Iron ore prices catapult higher on rising steel production in China, coal lags on quota drag

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

- Iron ore prices traded this week at $US124 per tonne, up $US2.25 per tonne on a week ago

- Coking coal prices were slightly higher this week at $US95.80 per tonne at Queensland ports

- China’s reinforcing bar price is at $US618.50 per tonne, up $US13.50 per tonne on a week ago

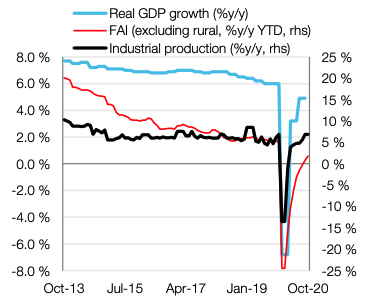

Iron ore prices pressed higher this week as the engine of the Chinese economy roared back to levels seen before the COVID outbreak.

The price of iron ore catapulted to $US124 per tonne ($169.35/tonne) this week, as demand continues to surge in a supply constrained market.

“Iron ore prices have recently reached a six-year high, as Chinese iron ore imports also surged to a new high of 322 million tonnes in the September quarter, and Chinese steel production remained above 90 million tonnes per month during May-September 2020,” said S&P Global Ratings analyst, Minh Hoang.

“Current prices have been primarily tied to resurgent Chinese steel demand from the ramp-up of industrial activity post-COVID-19,” said Hoang.

For the 62 per cent grade iron ore fines product, spot prices were transacting around $US124 per tonne, according to Metal Bulletin.

A week ago, iron ore cargoes delivered to ports in China were trading around $US121.75 per tonne, the price reporting agency said.

Iron ore prices remain well supported into 2021

S&P Global Ratings expect prices for iron ore cargoes to begin to moderate to around US$85 per tonne later in 2021.

“We see prices likely to remain supported into early 2021, particularly as Chinese steel mills move into seasonal re-stocking ahead of Chinese New Year,” Hoang said.

Supply of iron ore from Brazil’s mines has been affected by the COVID pandemic, but is starting to recover, analysts said.

“Brazil has been boosting its production output after being hit hard during the height of the COVID-19 pandemic,” said Hoang.

“Vale’s September quarter production surged 31 per cent, or 21 million tonnes, to reach 88.7 million tonnes in the September quarter; however, this remains below the circa 96 million tonnes run-rate Vale was able to achieve prior to its dam failure,” said Hoang.

“We continue to expect Vale”s idled capacity to incrementally return to the market, and together with new capacity coming to the market elsewhere, this could take some steam off iron ore prices over the next two years,” added the S&P Global Ratings analyst.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| TI1 | Tombador Iron | 0.042 | 40 | 24 | 100 | $28.6M |

| MGT | Magnetite Mines | 0.0105 | 17 | -19 | 251 | $31.4M |

| SRK | Strike Resources | 0.11 | 16 | 0 | 175 | $21.7M |

| CIA | Champion Iron Ltd | 4.59 | 13 | 50 | 124 | $2.0B |

| ADY | Admiralty Resources. | 0.014 | 8 | -18 | 56 | $18.5M |

| EUR | European Lithium Ltd | 0.042 | 5 | -7 | -53 | $32.0M |

| MGX | Mount Gibson Iron | 0.73 | 3 | 5 | -6 | $853.9M |

| MIN | Mineral Resources. | 28.49 | 2 | 13 | 94 | $5.3B |

| LCY | Legacy Iron Ore | 0.008 | 0 | 33 | 173 | $43.7M |

| FEX | Fenix Resources Ltd | 0.14 | 0 | -3 | 233 | $53.8M |

| FMG | Fortescue Metals Grp | 17.04 | -3 | 2 | 88 | $51.5B |

| MAG | Magmatic Resrce Ltd | 0.205 | -11 | 0 | 37 | $36.4M |

Champion Iron (ASX:CIA) announced this week that approval has been given for its acquisition of the Kamistiatusset iron ore project in the Canadian province of Newfoundland.

The acquisition price is $15m, and $19.4m of debt incurred by the project’s previous owner Alderon Iron Ore has been cancelled.

The project is located near Champion Iron’s Bloom Lake mine in Quebec that the company acquired from Cliffs Natural Resources for $10.5m in 2016.

“While our company is rapidly gaining global recognition for its ability to deliver quality iron ore products, the acquisition would further position our company to service the rising demand for high-grade iron ore concentrate globally,” said chief executive, David Cataford.

Steel product prices move higher

Steel product prices in China are on an upward trend, as are futures prices for hot rolled coil and reinforcing bar in China.

The price of steel reinforcing bar (rebar), which is used in construction, rose to $US618.50 per tonne this week.

This is up $US13.50 per tonne on a week ago, and up $US22 in the prior week, according to reports.

Crude steel production in China appears to be accelerating, and grew nearly 12.7 per cent in October.

