Iron ore prices rebound as a new round of Chinese environmental inspections begin

Picture: Getty Images

Iron ore prices rebounded on Wednesday, helped by a bounce in steel futures and speculation over further stimulus measures being rolled out to support China’s economy.

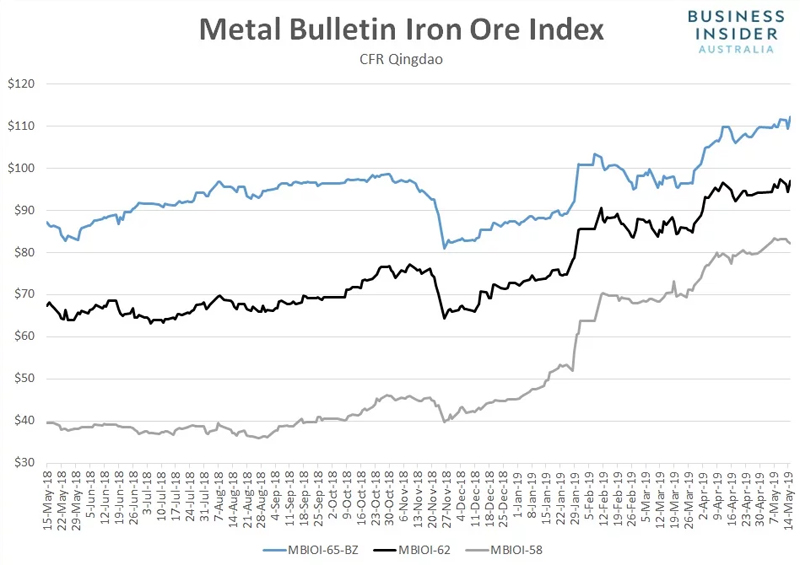

According to Metal Bulletin, the spot price for benchmark 62% fines surged 2.8% to $96.95 a tonne, largely reversing its losses from the prior two sessions.

65% fines also jumped, closing up 2.5% at $112.10 a tonne. That’s the highest level since Metal Bulletin first started producing data on the grade at the start of 2016.

In contrast to higher grades, the price for 58% fines went backwards, sliding 0.4% to a two-week low of $82.14 a tonne.

The divergent price performance followed news of a new round of environmental checks in China.

Reuters reports that “intensified anti-pollution inspections” from China’s environment ministry will be conducted between May 15 to 25.

981 inspectors have been sent to 25 cities and provinces across the country, including industrial hubs such as Beijing-Tianjin-Hebei, Shanxi-Shaanxi-Henan and the Yangtze River Delta.

In the past, environmental inspections have often led to speculative buying in Chinese steel futures. Based on the price action seen on Wednesday, there was no exception to the rule on this occasion.

Rebar and hot-rolled coil futures in Shanghai rose to 3,704 and 3,637 yuan respectively, up from the prior night session close of 3,666 and 3,595 yuan.

Weak Chinese economic data may have also provided support during the session, increasing the likelihood that Chinese policymakers will roll out additional stimulus measures in the period ahead to support activity levels.

Like steel contracts in Shanghai, iron ore futures in Dalian also reversed earlier losses, rising to 660 yuan, up from 645.5 yuan on Tuesday evening.

Similar moves were seen in coal and coke contracts which finished the session at 1,370 and 2,140 yuan respectively, up from Tuesday’s night session close of 1,342 and 2,096.5 yuan.

Along with higher steel prices and stimulus hopes, data from China’s NBS showing crude steel output rose to a record high of 85.03 million tonnes last month likely supported buying in the bulks.

A slight lift in Chinese property investment in April also helped to bolster sentiment about the outlook for demand.

Most of Wednesday’s day session gains were sustained in overnight trade.

SHFE Hot Rolled Coil ¥3,634 , 0.72%

SHFE Rebar ¥3,719 , 1.17%

DCE Iron Ore ¥658.50 , 1.39%

DCE Coking Coal ¥1,363.00 , 1.00%

DCE Coke ¥2,139.50 , 1.35%

Trade in Chinese commodity futures will resume at 11am AEST.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.