Iron ore prices could tank if Evergrande contagion more severe than expected: Oxford Economics

Pic: Getty/Stockhead

On Wednesday, Chinese property giant Evergrande made a last gasp interest payments on at least two bonds — missing them could have triggered collapse, impacting the Chinese and world economies.

Still, with some $300 billion in debt outstanding it is still teetering on the edge of default.

Evergrande’s struggles shine a spotlight on the downturn in China’s real estate sector that started in 2020 and has worsened recently, with momentum in both housing sales and housing starts weakening considerably.

Oxford Economics baseline (most expected) forecast is that China’s property downturn will be significant but contained, “due to a low stock of unsold housing, room for policy easing, continuing urbanization, and significant income growth”.

“But, with shifting demographics, high numbers of empty apartments, and some big property developers being heavily over-leveraged, China’s huge property sector could crash more heavily,” it says.

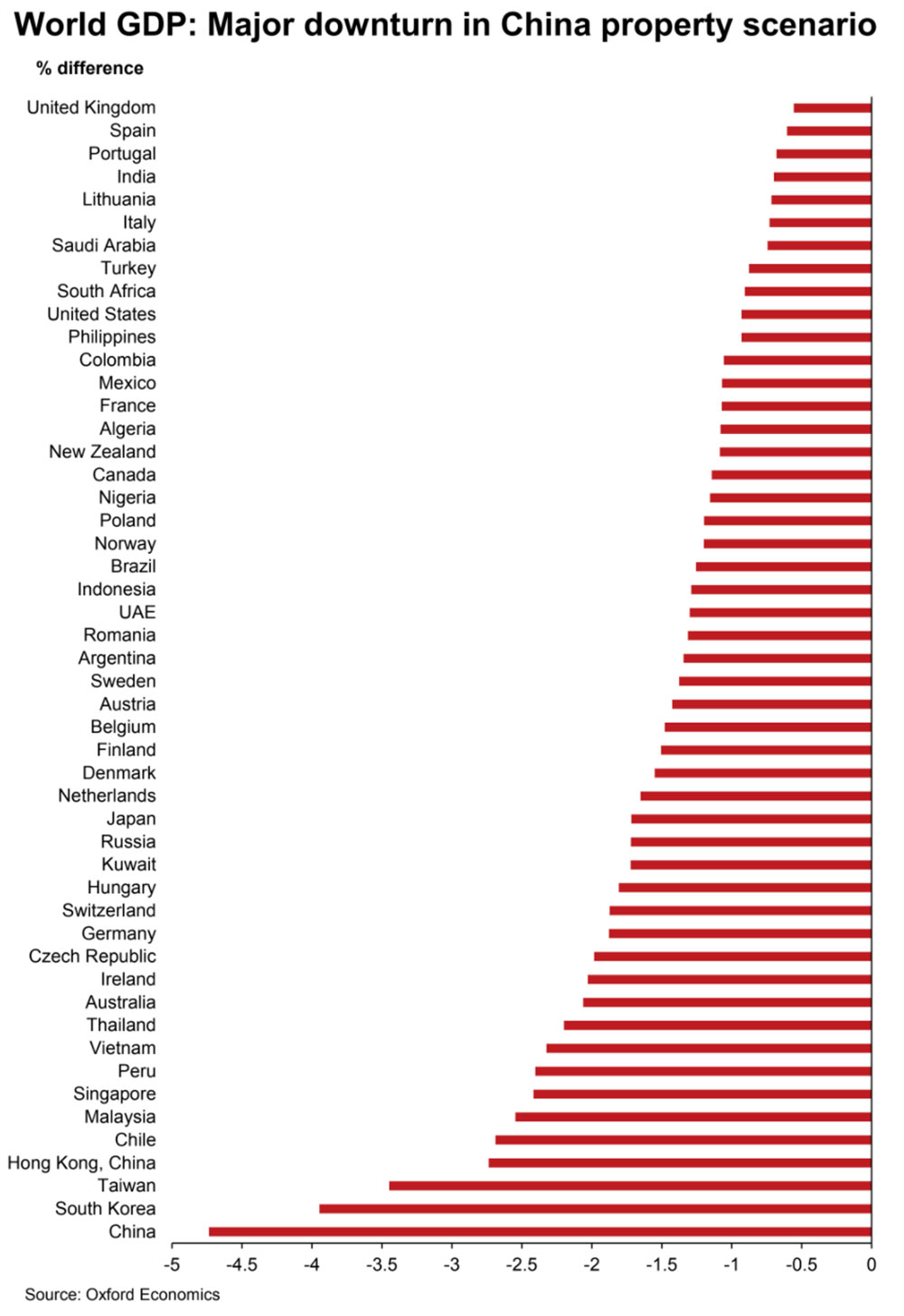

“According to our modelling, a more severe housing market downturn in China than we currently expect would slow China’s growth markedly and have a major impact on global growth.”

