iTech is taking the kaolin, rare earths and graphite fast lane

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Industrial and critical minerals such as kaolin and rare earths are the focus of ASX newcomer iTech Minerals’ exploration efforts, and there are very good reasons why.

Unlike some other newcomers on the bourse that list with very early stage projects, the company’s suite of assets is the result of acquiring all the exploration assets that were divested by Archer Minerals to focus on its materials technology strategy.

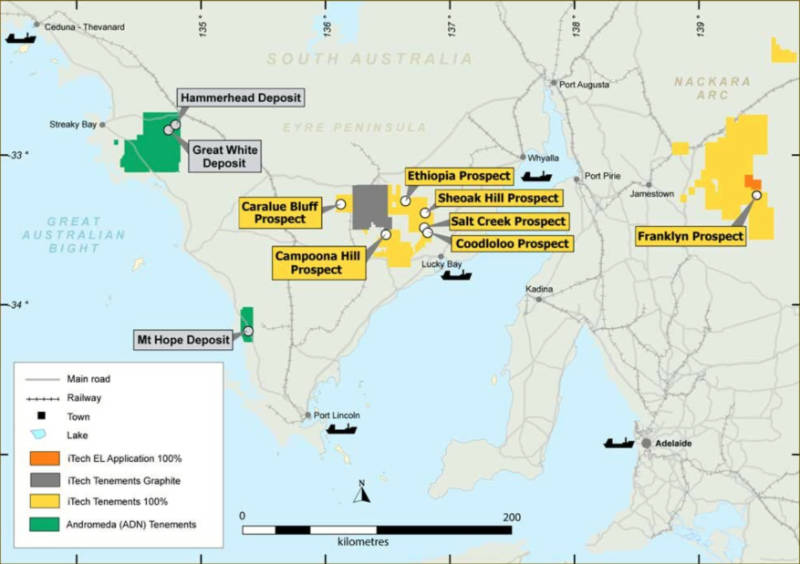

As such, iTech Minerals’ (ASX:ITM) assets have all seen at least some work conducted on them and it is this work that is giving it a leg-up for its Eyre Peninsula kaolin project. Work there has identified the potential for ionic adsorption clay-hosted rare earths mineralisation at the Ethiopia prospect.

Speaking with Stockhead, managing director Michael Schwarz said this discovery came about after the geologist the company had ‘inherited’ from Archer noted that he had sent off samples for further testing after noticing thick intervals of clay but had not followed up on the work.

“Since we closed the IPO and we were planning to go back and do some more drilling there, we managed to dig that data out and find the kaolin assessment work that they’ve done and it did show what he suspected, that there were some nice thick intervals between 6m to 24m,” he explained.

While these were only preliminary tests, it did reveal the potential yield from the samples and the low levels of impurities such as iron in the samples.

Schwarz added the geologist also pointed out that Ethiopia was originally a uranium prospect and was tested for uranium and thorium, but because uranium is often contained in the mineral monazite, it was also tested for cerium – a rare earth element that is very much enriched in monazite.

This testing confirmed that any uranium at the prospect was caught up in monazite, which ended further attempts at follow-up.

However, it’s this same cerium content that piqued iTech’s interest.

“When we looked at it, we thought that monazite normally disappears in the clay and that if the cerium is in monazite, you’ve got a whole lot of other rare earth elements associated with it,” Schwarz added.

“It’s most likely that these REE are now attached to the clays, so we thought this sounded exactly like an ionic adsorption clay deposit.”

Further research found that the geology in the area supported this theory, while mapping carried out by the Shell Company of Australia in the region back in the 1980s identified a REE-bearing outcrop that was about 6km by 2.5km.

“So we’ve got rare earth element rich rocks in the vicinity and when these things weathered, this is exactly the same situation you get in China and Malaysia and other places where they’re finding these types of deposits.”

The cerium grades also hint that the REE mineralisation at the prospect could be comparable to other IAC deposits. Schwarz noted that economic IAC deposits generally grade at between 500 parts per million to 1,000ppm total rare earth oxides.

“So when you’re getting 100-500ppm values for just one of REE indicators out of 17 rare earth elements, we’re thinking you can quite easily get up to those sorts of grades that would be economic,” he added.

