Juno raises full $3.6m, starts drilling in lithium ‘corridor of power’

Pic: Getty Images

- Successful issue of shortfall shares to raise full $3.6m

- Drilling kicks off at the Mount Ida lithium prospect

- Juno well-funded to expand exploration at Mount Ida lithium prospect and advance Mount Mason DSO hematite project

Special Report: Juno Minerals has boosted its bank balance by a further $1.6m after successfully placing the remaining shares in its non-renounceable entitlement offer, with drilling now underway at the highly prospective Mount Ida lithium prospect in Western Australia.

Bucking the downward pull of the current market and indicating the strong interest from investors in the lithium potential at Mount Ida, Juno Minerals (ASX:JNO) has completed the issue of the shortfall shares well before the January 31, 2024 deadline, adding a further $1.6m to the coffers.

The company initially raised around $2m and with the completion of the issue of all the shortfall shares has now reached its target of $3.6m.

Juno isn’t waiting until the new year to find out what it could be sitting on in the extremely hot lithium “corridor of power” – the same neighbourhood as the likes of Gina Rinehart, Chris Ellison’s Mineral Resources (ASX:MIN) and Delta Lithium (ASX:DLI) – and has started drilling ahead of the Christmas break.

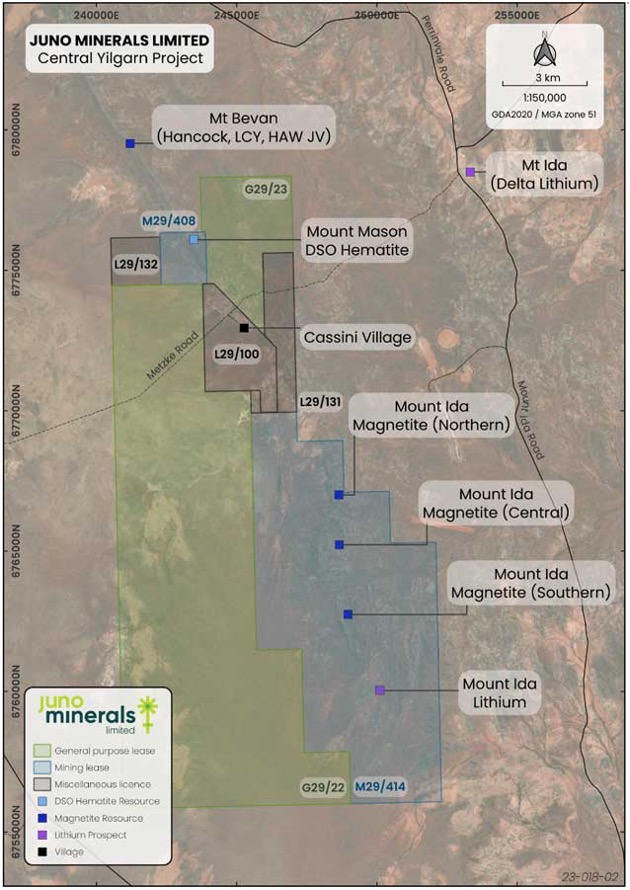

Funds from the entitlement offer will provide Juno with the financial muscle to expand its exploration activities at Mount Ida while also advancing its 5.9-million-tonne Mount Mason DSO hematite project only about 12km northwest of Mount Ida.

A previous independent review of soil sampling results from the Mount Ida lithium prospect confirmed two significant anomalies and multiple areas of interest as targets for planned drilling.

M&A frenzy

Regionally, the Mount Ida fault in the prolific Yilgarn region has become a seriously hot drawcard for its rare metal pegmatites.

Ellison and Rinehart are two major players in the region after taking large stakes in the likes of Delta Lithium and Liontown Resources (ASX:LTR).

Rinehart recently went up against the world’s largest producer, Albermarle, to topple its $4.3 billion bid for Liontown.

Delta’s Mt Ida lithium project is located 19km north of Juno’s Mount Ida lithium prospect, which also sits close to the Mt Bevan project owned by Legacy Iron Ore (ASX:LCY) and Hawthorn Resources (ASX:HAW) that Rinehart’s Hancock Prospecting is also a partner in –initially for the magnetite, but more recently for the lithium potential that has emerged.

This article was developed in collaboration with Juno Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.