Iron ore prices are threatening to climb past $100

Picture: Getty Images

Iron ore prices eased on Wednesday, pulling back from multi-year highs struck a session earlier.

With Chinese steel and iron ore futures continuing to slide in overnight trade, there may well be further weakness to come on Thursday.

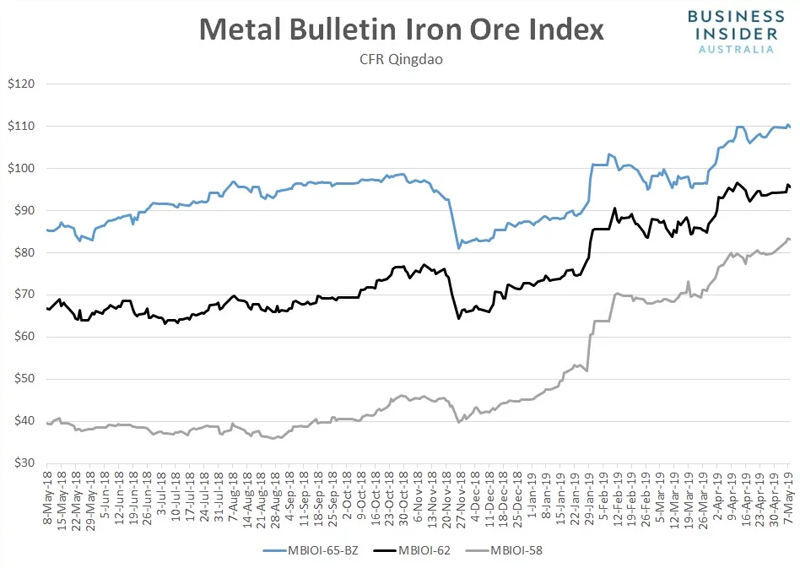

According to Metal Bulletin, the spot price for benchmark 62% fines slipped 0.6% to $95.57 a tonne, recording its first decline since April 25.

58% fines fell by a smaller 0.3% to $83.15 a tonne while 65% fines slid 0.5% to $109.80 a tonne.

Dalian iron ore futures also weakened during the session, mirroring the moves in physical markets.

The most actively traded September 2019 contract fell to 643 yuan, maintaining the losses seen in overnight trade on Tuesday.

While it had little impact in market pricing, Chinese trade data for April revealed iron ore imports slipped to 80.8 million tonnes during the month, down 6.5% from March and 2.6% from a year earlier.

The pullback was due to supply disruptions in Brazil and Australia — the latter by a cyclone that impacted shipments on the Pilbara coastline — rather than weaker demand. This has been a major factor behind the sharp rally in iron ore prices since the end of January.

Rather than the trade data, softness in steel futures likely contributed to the selling pressure seen in Wednesday.

Rebar and hot-rolled coil futures in Shanghai eased to 3,731 and 3,687 yuan respectively, down from 3,744 and 3,708 yuan on Tuesday evening.

Separately, coking coal futures were steady at 1,368 yuan while coke futures bucked the broader trend, lifting to 2,147.5 yuan.

Similar price trends were evident during Wednesday’s night session. Steel and iron ore futures fell, coking coal was basically flat while coke continued to push higher.

SHFE Hot Rolled Coil ¥3,670 , -0.81%

SHFE Rebar ¥3,728 , -0.37%

DCE Iron Ore ¥637.00 , -1.09%

DCE Coking Coal ¥1,364.00 , -0.37%

DCE Coke ¥2,159.50 , 1.34%

The weakness in steel and iron ore futures point to the likelihood of early weakness in physical markets on Thursday. Trade in Chinese commodity futures will resume at 11am AEST.

While the near-term prospects for prices appear to be slanted lower, commodity analysts at the Commonwealth Bank suggest strong Chinese demand, coupled with ongoing supply disruptions from Vale’s Brucutu mining complex in Brazil, may be enough to push the benchmark price above the $100 tonne levels in the not too distant future.

“The suspension of Vale’s Brucutu iron ore mine opens the door for iron ore prices to rise to $100 a tonne, said Vivek Dhar, Mining and Energy Commodities Analyst at the Commonwealth Bank.

“Demand conditions look more promising now, especially with Chinese steel mill margins rising through 2019. Combined with rising steel operating rates in Tangshan and falling iron ore port stockpiles, the ingredients may finally be right for iron ore to hit $100.”

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.