It could be boom time for African graphite mining projects as EV battery demand surges

Picture: Getty Images

- East Africa could be the new hub for graphite projects in a bid to diversify supply

- Natural graphite is forecast to move into a structural deficit by mid-decade

- Four ASX stocks have exposure to African graphite projects

The unprecedented growth in electric vehicle production is expected to drive a huge uptick in graphite demand and pricing over the next decade.

A lithium-ion battery needs 10 times more graphite than lithium, with each electric vehicle requiring ~55kg of flake graphite to make the battery anode.

And it looks like African projects could be set to benefit.

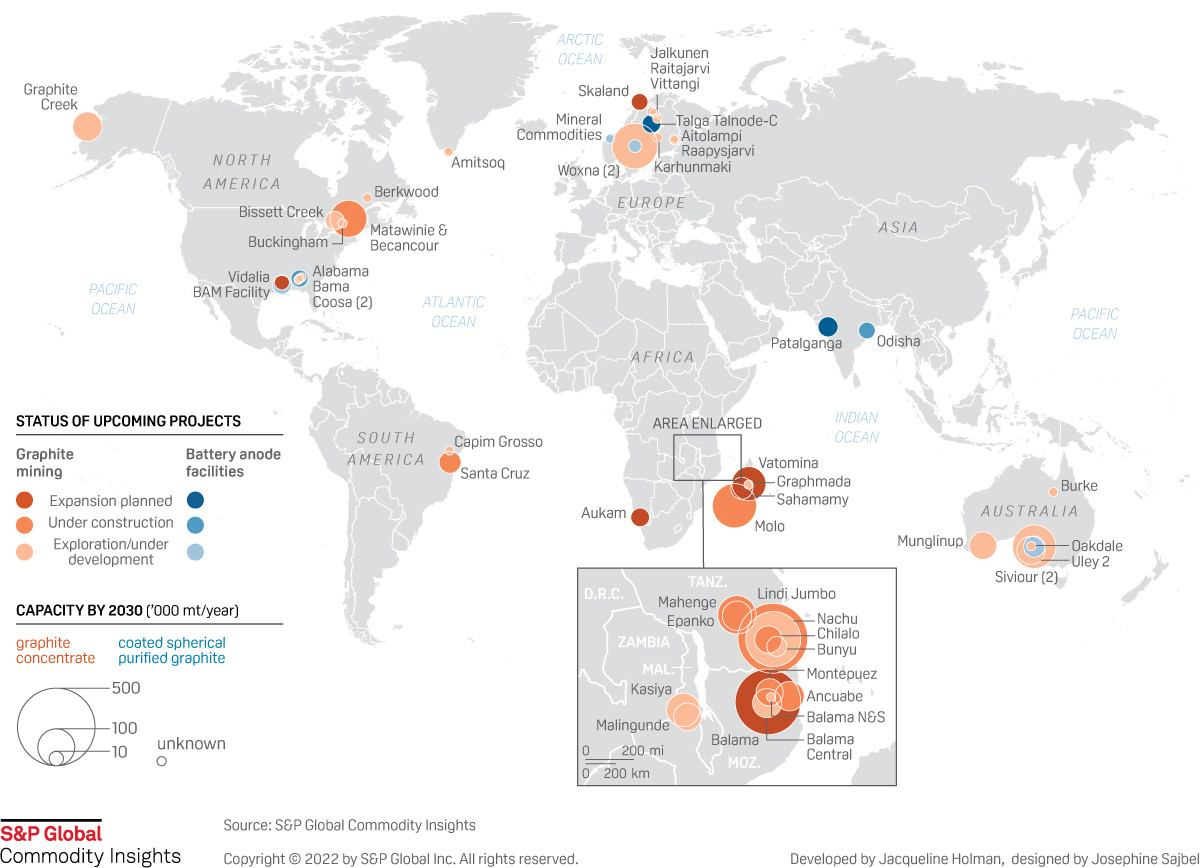

S&P Global Commodity Insights has flagged that Africa looks set to be home to the new boom in graphite mining projects.

Historically, most graphite has been mined and processed in China. The country produced an estimated 820,000 mt of graphite in 2021, around 79% of total global output, according to the US Geological Survey.

In comparison, the second-largest producer was Brazil at an estimated 68,000 mt, followed by Mozambique at an estimated 30,000 mt, Russia at 27,000 mt, and Madagascar at 22,000 mt.

But other countries like Scandinavia, North America, Australia – and specifically east Africa – are now launching projects.

Africa an alternative to Chinese supply

Benchmark Minerals Intelligence previously flagged Mozambique is set to develop as a key flake graphite-producing region, with forecasts anticipating that the country will grow its flake graphite production by five times by 2030 from 2021 levels.

