Juniors offer explanations for why they breached ASX trading policy

Told off ... ASX steers mining juniors in the right direction. Pic: Getty

A couple of ASX-listed juniors have had to explain themselves after they breached the Australian bourse’s securities trading policy.

Gold explorer Centennial Mining (ASX:CTL) said today in an ASX announcement that it had inadvertently issued 6 million shares to a son of one of its directors as part of a recent top-up placement.

Centennial told investors that as soon as the oversight was discovered, the company volunteered the information to the ASX and was told it was in breach of one of the ASX listing policies.

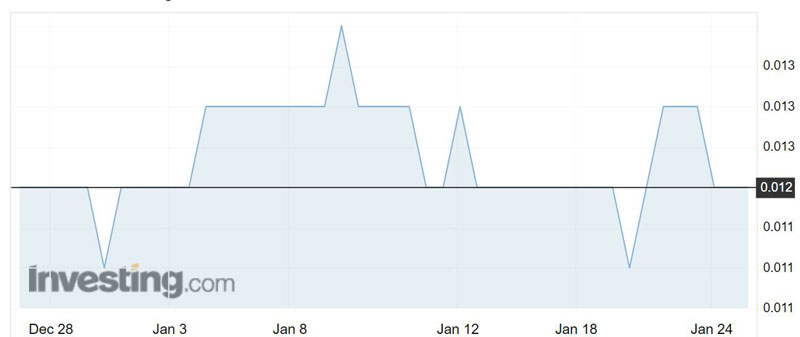

The shares slipped 7.7 per cent to 1.2c on Wednesday morning.

The ASX considered the son of chairman Dale Rogers a related party of Centennial — who could not take part in the placement without prior shareholder approval.

Centennial has asked Mr Rogers’ son to dispose of the shares by February 23 and donate any proceeds to charity.

“The company regrets the oversight,” Centennial told investors.

Trades during closed period

The executive chairman and CEO of mineral sands producer Mineral Commodities (ASX:MRC) has bought shares on-market during a closed period without first seeking approval.

A closed period is a fixed period specified by a company in its trading policy when directors and management are prohibited from trading in its securities.

Mark Caruso picked up a further 250,000 shares for $37,000 on January 16.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Mineral Commodities said it was only in a closed period because its financial year-end is December 31, 2017 and there were no market sensitive announcements pending.

“The company has reminded Mr Caruso of the requirements as set out under the Security Trading Policy to ensure there is no further trading during a close period, and that prior written approval is obtained when dealing in the company’s securities,” Mineral Commodities told investors.

Mr Caruso previously obtained shareholder approval to trade in the company’s shares in December, when Mineral Commodities was in an open period. He acquired 610,214 shares on market for just under $80,000.

Mineral Commodities has been contacted for comment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.