Iron ore prices are rocketing to multi-year highs

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Iron ore spot markets rocketed higher on Monday, powering to fresh multi-year highs.

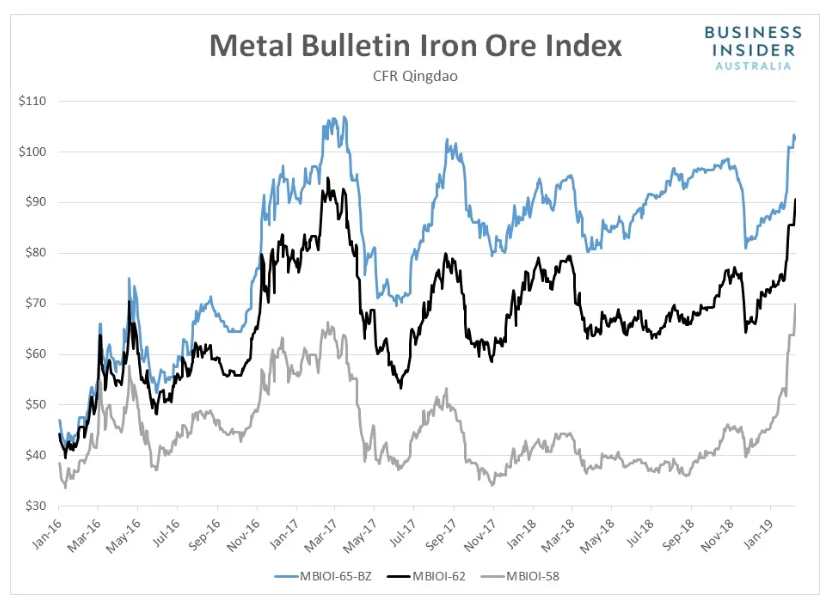

According to Metal Bulletin, the price for benchmark 62% fines jumped 5.9% to $90.58 a tonne, leaving it at the highest level since March 2017.

The benchmark has now rallied 41% since November 26, fueled by less onerous environmental restrictions in China compared to the same period a year ago and, more recently, heightened concerns about supply disruptions in seaborne markets following another mining disaster in Brazil in late January.

Making the move in the benchmark look small in comparison, prices for lower grade ore ripped higher on Monday, continuing the outperformance seen since late last year.

The price for 58% fines soared 9.6% to %$69.88 a tonne, leaving it at the highest level since September 2014.

From late November last year, the price for 58% fines has surged by a lazy 76%.

While low and mid-tier grades continued to rally, price for higher grade ore went backwards during the session.

65% fines fell 0.8% to $102.50, pulling back modestly after scaling fresh multi-year peaks on Friday.

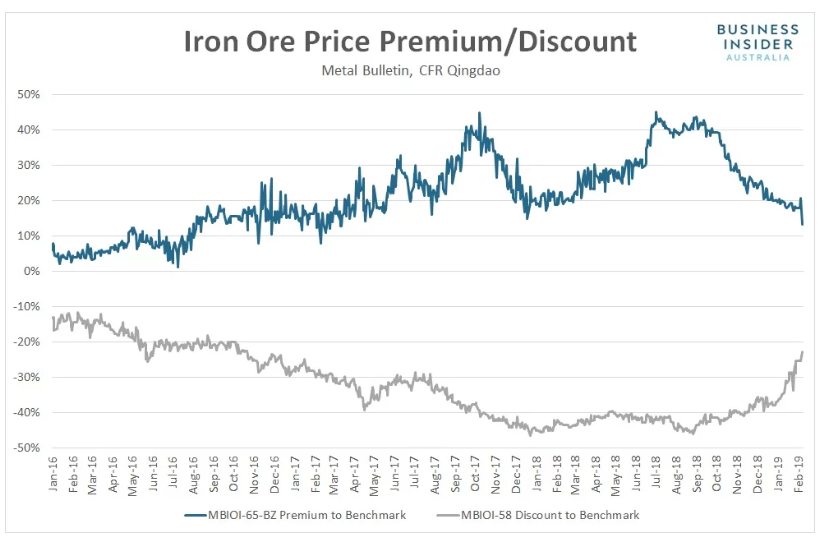

With prices for lower grades rising more than the benchmark, the price discount between the two grades narrowed to the lowest level since November 2016. The price premium demanded for 65% fines over the benchmark also fell to levels not seen March 2017.

“Iron ore prices have surged on supply concerns after the dam collapse at Vale’s Feijao mine has resulted in further supply being curtailed,” said Vivek Dhar, Mining and Energy Commodities Analyst at the Commonwealth Bank.

“The supply disruption to date is equivalent to around 4.5% of the seaborne iron ore market.”

While a scramble to secure ore explains the scale of the move seen in recent weeks, Dhar says Chinese steel mill margins will likely determine movements across individual iron ore grades in the period ahead.

“Subdued steel mill margins in China could limit the duration of any iron ore spike,” he says.

“Steel mills typically boost steel production and iron ore consumption following the Chinese New Year holiday period as construction season picks up. The likelihood of negative margins though could see China’s steel production growth slow more than expected.

“Negative margins will also likely increase the preference of Chinese steel mills towards lower grade iron ore as mills look to reduce costs.”

Given the movements across the grades on Monday, there’s already evidence to suggest that’s already taking place.

The massive spike in spot markets followed an equally large move in Chinese futures on Monday which opened limit up 8% and stayed there for the entirety of the session.

The May 2019 contract closed at 652 yuan, the highest level in nearly two years.

Strong gains were also seen in rebar and hot-rolled coil contracts while prices for coking coal and coke went backwards.

According to Reuters, Tangshan, the largest steel-producing hub in China, will impose production restrictions on its heavy industry from April to September in order to improve its air quality.

“Steel mills in the city will be ordered to halve sintering production, a process that prepares raw iron ore for smelting into steel, and to continue enforcing operation curbs on blast furnaces,” Reuters said.

After surging in day trade, iron ore, rebar and hot-rolled coil futures eased lower on Monday evening, hinting the fireworks in spot markets yesterday may not be repeated on Tuesday.

- SHFE Hot Rolled Coil ¥3,698 , -1.26%

- SHFE Rebar ¥3,807 , -1.27%

- DCE Iron Ore ¥646.50 , -0.77%

- DCE Coking Coal ¥1,274.00 , -0.55%

- DCE Coke ¥2,093.50 , -1.46%

Trade in Chinese commodity futures will resume at midday AEDT.

Not everyone expects the surge in futures and spot markets will be sustained beyond the ultra near-term.

“We think spot prices in the high $80’s look unsustainable,” says HSBC’s Metals and Mining Equities team.

“In the short term we expect prices to pull back towards $75 a tonne where there is seasonal support. The main risk to this view is that uncertainty regarding further disruptions at Vale from potential government intervention may keep prices elevated.

“However, we believe further price pressure from slowing steel production, contracting steel margins and recovering supply is likely to see prices trend towards our $67 a tonne average price forecast for 2019 as supportive factors wane.”

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.