Is scandium ready to pop, too? Here are some ASX juniors rising on deposits of the stuff

Scandium's caught the eye of investors lately as demand is pegged to outstrip supply. Pic: Getty Images

Scandium (Sc) production and refinement is super rare, as it’s mainly produced as a by-product through waste streams of metals such as nickel, cobalt, uranium, and titanium. In fact, there’s no standalone mine for the metal anywhere in the world.

That’s because China – like it does with other critical mineral supply chains the West has neglected – has a monopoly over scandium feedstock production and its refined oxides and metals.

Yet heightened interest in the element’s usage and the Middle Kingdom’s hegemony over the metal’s availability has become major drivers for developing scandium-laden deposits elsewhere, including Australia.

Growth in demand is also being seen in its adoption in specialty semiconductor applications – as is an increased focus on scandium-containing alloys in the aerospace, automotive and defence sectors.

Scandi-yum

It’s worth a bundle, too. From 2019 to 2023 Sc prices ranged from US$2,100/kg to US$3,900/kg (Sc oxide) and a whopping US$134,000/kg to US$269,000/kg (Sc metal), yet no one seems to be mining it as a primary source of income.

“There’s no single standalone production of scandium anywhere and anything over 100ppm is considered significant, yet the biggest problem with scandium is that supply is constrained by geopolitics,” Rimfire Pacific Mining’s (ASX:RIM) David Hutton whispered to Stockhead last month.

“The West is extremely reliant on China for production and our belief is that if we can generate a long-term, secure supply of scandium it will unlock the constraints and growth of its use in the market.”

The junior, which led the charge for gains for ressie stocks in FY24, just released a maiden resources of 21Mt at 125ppm Sc (4050t Sc oxide) at the Mulga North and 3Mt at 240ppm Sc (1120t Sc oxide) Melrose deposits.

There is some production out there, albeit produced as extra credits for primary operations. Mining major Rio Tinto (ASX:RIO) has been an early mover in sorting out ex-China production, turning on scandium production from its 70-year-old iron ore and titanium RTIT Quebec operation in Canada that now churns out 4 tonnes (t) of scandium-oxide a year, a run-rate which it aims to 4X in the near future.

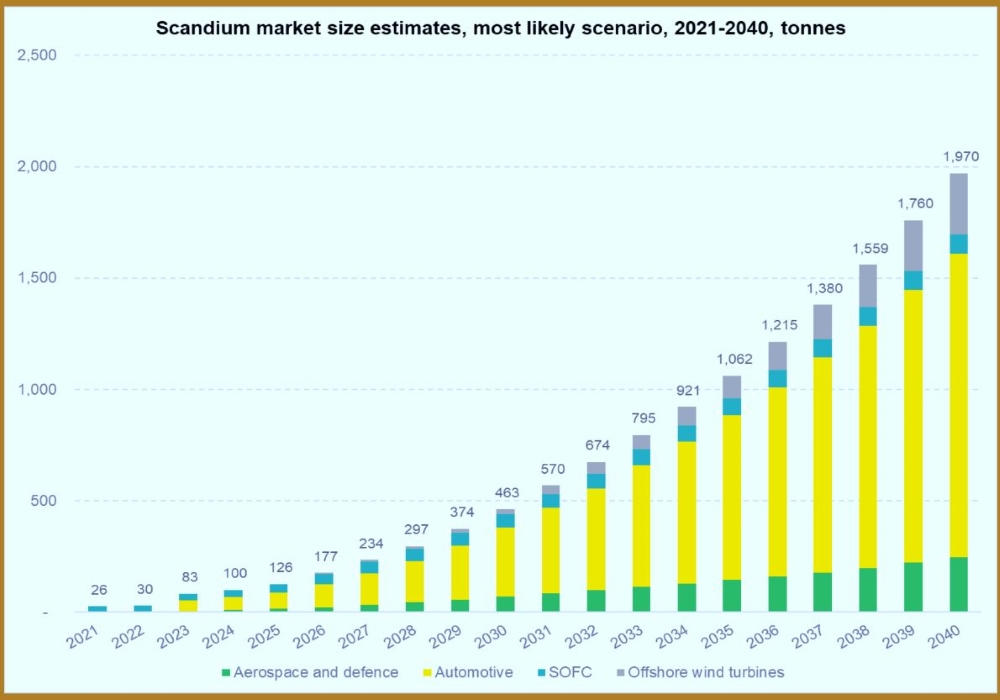

That’s just a drop in the ocean, as the world’s lust for scandium is set to rise from 83t last year to 1970t by 2040.

So who’s out there lighting candles for old mate scandium you ask? Let’s take a look.

Moving and shaking Australia’s scandium space

First cab off the rank is Sunrise Energy Metals (ASX:SRL) (formerly CleanTeq) which is going back to its Syerston project to conduct a reassessment of a planned stand-alone, fully integrated scandium mining, processing and refining facility near Dubbo in NSW.

The junior’s looking to update a 2016 PFS of the advanced Syerston project, recently contracting GR Engineering to reassess key economic and project parameters back in July.

