It’s a YES: Alvo options to buy Bluebush after maiden drilling shows high percentages of rare earths

Alvo Minerals has decided to commit itself to Bluebush. Pic via Getty Images.

- Alvo Minerals exercises option to purchase Bluebush rare earths project in Brazil

- First diamond hole assay returns up to 2,961ppm @ 28% MREO

- Metallurgical testwork to begin at Boa Vista once all assays are received

- Exploration at the wider tenure area of Bluebush has begun

Special Report: Positive initial exploration results have enticed Alvo Minerals to exercise its option to purchase the Bluebush REE project in Brazil.

Alvo Minerals’ (ASX:ALV) Bluebush is adjacent to the massive 911Mt @ 1,200ppm TREO Serra Verde ionic deposit – the only Tier 1 ionic REE project under construction outside China.

ALV recently confirmed Bluebush to be an ionic adsorption, clay-hosted REE deposit – an important factor in making the project economical.

First diamond hole

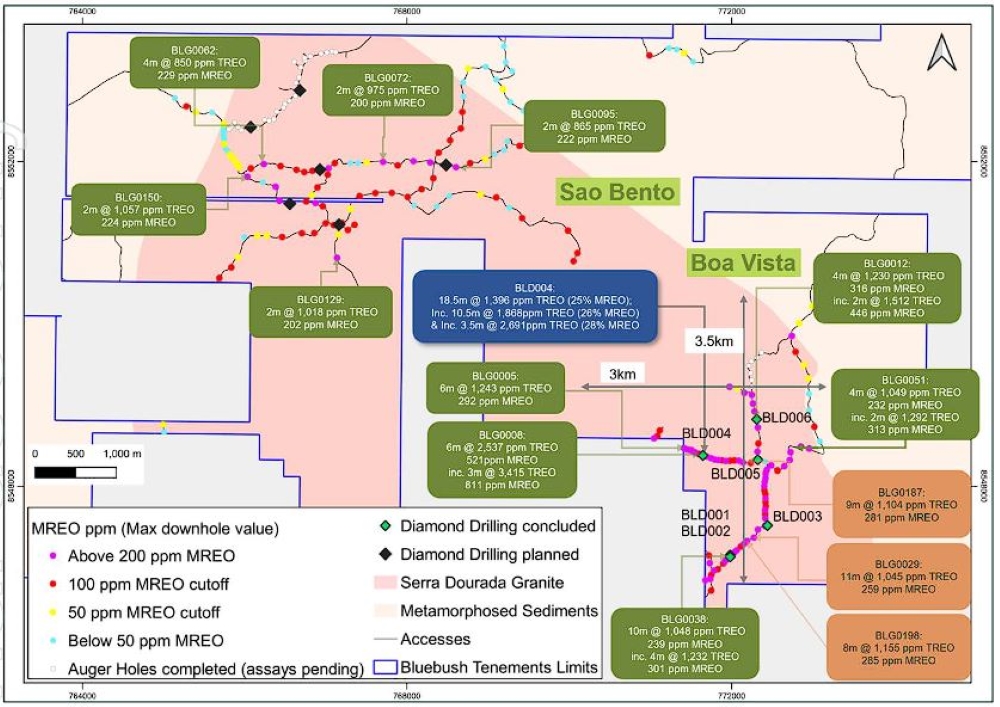

Six holes have been completed so far for 145m as part of a maiden diamond drill campaign, and all six intersected saprolite clay zones with widths of up to 28m and averaging 18m.

Results from hole BLD004 were prioritised at the lab and results have included mineralisation 0.5m from surface to the interface of saprock and fresh rock at ~35m, averaging 1,090ppm total rare earth oxides (TREO), of which 24% were the more valuable magnet rare earth oxides (MREO).

Within the broad saprolite clay interval of 34m @ 1,090ppm TREO (24% MREO), high-grade intervals included:

- 5m @ 1,396ppm TREO (25% MREO) from 0.5m, including 10.5m @ 1,868ppm TREO (26% MREO) from 0.5m and 3.5m @ 2,961ppm TREO (28% MREO) from 4.1m

- 6m @ 1,019ppm TREO (21% MREO) from 29m

All intervals of the hole contained the high-value MREOs of dysprosium and terbium.

“Our outstanding first diamond drilling assay result and results of exploration across the project over the last few months have given us great conviction to exercise the option over Bluebush IAC,” ALV MD Rob Smakman says.

“We signed the option believing the area could contain a project like our neighbours at Serra Verde and the results delivered to date have confirmed that potential.

“Our acquisition criteria of scale, grade and ionic adsorption clay mineralisation have been met and we are very comfortable in formalising the purchase of the project.”

What’s next for Bluebush?

When further diamond drill assays return from the lab, metallurgical testwork will be conducted to give ALV more of an idea of the mineralisation of Boa Vista as the company works towards a maiden resource at the deposit.

The explorer also intends to accelerate exploration work and identify new drill targets in the wider tenure area with portable surveys to map the extent of the saprolite horizons and get its truck-mounted auger drill rig which has already completed 264 holes at Bluebush.

“With samples from over 130 auger and six diamond holes in the lab for analysis, regional exploration through handheld auger drilling and the initiation of the Loupe geophysical surveys, we expect there will be plenty to report leading into the end of CY2023 from the Bluebush ionic REE project,” Smakman says.

“We will continue to expand our understanding of the broader Bluebush IAC REE project and plan to progress towards a maiden mineral resource estimate in the new year.

“Alvo is now poised to take advantage of the critical minerals thematic, having been able to demonstrate broad and thick zones of high-grade ionic clays.

“Bluebush has the added advantage of high levels of the more valuable magnet rare earths, which are the most critical for supply chain security across the world.”

This article was developed in collaboration with Alvo Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.