Iron ore prices are touching multi-year highs again

Picture: Getty Images

Iron ore prices jumped for a second consecutive session on Monday, moving back towards the multi-year highs struck earlier in the year.

Further supply disruptions, firm Chinese economic data and reports of an extension to industrial output curbs in northern China were the main catalysts behind the latest surge.

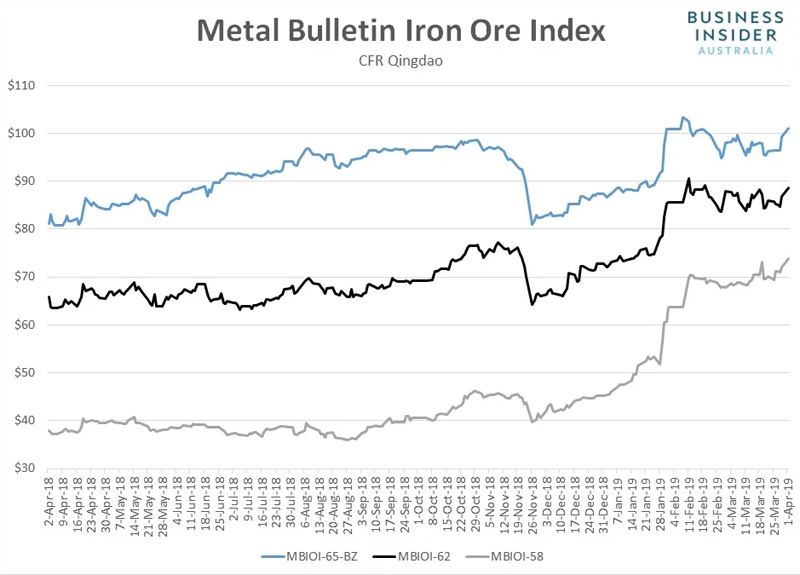

According to Metal Bulletin, the spot price for benchmark 62% fines jumped by a further 2.2% to $88.69 a tonne, adding to the 2.5% surge seen on Friday.

It now sits just below the multi-year peak of $90.58 a tonne set in early February.

Prices for higher grades also rose with 65% fines adding 1.7% to settle at $101 a tonne, leaving it at the highest level since February 11.

Gains in lower grades exceeded the boarder move with 58% fines surging 2.4% to $73.86 a tonne, leaving it at a five-year high.

The move in iron ore spot markets was mirrored in Chinese futures traded in Dalian.

According to the Dalian Commodities Exchange, the May 2019 iron ore contract rose to as high as 653.5 yuan at one point during Monday’s day session, leaving it just below the record high set in early February this year.

It eventually finished trade at 650 yuan, well above the 632.5 yuan level it closed on Friday evening.

The move coincided with news of further supply disruptions, this time from Australia.

On Monday, Rio Tinto cut its outlook for iron ore shipments from Australia’s Pilbara region this year due damage to caused by cyclone that struck the region last week.

Rio, the world’s second-largest iron ore producer behind Brazil’s Vale, said that annual shipments are now expected to be at the lower end of its previous guidance of between 338 and 350 million tonnes.

Along with supply concerns, demand indicators were also firm with manufacturing activity in China growing for the first time in for months in February. Capacity utilisation rates at Chinese steel mills also rose, helping to underpin prices for its raw materials.

According to Mysteel consultancy, Chinese steel mill capacity utilisation rates rose to 63.64% last week, adding to the uptick recorded a week earlier.

Aside from supply disruptions and firm economic data, sentiment may have also been supported by further strength in Chinese steel markets on Monday.

Rebar futures in Shanghai rallied to 3,806 yuan, up from 3,754 yuan on Friday evening. Hot-rolled coil contracts also rose from 3,754 to 3,778 yuan.

That followed reports that industrial output restrictions in Tangshan and Handan — the largest steel production hubs in China — will be extended into the June quarter in an attempt to improve air quality, according to multiple sources who spoke to Reuters.

However, after such a strong move earlier the session, there was evidence of profit-taking in steel and iron ore contracts in overnight trade on Monday.

SHFE Hot Rolled Coil ¥3,750 , -0.03%

SHFE Rebar ¥3,793 , 0.42%

DCE Iron Ore ¥646.00 , 1.17%

DCE Coking Coal ¥1,243.00 , 0.08%

DCE Coke ¥2,008.50 , 0.48%

That suggests there may be some early softness in physical markets in early deals on Tuesday.

Trade in Chinese futures will resume at midday AEDT.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.