JBY’s unassayed core a golden growth opportunity at Independence in Nevada

Mining

Mining

Special Report: James Bay Minerals has revealed a batch of unassayed core showing multiple stacked zones of mineralisation and a golden growth opportunity sandwiched at its Independence project in Nevada.

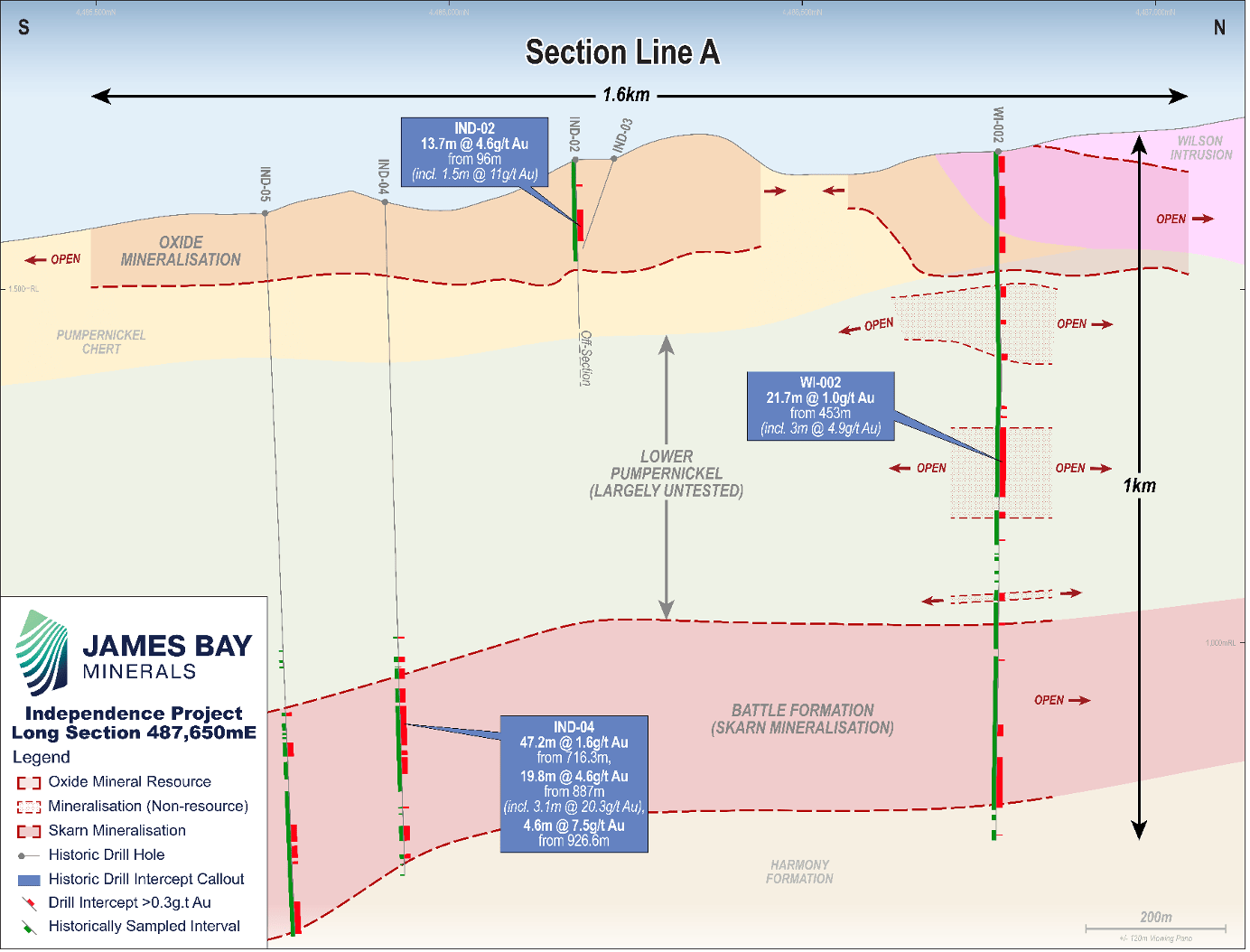

James Bay Minerals’ (ASX:JBY) review of unsampled historic core showed multiple stacked zones of mineralisation beneath its current oxide gold resource and an unassayed opportunity to build on its large established resource.

The review showed potential for missed mineralised lodes between the existing oxide and skarn resources, currently standing at a combined foreign tally of 1.18Moz of gold and 7.6Moz of silver.

Testing this area could identify the missing link between the shallow oxide and deep skarn mineralisation, with a massive gulf in knowledge around the potential resources in the Lower Pumpernickel formation at Independence.

JBY is now logging and sampling the historic holes, with one sent to the lab for gold and multi-metal analysis.

“Recent reviews of unsampled historical drill core at the Independence Project has unveiled significant potential for previously unrecognised mineralised zones, bridging the gap between our existing oxide and skarn mineral resources,” James Bay executive director Andrew Dornan said.

“Through the ongoing logging and sampling of historical core, coupled with the submission of hole IND-03 for detailed analysis, we are excited about the continued growth potential of the project.”

The JBY ticker has more than doubled in value since Independence was added to its portfolio as a potential company-maker.

And the project’s location in Nevada, regularly jockeying for top spot in the Fraser Institute’s survey on the top mining investment destinations, makes it a wonder no one has taken on the challenge with such intensity in recent years.

Dornan recently laid out the tailwinds and permitting advantages the junior would have in a presentation picked up by the incisive Barry FitzGerald.

The Independence ground is actually already covered by a plan of operations approval previously secured by Newmont (ASX:NEM), meaning a short 8-12 month process would only cost around $100,000.

And while gold ounces flirt with record prices, other high-grade historic hits have pointed to its potential as a multi-element operation.

Once the logging and sampling of historic core is done, JBY will use the information to plan diamond drilling targeting polymetallics within the sandwiched Pumpernickel formation and its multi-zonal potential.

Drilling will also investigate deeper gold-silver skarn mineralisation between the Battle formation, with assays due to come in the first half of 2025.

Assays are also soon due from mapping and rock chip sampling focused on finding more epithermal gold-silver and intrusion-related mineralisation in the northern half of Independence.

The 2000m of drilling already underway has an early focus on expanding near-surface oxide mineralisation across a poorly tested area before turning towards high-grade mineralisation related to northwest-trending faults.

This article was developed in collaboration with James Bay Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.