Javelin joins WA brownfields gold exploration boom with Kalgoorlie mine purchase

Javelin’s acquisition of Eureka opens up opportunities to find even more gold. Pic: Getty Images

- Javelin Minerals acquires previously producing Eureka gold mine on edge of Kalgoorlie for $3m

- Eureka sits on a Mining License, has an existing resource of 112,000oz of gold and has seen virtually no modern exploration

- Potential for more gold has been identified to the north and south of the open pit

- Payment to be made via $1.5 million in cash and $1.5 million in Javelin shares upfront, the latter under escrow for 12 months

Special Report: Javelin Minerals has joined the lucrative boom in WA brownfields gold exploration with a deal to buy the Eureka gold mine from Delta Lithium for an upfront payment of $1.5m in cash and $1.5m in shares.

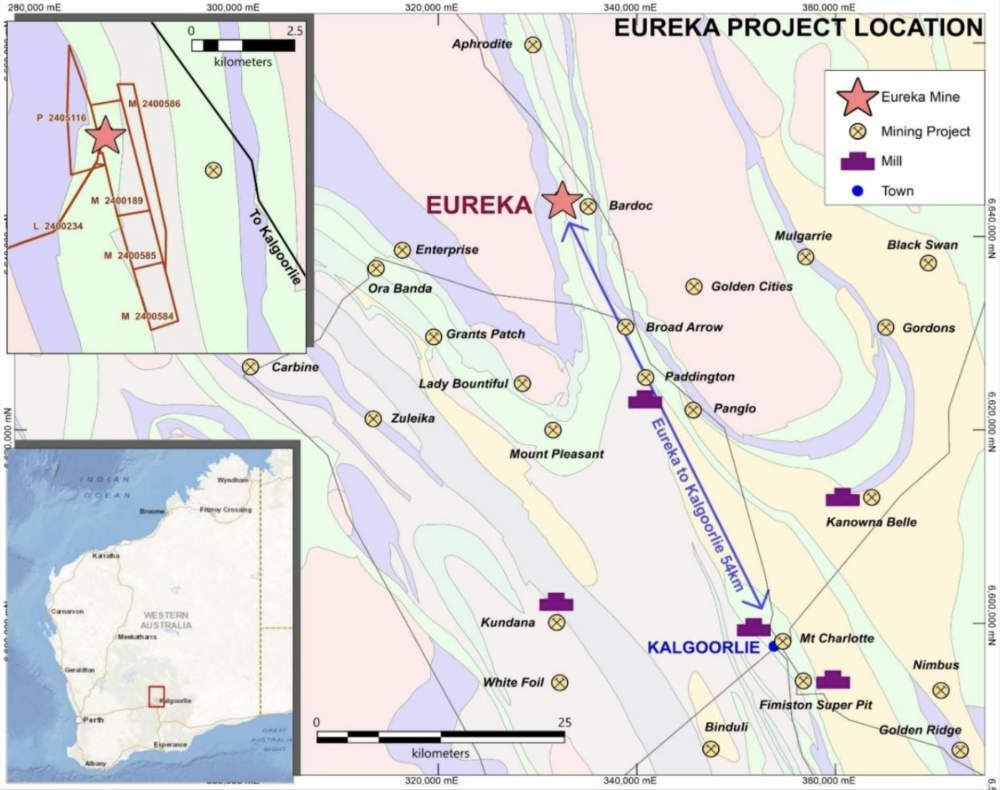

Eureka is 54km north-northwest of Kalgoorlie in WA’s Eastern Goldfields region, just 20km from the major Paddington gold mine, and near several other producing mines, placing it close to existing infrastructure including mills with production capacity.

It was mined in the early 1990s and then subjected to tribute mining in 2018.

Importantly for Javelin Minerals (ASX:JAV), Eureka will be its second brownfields exploration project with remaining resources of 2.45Mt grading 1.42g/t gold, or 112,000oz of contained gold, sitting in the immediate vicinity of the Eureka open pit, along strike and downdip.

As the icing on top, more than half of this resource (62,000oz) is in the higher confidence indicated category which provides enough certainty for mine planning.

Under the acquisition, Delta Lithium (ASX:DLI) will appoint a non-executive director to the company’s board.

“Eureka is an outstanding acquisition opportunity which has become available only because it doesn’t fit Delta’s wider strategy,” executive chairman Brett Mitchell said.

“But the project meets our strategy perfectly. It has an established resource with further known mineralisation which remains open at depth and along strike. And like Coogee, it has been exposed to virtually no modern exploration.

“Javelin now has two compelling brownfields exploration projects 50km either side of Kalgoorlie with immense exploration upside, giving us huge opportunities to create value for shareholders with further exploration.”

Separately, the company is poised to start drilling at its Coogee project, which currently hosts 126,685oz of gold, this quarter.

Eureka project

The Eureka project consists of four mining licences – M24/0584, M24/0585, M24/0586 and M24/0189 – and three prospecting licences – P24/5116, P24/5549 and P24/5548 – within the same greenstone lithological sequence that hosts major gold deposits such as Paddington.

Eureka also features a structural setting similar to Bardoc Gold’s (ASX:BDC) 530,000oz Zoroastrian deposit about 1.4km to the east.

It was first discovered in the 1890s with an underground mine producing until 1940, churning 809t averaging 27.8g/t gold.

Historical information noted the gold mineralisation is associated with shearing and quartz veining within easterly dipping oxidised fine-grained mafic rock.

Eureka was then mined via an open pit by West Coast Holdings, producing 32,000oz of gold at 4.5g/t from 1985 to 1988, while in 2018, Tyranna Resources (ASX:TYX) mined 50,600t of ore at 3.16g/t.

Gold mineralisation at Eureka occurs as a number of lens-shaped ore shoots up to 10m wide within the shear zone and is hosted in quartz veins and quartz stringers within the altered mafic host rocks.

To date, mineralisation has been exploited in a 120m deep, 300m long open pit that was developed within an intensely sheared zone ~30m wide.

Mineralisation is sub-vertically dipping and strikes in a north-south orientation with several offsets and splays form the main structure.

Plenty of potential

JAV notes that ~750m of strike north of the pit remains poorly tested as previous exploration drillholes were terminated at shallow depths without penetrating the zone of near-surface leaching.

Additionally, the drill traverses were restrictive in coverage and may have missed the best target zones, though this work did return notable results such as 4m grading 135g/t gold from 53m (ERC39), 4m at 32.6g/t from 104m (WRRC0106), and 3m at 48.75g/t from 129m (WRRC0135).

The main host structure also strikes over the western boundary of the lease ~330m south of the pit.

Drilling south of the pit returned results such as 13m at 2.22g/t gold from 51m (WRRC0001) and 5m at 13.88g/t from 38m (WRRC0121).

Parallel structures also strike for some 4400m south of the pit, though this zone remains poorly tested with all drilling concentrating around the Eureka pit.

There is also potential at depth as mineralised veins have been drilled over 180m vertically below the bottom of the current pit.

Deeper drilling has been suggested to test the continuation of the subvertical east dipping gold mineralised zone.

Acquisition terms

JAV is acquiring 100% of the issued capital of Warriedar Mining, a wholly owned subsidiary of DLI that holds the Eureka Mine, for an upfront payment of $1.5m in cash and $1.5m in JAV shares at a deemed price equal to the 10-day volume weighted average price.

The company will pay DLI a further $1m in shares under the same terms upon the earlier of restarting mining operations or increasing the JORC resource to 200,000oz at a 0.5g/t gold cut-off.

This article was developed in collaboration with Javelin Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.