Is this nickel player Norm Seckold’s next payday?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Santana Minerals (ASX:SMI) has landed itself a highly prospective exploration project that has all the hallmarks of China’s largest nickel mine and is backed by successful mining investor Norm Seckold.

Not a bad position to be in and a potential game changer for Santana.

Just before Christmas the company completed its acquisition of Mekong Minerals’ 75 per cent stake in the Sayabouly project in Laos and 85 per cent interest in two Cambodian gold projects in which Mekong holds farmed out interests.

But it is the Sayabouly project that is the jewel in Santana’s crown, with early signs pointing to the potential for it to be much bigger than the Jinchuan nickel mine in China.

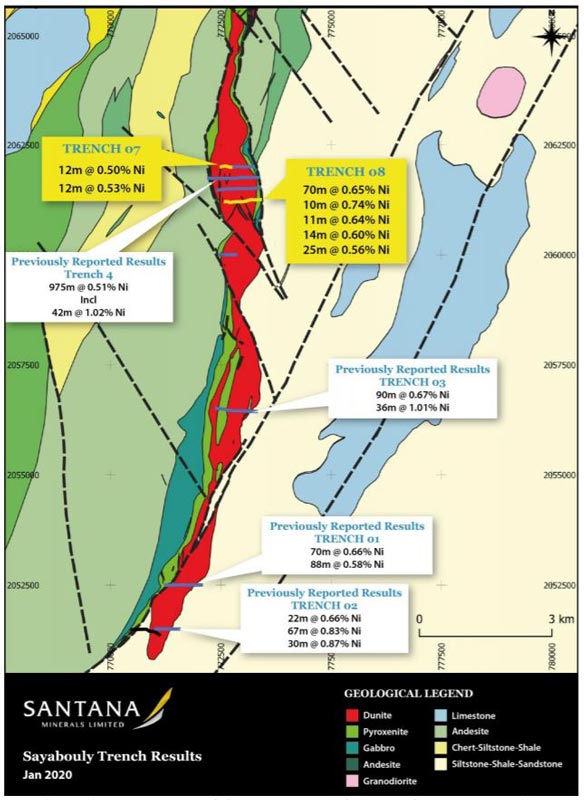

The main prospect is Phu Lon, where trenching has returned very broad hits of 975m at 0.51 per cent nickel, including 42m at 1.02 per cent nickel.

And Phu Lon is host to the more highly sought-after nickel sulphides.

Nickel is usually found in two main ore types – sulphide or laterite.

Laterites are harder and more expensive to mine and process, whereas sulphides are much cheaper and fetch a premium price.

Phu Lon, which spans 14km by 1km, also has potential by-products of platinum, cobalt and chromium, which could potentially make any operation more profitable down the track.

CEO Shane Pike told Stockhead the geology at Phu Lon was very similar to China’s large Jinchuan mine, with both deposits hosted in a layered ultramafic (rocks rich in minerals and low in silica) package with the mineralisation predominantly in dunites (another type of rock).

Jinchuan was discovered in the 50s and hosts a resource of 500 million tonnes at 1.2 per cent nickel, 0.7 per cent copper and 0.4 grams per tonne (g/t) platinum group elements.

But Phu Lon has never been drilled.

“The only testing it has had on it is trenching,” Pike explained. “This ultramafic is mineralised from head to toe effectively and the fact that it hasn’t been drill tested previously is astonishing.

“The results that we’re getting just from trenching look very similar to what came out of Jinchuan.

“Jinchuan was discovered in the 50s and basically the footprint of this that outcrops at surface is probably 20 per cent of what we’re seeing at Phu Lon. Phu Lon is much bigger.”

More proof it could be a Jinchuan lookalike

Previously released petrology results identified nickel sulphide minerals, which Santana says strengthens the interpretation of a model based on the large and iconic Jinchuan nickel mine.

The most recent trenching results delivered more thick intercepts and provided further evidence of strong near-surface nickel mineralisation at Phu Lon.

Results from Trench 8 included 70m at 0.65 per cent nickel, 10m at 0.74 per cent nickel, and 25m at 0.56 per cent nickel.

