Is lithium the ace up Strike Resources’ sleeve?

Pic: John W Banagan / Stone via Getty Images

Special Report: Strike Resources may have built a reputation – and soon enough a mine – on iron ore, but the company has an ace up its sleeve by way of a project of a different kind.

Having been off the boil for the past few years, lithium and battery metals are back in vogue and pundits are picking them to be here to stay.

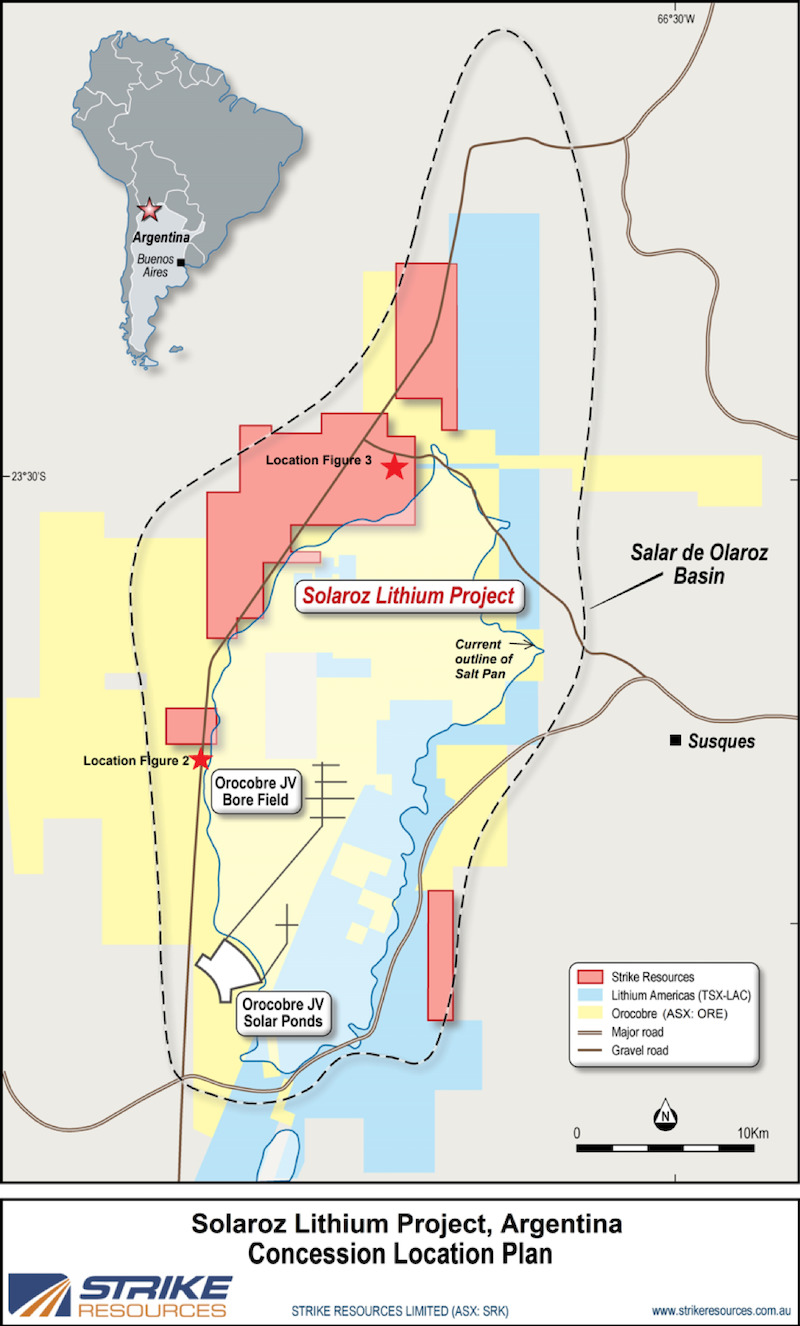

Fortuitous, then, that Strike Resources (ASX:SRK) – a company soon to have cashflow coming in courtesy of the Paulsens East iron ore project – is sitting on a massive lithium brine project immediately next door to Orocobre’s (ASX:ORE) world-famous Olaroz project in Argentina.

So close is Strike’s 90 per cent-owned Solaroz project to the established Orocobre project that the pair sit on the same salt lake.

“We’ve been focused on iron ore for the last 15 years, but back in 2018 – 2019 we were looking for some diversification,” Strike Resources managing director William Johnson told Stockhead.

“I really like the battery minerals space, so we picked up this project in Argentina. We were able to secure a very large land package, and if exploration pans out and we can confirm our landholding sits above the same aquifer as Orocobre, there’s no reason we couldn’t eventually replicate what they’re doing with a project of our own.”

Strike’s focus has historically been on iron ore – both in WA at East Paulsens and at the long-held Apurimac magnetite iron ore project in Peru. Having picked up Solaroz in 2019, the company is looking to get moving at the project in 2021.

“We were hoping to start some exploration on it last year but COVID put a halt to that,” Johnson said.

“Unfortunately Argentina was hit quite badly and it’s been hard to get early stage exploration done, but we’ve got a really good partner on the ground with an experienced team, and the advice now is that things are starting to free up.

“We are hoping to get on the ground and start some exploration work in the first half of this year.”

In the pipeline at Solaroz is a program which includes a six-month program of geophysics and drilling to test the geological model and ensure the mining concessions sit above the aquifer. Once confirmed, Strike intends to ramp up more studies.

“Paulsens East is definitely our number one project at the moment, because it’s near-term production and the iron ore price is strong, which makes it an extremely valuable asset to the company and good cashflow for us,” Johnson said.

“But I think the timing is good in that we can run these in parallel – the team in Argentina will be advancing the exploration onsite in parallel with us here at Paulsens East.

“Once we get Paulsens East up and running, and we’re generating some cash from there, that will give us an opportunity to potentially divert some cash into ramping up Argentinian activity.”

Paulsens East the key

Paulsens East, on which a compelling feasibility study was completed in November, looms as the key to unlocking the substantial value in the Strike Resources playbook longer term.

Within that playbook is Solaroz, as well as the mammoth Apurimac iron ore project. Strike once fielded an offer of over $500 million for the enormous Peruvian iron ore play, which has a JORC resource of 269.4Mt of high-grade 57% Fe magnetite iron ore.

Johnson spoke with Stockhead in December about the potential to leverage the value generated by Paulsens East into both Apurimac and Solaroz – two projects which have the potential to be globally significant in their respective industry.

Particularly compelling at Solaroz is the low cost potential once infrastructure is in place – retrieving lithium from brines is a comparatively lower cost, lower intensity process than getting the element from the hard rock equivalent more commonly found in Australia.

“These lithium brine projects in Argentina are some of the lowest on the cost curve anywhere in the world,” Johnson said.

“That’s one of the greatest advantages of these kinds of projects. They’re basically solar powered, in that the sun does most of the work through evaporation. The cost of producing lithium carbonate is very low compared to other types of projects.”

With both lithium and iron ore performing strongly, Strike Resources is well placed to capitalise over the next few years and beyond.

This article was developed in collaboration with Strike Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.