Iron ore prices perk up as Chinese air quality gets hazy

A Chinese citizen wears a mask with the Beijing skyline in the background. Picture: Getty Images

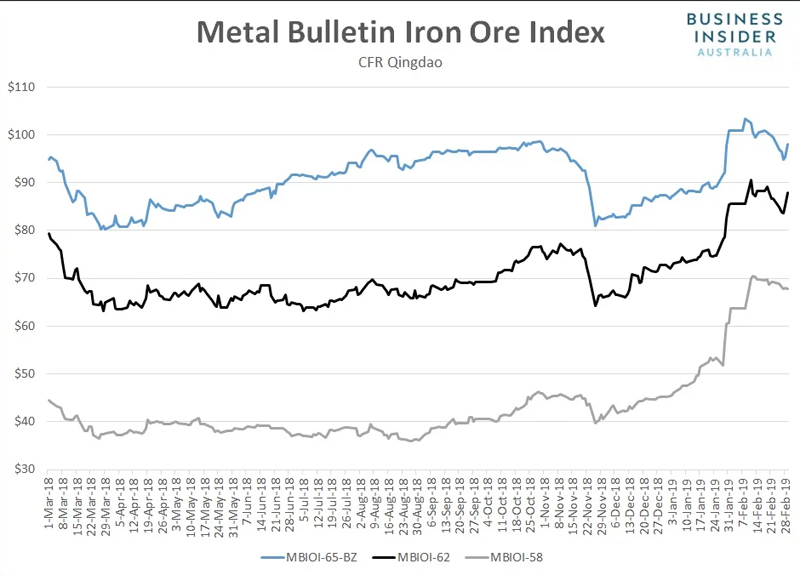

According to Metal Bulletin, the price for benchmark 62% fines surged 3.1% to $87.92 a tonne, extending its rally over the past two sessions to 5.2%.

It now sits at the highest level since February 20.

Large gains were also seen across higher grades on Friday, along with the premium demanded for iron ore lump.

The price for 65% Brazilian fines jumped 2.8% to $98.10 a tonne. The premium for Australian iron ore lump over the benchmark price also soared by 12.1% to $37 a tonne.

In contrast, the price for 58% fines went backwards, losing 0.2% to $67.85 a tonne.

The divergence across spot markets followed news that officials in Tangshan, China’s top steel-producing city, had issued a level one smog alert between March 1 to 6, prohibiting or curbing industrial activity in an attempt to help improve air quality.

The level one alert is the most severe preventative measure, helping to explain the jump in higher iron ore grades and lump prices given they are higher yielding for the same level of air emissions.

Separately, officials in China’s capital city of Beijing also issued a second level smog alert that comes to a conclusion today. Along with a stronger-than-expected China manufacturing PMI released by IHS Markit for February, and optimism over the outlook for Chinese steel mill demand given a lift in steel prices, it helps to explain the strong gains seen across most spot products on Friday.

The move was also replicated in Chinese steel and bulk commodity futures on Friday.

According to the Shanghai Futures Exchange, the most actively traded rebar and hot-rolled coil contracts soared to 3,815 and 3,825 yuan respectively during Friday’s day session, up from 3,768 and 3.785 yuan on Thursday evening.

The strength in steel markets flowed through to bulk commodity futures in Dalian with the most actively traded iron ore, coking coal and coke contracts climbing from 613.5, 1.299 and 2,125 yuan respectively on Thursday night to 625.5, 1,313.5 and 2,168 yuan at the the conclusion of Friday’s day session.

And those moves were largely sustained or built upon on Friday evening, led by Dalian iron ore.

SHFE Hot Rolled Coil ¥3,817 , 0.77%

SHFE Rebar ¥3,847 , 1.85%

DCE Iron Ore ¥643.50 , 4.38%

DCE Coking Coal ¥1,312.00 , 0.77%

DCE Coke ¥2,157.50 , 0.82%

The strong push higher in futures markets, leaving the May 2019 iron ore contract just below the multi-year peak of 657.5 yuan set earlier this month, points to strength in spot markets in early deals on Monday.

Trade in Chinese commodity futures will resume at midday AEDT.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.