mapping and rock sampling.

This work confirmed an additional porphyry-related mineral system with the Ngerdani target area, bringing the total number of porphyry-related systems identified within the Trenggalek to six.

The explorer is now looking to test nine defined porphyry-related targets as part of an upcoming Phase-1 drilling program.

Sihayo Gold led by BHP and Newcrest Mining executive

Over in North Sumatra, Sihayo Gold (ASX:SIH) has been carrying out surface exploration on several prospects within its Sihayo-Pungkut 7th Generation Contract of Work landholding with low-cost prospecting and surface geochemical surveys.

The team is backed by former BHP and Newcrest Mining executive Colin Moorhead, whose seven-year involvement with the latter took place during a period of significant growth for what is now one of the world’s largest gold companies.

His experience as CEO of Indonesian gold producer PT Merdeka Copper Gold Tbk saw him build and lead the team that constructed and commissioned the highly successful Tujuh Bukit Gold Mine.

SIH’s gold project hosts 24Mt at 2 g/t for 1.5M contained ounces of gold.

The company has been the subject of multiple all-cash take over attempts by shareholder Provident Minerals, an investor in SIH since 2013.

Oil and gas developments

Unlike many foreign investment destinations, Indonesia is openly welcoming of investment in its oil and gas sector.

Wendt says the country is actively encouraging exploration and investment and after 13% growth in investment the industry during 2023, the Indonesian government is hoping to more than double this in 2024 to $17 billion.

That’s great news for oil and gas players like Conrad Asia Energy (ASX:CRD) and Bass Oil (ASX:BAS).

CRD signed a MOU with Perusahaan Gas Negara (PGN) back in March to provide LNG and infrastructure from its two Aceh production sharing contracts (PSCs) offshore of Indonesia.

The company’s Offshore Northwest Aceh (Meulaboh) and Offshore Southwest Aceh (Singkil) are estimated to contain 2C contingent resource of 214 billion cubic feet (Bcf) of sales gas (161 Bcf net attributable to Conrad) in three of the four shallow water discovered gas accumulations in the two PSCs.

Planned 3D seismic this year should lead to increased confidence of additional resources in and around the existing discoveries.

Bass Oil is building towards a substantial onshore Indonesial oil and gas business with a clear focus on executing opportunities in Australia’s Copper Basin and 55% interest in a South Sumatra Basin KSO.

BAS was awarded a 10-year extension to the Tangai-Sukananti KSO in August last year with the Indonesian state-owned oil company Pertamina EP.

The extension was granted under improved fiscal terms after a period of constructive negotiations with Pertamina.

Recent strength in production levels in the KSO as well as Pertamina’s success in an adjacent licence gives Bass encouragement to exploit the potential upside of the Bunian field and other secondary hydrocarbon bearing zones in the existing wells.

Metallurgical coal player soars on mine development news

Indonesia is also one of the world’s largest coal producers and consumers, with 254 coal-fired plants operating at a total capacity of 51.56 gigawatts (GW) with an additional 40 plants under construction.

Cokal is its name, high-margin metallurgical coal is its game.

The company has signed a binding agreement with mining contractor PT Cipta Bersama Indonesia (CBI) to develop an underground mining operation at Pit 1 of the BBM metallurgical coal mine.

It represents a significant windfall for Cokal, as there were no plans to develop any underground operations at BBM Pit 1 within the foreseeable future.

CBI will be the contractor in charge of the underground mine development and will pay all mine development costs as well as 100% of ongoing operating costs through to delivery of the coal product to BBM ROM stockpile.

At Stockhead we tell it like it is. While Far East Gold and Conrad Asia Energy are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.