“With Chinese graphite production expected to increase by 45% in the same period, and downstream demand set to scale further, non-integrated Chinese market participants may increasingly look to overseas supply to meet their feedstock needs, which will see Africa increasingly act as an alternative hub of flake graphite supply,” it said.

Benchmark anticipates African flake production will capture 44.3% of the market by 2030, compared to 12.5% in 2021.

Small flake graphite prices are rising

While prices haven’t soared 400% like lithium, they are still up 22% over the past year.

Prices for small flake graphite suited for the battery market are up above US$800/t, having traditionally traded between US$500-550/t.

The prices has been exacerbated by the Russia-Ukraine conflict, which could cut 30,000t of supply into the European market from Volt Resources’ (ASX:VRC) Zavalievsky mine in Ukraine and Ural Graphite’s Taginka mine in Russia, according to Benchmark Mineral Intelligence.

Plus, cyclones earlier this year in Madagascar and Covid cases in China have also caused logistical disruptions.

Structural deficit as soon as 2023-24

Not to mention that natural graphite is forecast to move into a structural deficit as soon as 2023-24, as global demand growth for processed graphite, also known as spherical graphite, begins to outstrip supply.

UBS estimates a natural graphite deficit of 3.7 million mt in 2030, representing some 37% of the market.

Although EV graphite anodes could be synthetic or natural, by 2030 natural graphite anodes are expected to represent almost half of demand.

“The market share of natural flake graphite is expected to increase due to its favourable environmental footprint, especially as OEMs become ever more focused on supply chain sustainability,” EIT InnoEnergy and European Battery Alliance policy manager Ilka von Dalwigk told S&P Global Commodity Insights.

Which ASX stocks have a piece of the African graphite pie?

Syrah Resources (ASX:SYR) began production from its Balama project in Mozambique in November 2017, and in the March quarter the project produced 46,000t natural graphite at 76% recovery with 35,000t sold and shipped.

The company says China domestic fines price increased through Q1 2022 with robust anode demand and Chinese supply disruptions, and that it’s got more than 90,000t of natural graphite sales orders for Q2 2022 and into H2 2022.

In February, the company raised US$178 million ($250 million) to fund its Vidalia plant in Louisiana in the US after securing an offtake deal for 8000tpa of anode materials with Tesla.

The 11.25ktpa active anode material facility is targeted to start production in Q3 2023.

Syrah had a cash balance of US$205m at the end of the quarter.

Walkabout Resources (ASX:WKT) is just months from opening its US$32 million Lindi Jumbo graphite mine in Tanzania, a project which will produce 40,000tpa of 95% pure flake graphite over the next 24 years.

The project also has proven and probable reserves of 5.5 million tonnes at 17.9% total graphitic content.

In its March quarterly the company said demand continues to outstrip supply for flake graphite with prices rising between 10% and 37% in just six months.

Walkabout CEO Andrew Cunningham recently told Stockhead’s Josh Chiat that an emerging deficit in graphite supply and underinvestment in new mines has slipped under the radar.

“It’s important for the graphite market; there is such a shortage of graphite now and there’s such a misconception and not enough investment going into graphite and getting graphite projects up and running,”

“Already this year, there’s a shortage of 85,000 tons of graphite predicted and nobody knows where it’s going to come from.

“Not enough attention is going into investing into the raw material.”

Triton Minerals (ASX:TON) is advancing its Ancuabe Graphite Project in the East African country of Mozambique.

The company announced it had signed a binding offtake agreement with Chinese graphite products manufacturer Yichang Xincheng Graphite (Xincheng) in November.

Under the agreement, Triton will supply Xincheng with up to 10,000 tpa of flake graphite concentrate from its commercial pilot plant at Ancuabe.

The deal, which will last five years, has the potential to be increased to a larger volume following the full construction of the Ancuabe project which has a target nameplate capacity of 60,000tpa, should the initial phase be successful.

The plan is to initially construct a small-scale commercial pilot plant, capable of producing flake graphite concentrate on a commercial basis within 18 months, by the September quarter 2023.

Then the company would expand to a large-scale mine as envisioned in the 2017.

Tritton had $3.2m cash on hand as of 31 March 2022.

Black Rock Mining (ASX:BKT) owns the Mahenge graphite project in Tanzania and updated the mineral resource recently by 25% to 213.1M tonnes at 7.8% TGC (Previously 211.9 Mt at 7.8% TGC).

Last year, the company completed the operation of a large-scale qualification plant campaign in China which processed 500 tonnes of bulk graphite from the Mahenge project.

Major construction activities are expected to commence in Q3 CY22 and based on a 15-month construction period, the company is targeting first production from Module 1 in Q4 CY23.

“Global demand for graphite continues to grow, with positive market tailwinds providing Black Rock with an exceptional opportunity to become a major producer of graphite into the clean energy supply chain,” the company said in its March quarterly.

“Graphite prices have also begun to move and are up ~60% over the last 12-months.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.