Sunrise is also investing in scandium alloy development programs – material innovations that are pegged to service the aerospace and automotive industries in the near future.

It’s poured in to aiding Michigan Tech’s unique ‘6xxx-series’ scandium-contained alloy that delivers strength improvements of ~33% over standard alloys.

This, Sunrise says, opens up the possibility of using aluminium-scandium alloys in automotive applications where high-strength steels currently dominate and is engaging with US partners to get commercial trials underway so it can test the alloys in a range of automotive components.

The junior is looking at building a processing plant on-site at Syerston with a throughput of 64,000tpa from ore fed into it from the near-surface, high-grade scandium resource over an initial 20-year mine life.

With an 18-month construction timeframe, the plant would consist of a small high-pressure acid leach (HPAL) circuit, a resin-in-pulp plant and a hydrometallurgical refinery to purify product from the Syerston deposit.

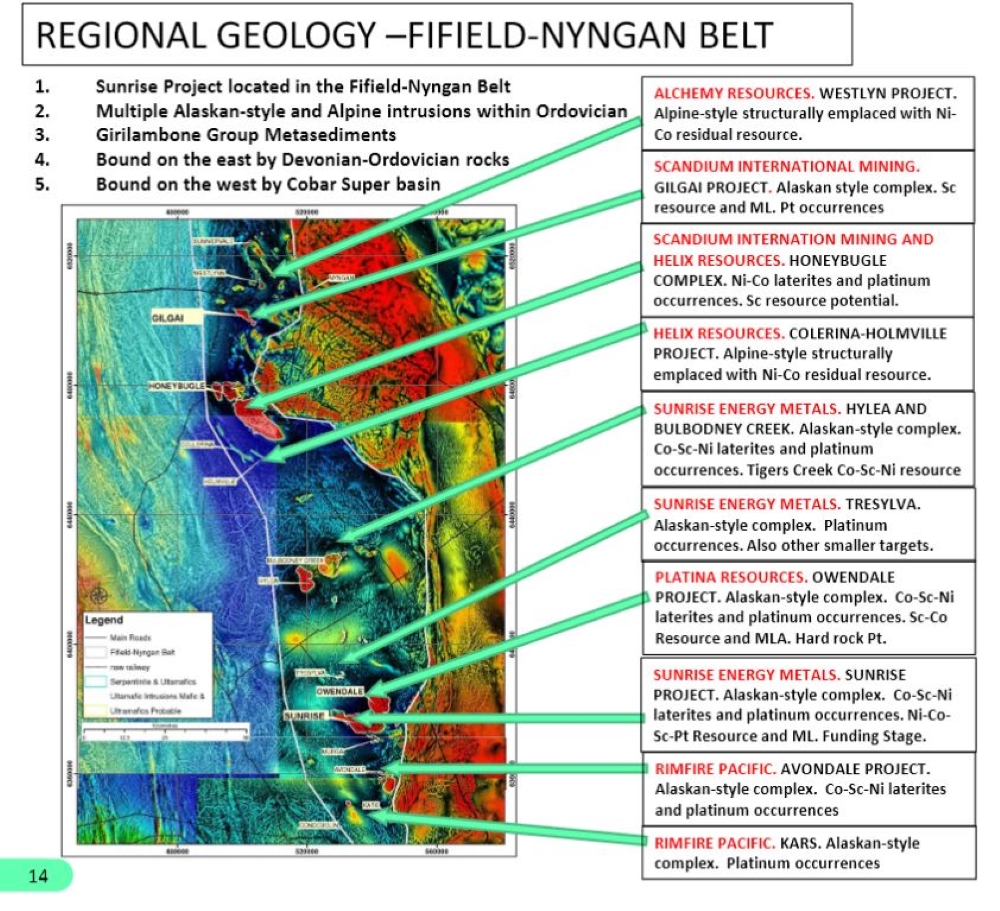

Check out who else is around the Fifield-Nyngan Belt in NSW:

Nearology call could lead to a world-class scandium mining hub

While Australian Mines (ASX:AUZ) has been focused this past year on its REE and lithium prospectivity in Brazil, Sunrise’s latest moves near AUZ’s long-held 3.1Mt at 434ppm Sc Flemington project has both investors and the explorer pricking up their ears.

Bought from Jervois Mining, AUZ had proved up a maiden resource of 2.7Mt at 0.101 % cobalt and 403ppm Sc back in 2018 and has held onto it since.

High-grade intersections from the tenure include 21m at 577ppm Sc, 23m at 459 ppm Sc, 21m at 485ppm Sc and 23m at 543ppm Sc – which are all from surface and some of the highest grades of scandium found to-date in Australia.

The junior also owns the $1.5bn Sconi nickel-cobalt-scandium project in QLD, that, if developed would support running a 2Mtpa processing plant and put 800 permanent boots on the ground to run the operation.

TSX-listed Scandium International owns the shovel-ready Nyngan nickel-scandium project in central NSW, targeting 38tpa of scandium-oxide, while Platina Resources (ASX:PGM) sold a scandium project in the region to Rio last year for $14m.

At Stockhead we tell it like it is. While Australian Mines is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.