Juno IPO prospects soar after pension fund aborts Jupiter mission

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

The IPO prospects of Western Australian iron ore developer Juno Minerals have been bolstered following the departure of Stichting Pensioenfonds ABP (ABP) from the share register of Juno’s parent, Jupiter Mines.

Juno, which owns the Mt Mason DSO hematite project and the Mt Ida magnetite project in WA’s Yilgarn region, is being demerged from Jupiter with existing shareholders to receive an in-specie distribution of 120 million Juno shares.

Jupiter will also provide Juno with $5 million in seed capital, while a public offer of up to 80 million Juno shares is currently open that could raise as much as an additional $20 million with which to progress Mt Mason and Mt Ida.

Jupiter shareholders voted overwhelmingly in favour of the demerger proceeding at a general meeting in March, but Netherlands-based ABP, one of the world’s largest pension funds and at the time 15% owner of Jupiter, opposed the move.

Its statement that it did not intend to meet the regulatory requirements of the Foreign Investment Review Board, a condition of the proposed in-specie distribution and capital reduction, left the boards of Jupiter and Juno wondering if their plans would amount to nought.

It was soon established that the demerger could go ahead on a delayed timetable without ABP’s blessing. But in terms of perceptions, some investors were already concluding that Juno would be hit with heavy selling by the pension fund immediately upon listing.

That scenario has now been put to bed after ABP sold its entire Jupiter stake in a special crossing last Wednesday afternoon.

The buyer of the stake has since been revealed as Ntsimbintle Mining, Jupiter’s partner in the Tshipi manganese mine in South Africa. Ntsimbintle is understood to be supportive of the demerger.

“While we’d like to think we could have maintained a dialogue with ABP to ensure an orderly disposal of the stake if that is in fact what they wanted to do, it is much better to have removed that uncertainty,” Juno managing director Greg Durack said.

“We can now move ahead with confidence, complete the IPO and get on with bringing the Mt Mason DSO project into production as soon as possible to take full advantage of the buoyant iron ore market.”

Fast-track to first production

Using a contractor-based model, Durack, who managed the original feasibility study completed on Mt Mason in 2012, believes he can get the project into production before the end of the year for minimal upfront capital.

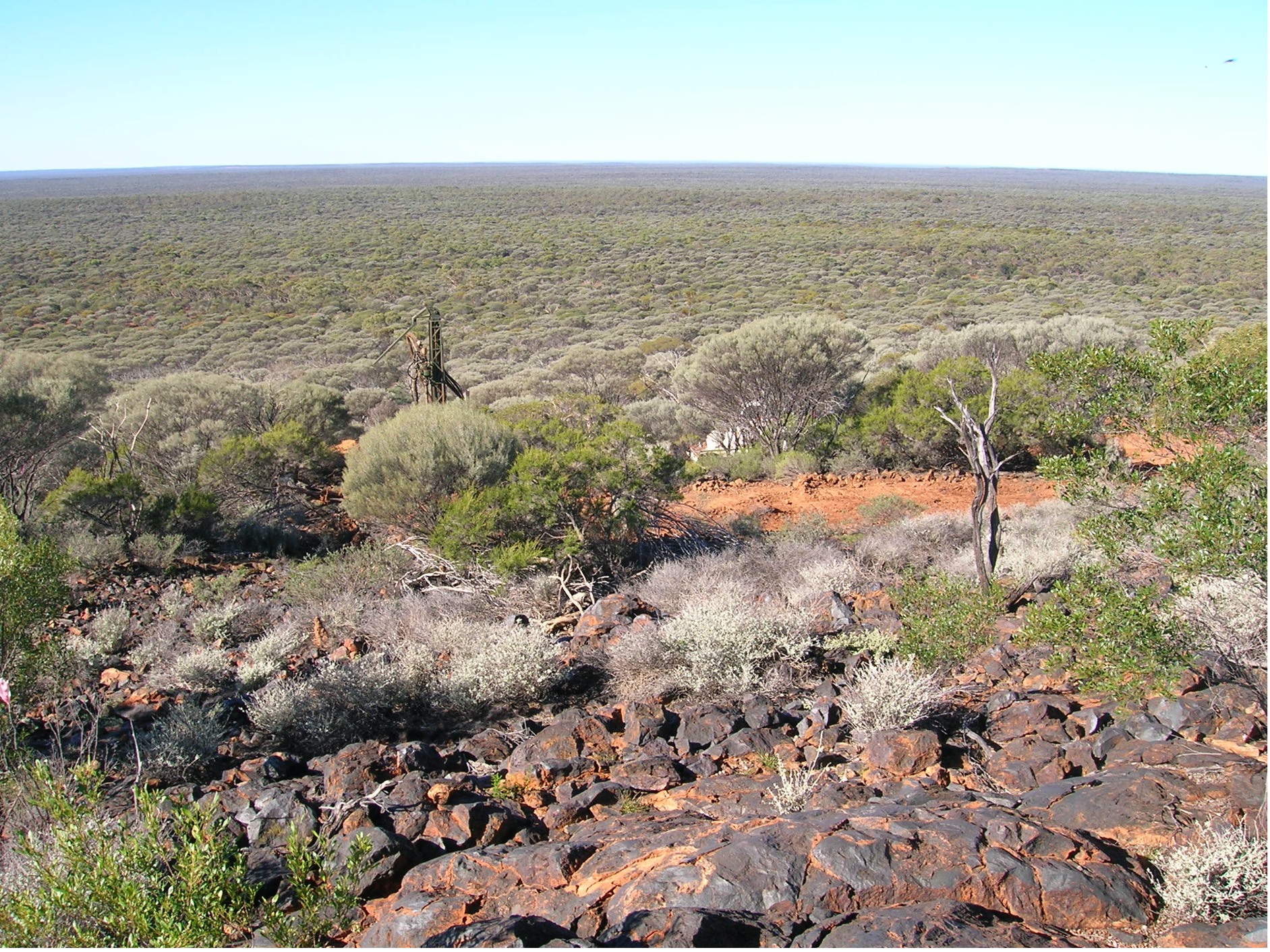

Mt Mason contains a measured and indicated Mineral Resource of 5.9 million tonnes at 60.1% iron and aside from native vegetation clearing permits and works approvals that have had to be resubmitted, has all the necessary approvals in place for mining to start.

The plan is for DSO fines to be transported by truck to an existing rail siding before being transported by train to the port of Esperance.

Mt Ida is a larger, longer-dated proposition, hosting a resource of 1.85 billion tonnes at 29.5% iron on a granted mining lease.

Durack believes it has the potential to be a tier one magnetite mine and will benefit from learnings drawn from other magnetite ventures currently being pursued in WA.

The Juno IPO is scheduled to close on 30 April. Should the company raise the maximum $20 million it is seeking, it will begin listed life with a market capitalisation of $50.2 million and an enterprise value of $25.2 million.

While Jupiter CEO Priyank Thapliyal will serve as non-executive chairman, the larger company will not hold shares in Juno upon its listing.

However, the Juno share register will feature some heavyweight names including AMCI and POSCO as a result of the in-specie distribution.

This story was developed in collaboration with Juno Minerals Limited, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.