This would have outsized impacts on Australia, as a major exporter of raw commodities to China.

Scenario 1: A repeat of China’s 2014-2015 property slump

This is a medium probability scenario, potentially triggered by the relatively disorderly collapse of the large property developer.

If the property downturn were to follow the pattern of China’s 2014-2015 property slump, real estate investment growth would crater at -8.8% in Q4 2022.

Consequently, China’s GDP growth would drop to 3% year-on year in Q4 2022, compared to 5.3% in Oxford’s baseline.

The impact on the overall global economy is also sizeable, Oxford says.

“The direct impact from weaker Chinese imports of construction equipment and raw commodities, plus the indirect impact on Chinese imports from a weaker overall Chinese economy and further international feedback effects, mean global GDP growth would be 0.7 ppts lower in Q4 2022 than in our baseline,” it says.

“Countries that export a lot to China relative to their GDP would see activity weaken more.”

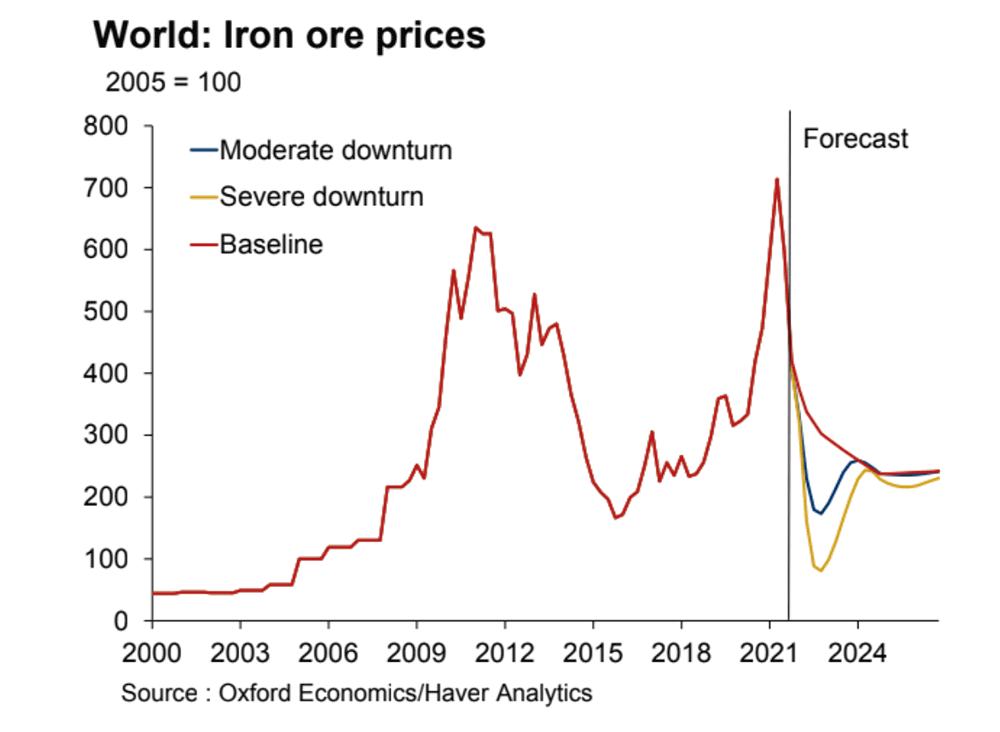

What’s more, as China’s real estate investment is particularly commodity intensive, the substantial drop in imports of raw commodities would drive down their prices.

Global metal prices would be 30% lower in Q3 2022 than in the baseline, with iron ore prices down 44%, Oxford says.

“This would aggravate the impact on industrial commodity producers such as Chile, Peru, Australia, and Saudi Arabia.”

Scenario 2: Welcome to Doomsday

If China’s residential investment were to crash as much as it did in the US and Spain in the 2000s — aka the Global Financial Crisis — overall GDP growth would trough at a paltry 1% in Q4 2024, and global GDP growth would be 1.6ppts lower than in the baseline forecast.

Factors that could aggravate the property downturn include major economic and financial spill-overs from defaults by Evergrande or other developers, a sharp deterioration of sentiment in the housing market, and a doggedly hawkish policy stance.

“The global impact is heightened by a lack of forceful discretionary policy easing globally,” Oxford says.

“This could happen if international policymakers assume Beijing will step in with forceful stimulus, but China’s policymakers decide not to do that.”

“Meanwhile, as China’s imports of commodities tank, global metal prices would be 55% lower than in our baseline in H2 of 2022, and iron ore prices 73% down.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.