Iron ore juniors escape ASX maelstrom as price rallies

(Getty Images)

Investors were more bullish on iron ore players on Monday following a strengthening in the price of the steel-making commodity.

A handful of ASX-listed junior iron ore explorers managed to escape the downward pull of the market on Monday amid a 1.6 per cent fall in the ASX200 index. (Though the stocks faced another tough day on Tuesday after the Dow Jones lost 4.6 per cent overnight).

Centrex Metals (ASX:CXM) led the pack with an 8.3 per cent gain to close the day at 1.2c.

GWR Group (ASX:GWR), Freehill Mining (ASX:FHS) and Iron Road (ASX:IRD) all made gains of more than 5 per cent.

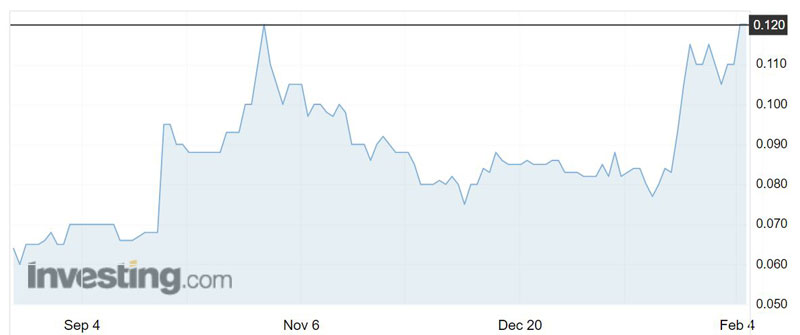

Iron ore stocks have been on the nose for investors for the past few years, ever since late 2015, when the price bombed below $US40 per tonne and companies were forced to mothball production.

The price recovered to around US$95 per tonne in February last year, but has lost some ground since then.

However, whispers that China is planning to extend its production cuts have spurred Chinese investor buying in derivatives, which has prompted a rally in the spot market price.

The price for benchmark 62 per cent fines (fine iron ore products smaller than 6mm in size) has climbed back up to $US74.39, marking a 2.1 per cent gain and its highest level since January 26, according to the Metal Bulletin.

The Chinese market is very sentiment driven, S&P Global Patts senior managing editor Paul Bartholomew told Stockhead.

“Particularly Shanghai rebar and the Dalian iron ore futures is very sentiment driven, not always related to fundamentals,” he said.

“The physical market does take its lead a lot from futures markets. The thing about futures markets is you’ve got a lot more Chinese retail investors, mum and dad investors, sort of piling into commodities derivatives and getting out of the share market.”

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The share market and housing market in China have been quite volatile of late, according to Mr Bartholomew.

“They don’t quite know where that’s going to go so a lot of hot money has been going into derivatives and that’s probably a trend we’ve been seeing for the last couple of years,” he said.

China has been cracking down on its polluting industries, in particular steel mills using lower quality iron ore to make steel. The production cuts were due to come to an end on March 15.

“The market is a lot more reactive to Chinese policy and also rumours of Chinese policy. There’s been rumours that China might keep the production cuts extended a bit longer, but at the same time some of the production cuts haven’t been as significant as expected for various reasons.”

Steel demand in 2018, however, is expected to be a lot softer, with analysts predicting an average iron ore price of US$65 per tonne, compared to US$71.30 per tonne in 2017.

The iron ore market will be a lot quieter from next week with Chinese New year celebrations reducing demand for at least the next two weeks.

“At the moment there’s not very much buying interest for seaborne iron ore because Chinese mills and traders have already stocked up and they’ve got enough iron ore inventory to last them until the end of the lunar new year holiday period,” Mr Bartholomew said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.