Iron ore just touched its highest price in five years

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

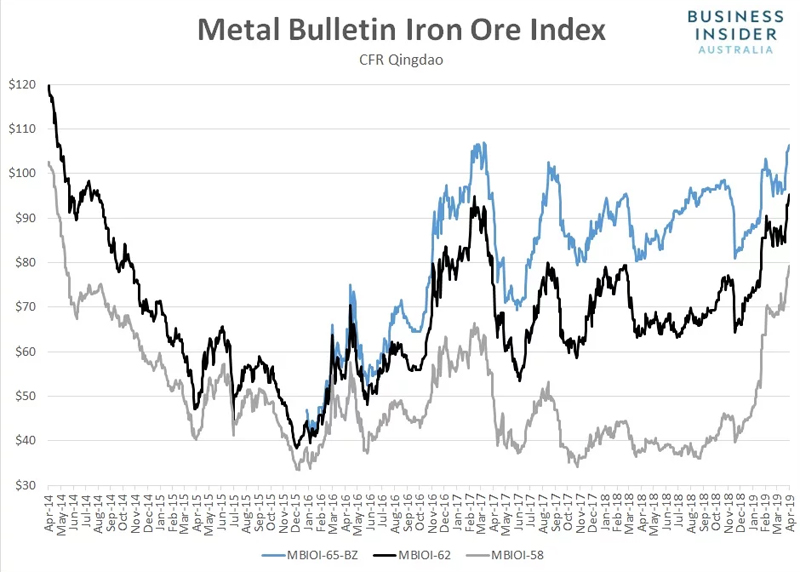

Iron ore prices continued to surge on Monday with all major grades closing at multi-year highs.

According to Metal Bulletin, the spot price for benchmark 62% fines jumped 2.6% to $95.30 a tonne, leaving it at the highest level since August 2014.

As has been the case in recent months, gains across lower grades were even greater during the session with 58% fines lifting 3.1% to $79.21 a tonne. Not since May 2014 has its price been this high.

Higher grade ores were the relative laggard on Monday with 65% Brazilian fines increasing 1.2% to $106.30 a tonne, leaving it at fresh two-year highs.

Since late November last year, the price for 58% fines has doubled. 62% and 65% fines have also seen gains of 48% and 31% respectively over the same period.

With lower grades rising significantly faster than mid and higher grades, the price discount between 58% and 65% fines now sits at the lowest level since mid-2016.

While supply disruptions in Brazil and Australia, two of the world’s largest iron ore seaborne exporters, have been a major factor behind the price surge seen across all grades over the past few months, the gains on Monday coincided with rampant buying of Chinese steel futures.

The May 2013 rebar contract on the Shanghai Futures Exchange surged to 4,030 yuan, up a substantial 3.95% from Thursday’s day session close. Chinese commodity futures were closed on Friday for the Tomb Sweeping Holiday. Hot-rolled coil futures that expire in May also jumped to 3,944, up 3.11% from where they closed on Thursday afternoon.

Analysts said prices were supported by renewed demand as warmer weather prompted a pickup in Chinese construction activity.

“The physical prices of steel have also increased over the last few days, driven by the seasonal demand improvement,” Richard Lu, senior analyst at CRU Group, told Reuters.

An extension of industrial output restrictions in the northern Chinese cities of Tangshan and Handan, the largest steel production hubs in China, may have also contributed to the price gains seen during the session. Restrictions to help improve air quality in northern China were originally scheduled to cease at the end of March.

A statement released by the Chinese government on Sunday, pledging further support for the economy, may have also helped to buoy sentiment during the session.

Firmer steel prices, helping to boost profitability at steel mills, also prompted brisk buying in bulk commodity futures in Dalian, boosting confidence that it will lead to stronger demand.

The May 2019 iron ore contract surged to 715 yuan at one point during the session, leaving it the highest level since trade in Chinese iron ore futures began in 2013.

It eventually closed at 712 yuan, up 4.3% from Thursday’s day session close.

Coking coal and coked contracts were also well supported, lifting to 1,258.5 and 2,048.5 yuan respectively.

Apart from coking coal and coke, all other contracts went on with the rally in overnight trade on Monday.

SHFE Hot Rolled Coil ¥3,967 , 1.22%

SHFE Rebar ¥4,058 , 1.99%

DCE Iron Ore ¥716.00 , 2.07%

DCE Coking Coal ¥1,251.50 , -0.24%

DCE Coke ¥2,041.00 , -0.07%

Trade in Chinese commodity futures will resume at 11am AEST.

Analysts at the Commonwealth Bank expect recent price gains will be sustained, at least in the short-term.

“We expect iron ore prices to [hold] above $90 a tonne in the short term as physical markets tighten since the disruption to Vale’s iron ore exports is only now being felt by importers,” said the bank’s Mining and Energy Commodities Analyst Vivek Dhar.

“Once China’s supply and demand responses are taken into account, cost curves suggest that prices will settle closer to $85 a tonne by the end of the year.”

As for the risks to his price view, Dhar says the remain to the upside for now.

“We see upside risks to our iron ore price outlook as considerable uncertainty and downside risks exist for Vale’s iron ore production,” he said.

“On the demand side, too, infrastructure is set to grow strongly over the remainder of 2019, limiting the prospect of weaker demand by Chinese steel mills.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.