James Bay V2.0? Quebec’s Abitibi region is littered with ASX juniors making hay

The Abitibi is already a well-established mining region. Pic via Getty Images.

- The Abitibi Hub is a flurry of activity with ASX juniors proving up Li2O resources

- Sayona and Piedmont’s NAL operation is already producing

- Olympio says established infrastructure gives it an edge over James Bay projects

South of the prolific James Bay, Quebec, lies a re-emerging mining district in the Abitibi-Témiscamingue region, where gold has been produced since 1939 and centered around the mining towns of Malartic and Val d’Or.

This time, it’s lithium.

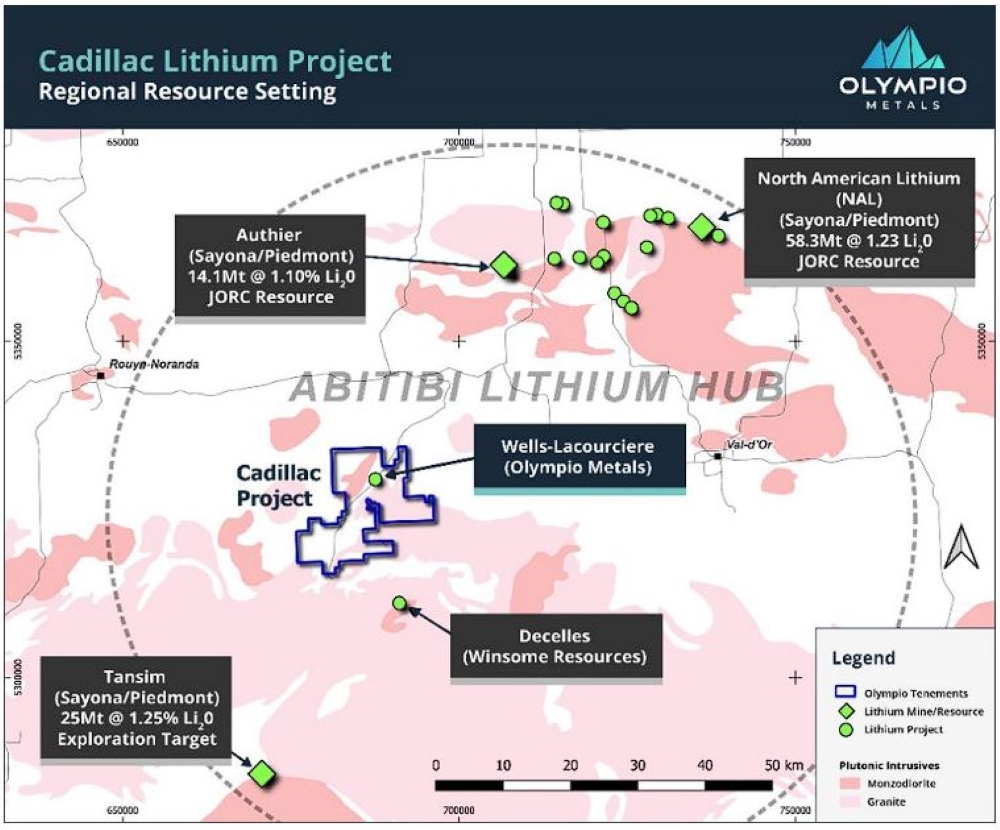

It’s already well-vetted for Li, with a swarm of explorers now surrounding Sayona Mining (ASX:SYA) and Piedmont Lithium (ASX:PLL) 75.4Mt @ 1.18% Li2O Abitibi Hub JV, where the partners are already producing from their North American Lithium (NAL) operation.

The JV’s ‘Abitibi Hub’ also includes the 14.1Mt Authier project to the west and 25Mt Tansim exploration target in the south of the region.

In August, Sayona announced the first shipment of NAL spodumene concentrate to the international lithium market, marking a major milestone and paving the way for first revenues within two years of NAL’s acquisition.

And the juniors are increasingly swimming about.

Access to infrastructure the key

At the helm of one such ASX-listed junior is Olympio Metals (ASX:OLY) managing director Sean Delaney, who believes the infrastructure and proximity to markets in the Abitibi region lowers capex and opex and a clear advantage over explorers to the north – such as those in the prolific James Bay lithium province.

“There’s a saying going around that it can cost three times as much for one tonne of lithium in James Bay than it does in the Abitibi Hub,” Delaney says.

“Our project is within the Abitibi Hub and smack bang inbetween Sayona/Piedmont’s Authier and NAL deposits to the north and Tansim to the south.”

The region is also closer to the US border, meaning it has less weeks of the year frozen and longer summer mining seasons.

At OLY’s Cadillac project, first-pass drilling completed by Vision Lithium in 2022 intersected spodumene-bearing LCT pegmatites with visible crystals in the drill core that showed high grades of up to 3.14% Li2O.

The explorer is looking to prove up a sizeable cache of lithium at Cadillac and has already been encouraged by Phase 2 exploration where rock chips confirmed high-grade lithium of up to 7.43% Li2O at surface.

“Location, location, location remains the key for Olympio and the Cadillac project,” Delaney told Stockhead.

“Having a lithium exploration asset just 50km from Val d’Or is a massive advantage particularly when you consider future development prospects.

“Infrastructure is already in place, while costs to explore there are a lot lower given the proximity of local drillers.”

Pinnacle Minerals (ASX:PIM) has applied for two prospective lithium projects covering 271.2km2 in the Abitibi Greenstone Belt.

PIM’s Lac Rug project consists of 205 claims covering 116.5km2 where multiple mapped pegmatites have been discovered throughout the project area, while its Lac Bigniba tenure consists of 282 claims covering 154.7km2 and borders the mineral-rich Laberge Deformation Zone.

TSX-listed Power Metals recently acquired Winsome Resources’ (ASX:WR1) Decelles and Mazerac projects in the Abitibi region, with WR1 boosting its stake in Power to 19.59%.

Burley Minerals’ (ASX:BUR) Chubb lithium project is just 25km north of the mining community of Val-d’Or in the heart of the emerging world-class Abitibi lithium province of Québec, Canada.

It’s nestled within the Manneville deformation corridor, where diamond drilling recently extended spodumene mineralisation within the Main Dyke more than 560m in length and 200m in depth, showing Li2O grades of up to 1.57%.

More than 12,000m has been completed since April this year as BUR continues to extend and expand the mineralised zone at Chubb Central. According to the company, the unexpected yet fortunate pollucite discovery supports ongoing drilling and overall project appreciation.

While Burley Minerals and Olympio Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.