“China’s steel demand is being driven by China’s infrastructure and manufacturing sectors,” said Commonwealth Bank of Australia analysts in a report.

Output is expected to slow over the year-end, as Chinese blast furnaces are idled as an air pollution reduction measure.

Levels of industrial production in China are now back to where they were before the global pandemic started.

Australian coking coal prices trade sideways in uncertain market

Hard coking coal at the Queensland shipping terminal of Dalrymple Bay traded 80c higher week on week at $US95.80 per tonne.

Trading in spot cargoes of Australian hard coking coal has been thin this week, as demand has slowed from China and India.

Cargoes of coking coal for delivery to ports in northeastern China were heard at $US141 per tonne, up $US16 on week.

North American coking coal is still popular with Chinese buyers, and is setting prices for coking coal imports at Chinese ports.

Buyers in China appear willing to pay a slight premium for cargoes of North American origin.

This is despite the higher sulphur levels in North American coking coal which is not ideal for blast furnaces.

Russian coking coal delivered from ports on the Pacific is another option for Chinese buyers.

It has a lower price than North American or Australian coking coal because of its shorter shipping distance.

China’s import quota for coal products of ~270 million tonnes has been mostly filled for the year already.

This is not untypical as buying bunches in the first half of the year, as buyers book cargoes early while quotas are still open.

Very little of the import quota is left unfilled for the balance of the year, according to market analysts.

Buyers can start to book cargoes of coking coal for arrival in the new year, when import quotas are reset for 2021.

This may lead to an upturn in demand for coking coal cargoes from Australia, analysts said.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| WHC | Whitehaven Coal | 1.26 | 17 | 24 | -60 | $1.2B |

| LNY | Laneway Res Ltd | 0.008 | 14 | 0 | 33 | $26.4M |

| CRN | Coronado Global Res | 0.9 | 13 | 10 | -59 | $1.2B |

| PDZ | Prairie Mining Ltd | 0.21 | 11 | -7 | -9 | $45.7M |

| NCZ | New Century Resource | 0.185 | 9 | 24 | -47 | $183.5M |

| MEY | Marenica Energy Ltd | 0.098 | 7 | -1 | 2 | $13.6M |

| AKM | Aspire Mining Ltd | 0.075 | 6 | 0 | -38 | $36.5M |

| YAL | Yancoal Aust Ltd | 1.95 | 2 | 2 | -35 | $2.6B |

| TER | Terracom Ltd | 0.145 | 0 | -3 | -60 | $113.0M |

| NAE | New Age Exploration | 0.014 | 0 | -18 | 367 | $15.6M |

| MCM | Mc Mining Ltd | 0.19 | 0 | 73 | -65 | $29.3M |

| SPN | Sparc Tech Ltd | 0.001 | 0 | 0 | 0 | $20K |

| CKA | Cokal Ltd | 0.063 | -2 | -2 | 31 | $57.2M |

| AHQ | Allegiance Coal Ltd | 0.057 | -2 | -17 | -54 | $41.7M |

| BCB | Bowen Coal Limited | 0.05 | -2 | -17 | -17 | $43.6M |

| JAL | Jameson Resources | 0.12 | -4 | 0 | -33 | $37.9M |

| SMR | Stanmore Coal Ltd | 0.68 | -6 | -6 | -38 | $183.9M |

| BRL | Bathurst Res Ltd. | 0.039 | -7 | 3 | -63 | $68.3M |

| PAK | Pacific American Hld | 0.024 | -8 | 9 | -21 | $7.8M |

Australia-listed Cokal (ASX:CKA) has awarded a mining services contract for its Bumi Barito Mineral coking coal project in Indonesia.

The milestone is significant in developing BBM into a mine producing premium export quality coking coal and pulverised coal injection products for Asian steel markets.

The mining services contract is for five years and includes overburden removal at the BBM open-pit mine and coal haulage from pit to stockpile facilities.

“The use of contract mining enables reduction of upfront capital requirements for commencement of mining and expedites the development of BBM,” director, Karan Bangur, said.

BBM is Cokal’s most advanced project, and is located in Indonesia’s Kalimantan province covering an area of 14,980 hectares.

Coking coal futures prices point to looser market

Futures contract prices for Australian coking coal on the Chicago Mercantile Exchange (CME) are trading lower this week.

For December settlement, the futures price is US$103 per tonne, down $US19 on a week ago; while for January 2021 settlement the price has dropped $US11 on-week to $US123 per tonne.

The flattening of the futures forward price curve, indicates that the market for coking coal is becoming looser, with supply moving ahead of available demand.

Latest import figures show a slowing in the international trade for coking coal into the Chinese market.

China imported 13.7 million tonnes of coal in October, both thermal and coking, and the total was not broken down by category.

This represents a sharp year-on-year decline of 47 per cent, and a drop of 27 per cent on September’s imports total.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.