Two for the price of one

Proving up this REE mineralisation will be handy for iTech as it would be able to combine the processing circuits for both kaolin and REE for a comparatively low capital cost.

This is due to requiring just another circuit to leach off the rare earths after the clays undergo a water wash to float the clays off.

Schwarz noted that the clay beneficiation also had the advantage of concentrating the clays by getting rid of the quartz that could make up to 50% of the material.

“So all of a sudden, you’re getting a doubling of your grade because you’re keeping the clay and the rare earths are in that, you’re beneficiating it by default,” he added.

Schwarz also noted that while Ethiopia is currently seen as a kaolin/halloysite deposit with valuable REE credits, the increasing value of rare earths could well reverse this view.

“Either way, if we can make two sellable products out of it, all the better for the project,” he added.

Upcoming Ethiopia activity

The company is currently waiting on the results from the samples that it has resubmitted for the full suite of REE as well as work on the kaolin reflectance and the proportion of kaolin vs halloysite.

“We’re going to get those initial results back in the next three weeks and we are booked in to resample all the holes in early November,” Schwarz told Stockhead.

“So in a week or two’s time, I think we’re going to go back and take all the individual metres and will resubmit those so we’ve got a real good understanding of how it’s behaving across the whole set of drilling.”

Once the company receives more geochemistry over the 1km by 1km area, and when the cereal crops that are currently growing in the area are harvested, iTech will then go in and drill out the prospect.

This is aimed at defining a kaolin and REE resource within the next three to six months.

Other projects

The Ethiopia prospect is not the only iron in the company’s fire.

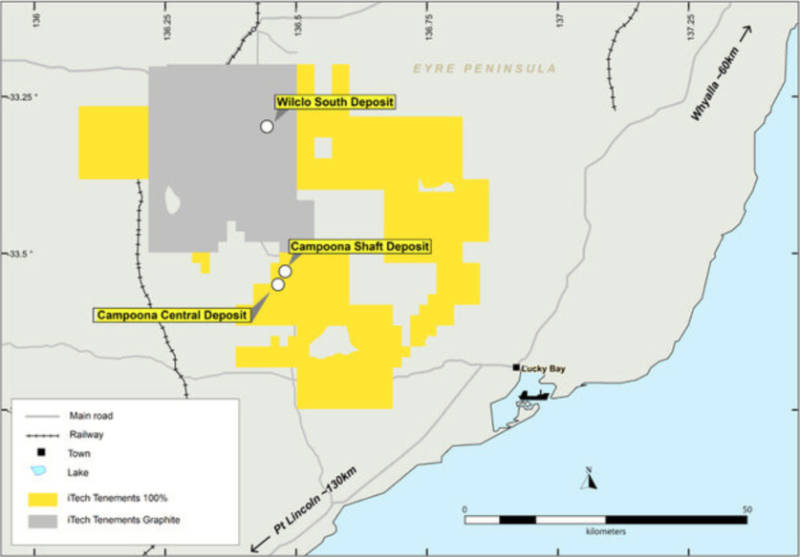

iTech is also assessing the potential of the Franklyn kaolin-halloysite project in the Nackara Arc and the Campoona graphite project in the Eyre Peninsula.

At Franklyn, iTech has gone back and sampled historical holes and submitted them for both kaolin and REE analysis.

This is expected to be followed by a drilling program either before the end of this year or early next year.

The size of this program will be determined by the results of the company’s geochemistry and mineralogy.

On Campoona, the company is liaising with its technical partners in Germany, ANZAPLAN, which are a specialist battery materials and critical minerals metallurgy group.

“We’re planning on sending a ton of our run of mine Campoona material over there for them to produce spheroidal graphite for lithium ion batteries,” Schwarz said.

“So over the next three months they’ll be doing that process and so towards the end of the year we’re looking early next year looking at having a whole new batch of metallurgical results and how they can produce spheroidal graphite from our Campoona material.”

The company is also talking with M Plan to potentially update and carry out a scoping study for the project, for which it already has a granted mining lease in place.

“We can move pretty quickly once we’ve got all the economics sorted out and decide to move into pre-feasibility,” he added.

iTech also holds the Bartels gold project, the Nackara Arc copper project and the Billa Kalina IOCG project, though the company’s attention is on the Ethiopia, Campoona and Franklyn prospects and projects.

This article was developed in collaboration with iTech Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.