What potentially gives Santana another leg up is the fact that Trench 8 was excavated directly above a high chargeable/low resistivity electrical geophysical anomaly believed to be a large buried zone of nickel sulphides.

Sayabouly sits 250km northwest of the Laos capital, Vientiane, and is situated right next to a sealed highway that runs to the capital and right next to hydro power lines, meaning it shouldn’t be too difficult a task to eventually power an operation and transport nickel.

The promising trenching results have prompted Santana to start drilling this week.

Drilling is starting in the north of the Phu Lon prospect (Trench 4), then moving and drilling the significant trench results recorded from Trenches 1 and 2 in the south.

Pike said Santana would start with a 13-hole, 2000m drilling campaign but that there was every chance that would be expanded.

“Some excellent trenching results and petrology analysis have provided us a great interpretive

model from which to plan and execute this drilling program,” he said.

“Over the course of the next several weeks we will systematically target interpreted zones of nickel sulphide mineralisation, the confirmation of which has the potential to deliver significant value for all Santana shareholders.”

Pike said four of the drill holes would be diamond and then Santana would switch to reverse circulation (RC) if it got a hold on the geology.

Diamond drilling is usually done to recover mineral samples from depth or from within areas that are harder to drill, while RC drilling is used to gather preliminary data on minerals and is cheaper and faster than diamond drilling.

“So that will spread out the metres a lot more, and once we do that first pass, we’ve got enough cash in the kitty to complete further drilling if we see some colour in some of these holes.

“The first results we expect to get back by the end of February.”

If Santana, which has around $4m in the bank, decides to undertake follow-up drilling it has plenty of time before the wet season kicks in around mid-May.

The backing of a high-profile mining personality

Following the acquisition of the Sayabouly project, Norm Seckold — who was chairman of vendor Mekong Minerals — moved to the chairman’s seat on Santana’s board.

He has had a lot of success in the mining industry, having sat at the helm of 18 companies, including Bolnisi Gold, which North America’s Coeur d’Alene dropped just under $1 billion on to acquire back in 2007.

More recently Seckold helped successfully complete the $200m float of Nickel Mines (ASX:NIC) — one of the biggest floats in several years — as the company’s deputy chairman. The nickel miner now has a market value of nearly $1 billion after less than 18 months on the bourse.

And Seckold doesn’t just sit on the company’s board, he actually has substantial skin in the game: a 7.43 per cent stake worth nearly $US52m ($75m).

Having spent so many years in the mining industry, Seckold is also very well connected.

Nickel Mines’ partner is none other than one of China’s biggest steel producers, Tsingshan Holding Group.

“His [Seckold’s] contacts in the nickel industry through Nickel Mines are pretty significant,” Pike said.

So what attracted the high-profile mining investor to Sayabouly and Santana?

“Santana Minerals’ Sayabouly project, and in particular the Phu Lon nickel prospect, is a highly prospective target,” he told Stockhead.

“Frankly, it’s astonishing that a 14km x 1km zone of nickel mineralisation with significant surface results has remained untested by drilling.

“We are very much looking forward to the maiden drilling program at Phu Lon in January; we are hopeful it may deliver significant value to Santana shareholders.”

Top nickel hits drive value

In recent times we’ve seen investors get very excited over really big nickel hits. Just take Legend Mining (ASX:LEG), which saw its share price more than double on news it had made a ‘Nova-like’ nickel-copper discovery in WA’s Fraser Range.

Legend reported a 70.15m-long sulphide bearing interval grading 0.52 per cent nickel, 0.36 per cent copper and 0.03 per cent cobalt, just 88.2m from surface. This intercept included a hit of 14.9m at 1.07 per cent nickel.

And Santana’s trenching results are delivering much broader widths at similar grades.

“There’s no reason why we can’t replicate what we’re seeing in the trench results, 42m at 1 per cent, in our own [drill] holes,” Pike said.

“What that did to Legend was it added $100m to their market cap, so if we were to replicate what we’re seeing at the moment, it would be a really good result.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.