Cheap iron ore is now 85% up in the past four months

Picture: Getty Images

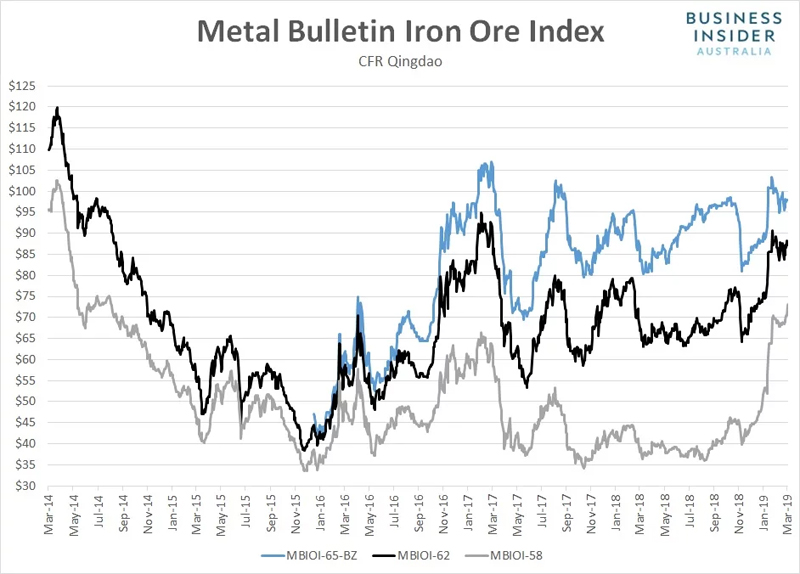

Lower grade iron ore prices have soared to fresh multi-year highs.

According to Metal Bulletin, the spot price for 58% iron ore fines jumped 3.7% to $73.09 a tonne, leaving it at the highest level since August 2014.

It has now gained in each of the past six sessions, extending its rally from late November last year to a mind-boggling 85%.

While prices for lower grade ore jumped, mid and higher grades went backwards on Tuesday.

The price for benchmark 62% fines fell 1.2% to $87.23 a tonne, continuing the seesaw pattern seen in each of the past sessions.

Higher grade ore also slipped with the price for 65% Brazilian fines dipping 0.1% to $97.90 a tonne.

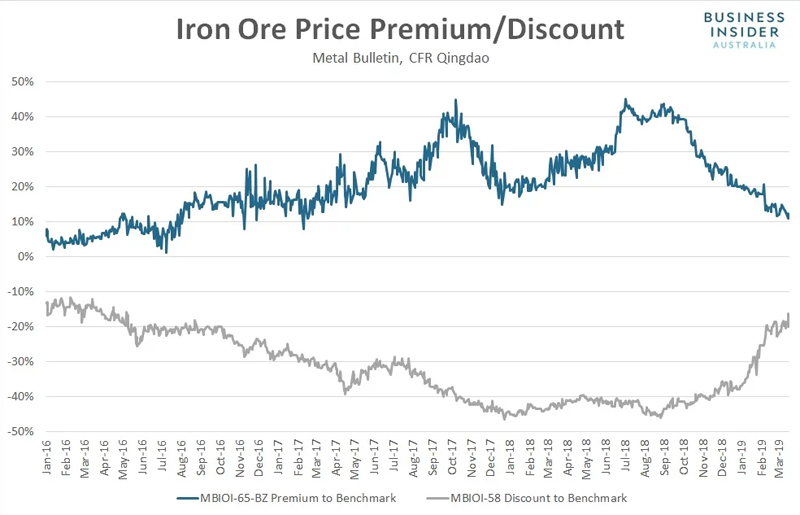

With the benchmark price going backwards while 58% fines rallied, the price discount for the latter fell to the lowest level since May 2016. As a whole, the price spread between lower and higher grades has narrowed significantly this year, reflecting less onerous environmental restrictions and lower steel mill profit margins in China.

The mixed performance in spot markets was similar to the price action in Chinese steel and bulk commodity futures on Tuesday — all bar coking coal contracts fell from Monday’s night session close.

Rebar and iron ore futures in Shanghai fell from 3,820 and 3,727 yuan on Monday night to close at 3,788 and 3,699 yuan respectively.

Dalian iron ore futures also went into reverse, falling from 643 yuan to close at 636 yuan. Coke contracts dipped from 1,981.5 yuan to 1,964 yuan.

Coking coal was the exception to the rule, lifting from 1,245.5 yuan on Monday evening to close at 1,277.5 yuan. That may reflect reports of further delays in Chinese coal imports clearing customs.

However, as seen in the closing scoreboard from Tuesday evening, that move was reversed in overnight trade. Coke and iron ore futures finished largely unchanged despite a small bounce in Chinese steel contracts.

SHFE Hot Rolled Coil ¥3,723 , 0.54%

SHFE Rebar ¥3,797 , 0.08%

DCE Iron Ore ¥635.00 , -0.31%

DCE Coking Coal ¥1,237.50 , 0.04%

DCE Coke ¥1,968.00 , 0.20%

Trade in Chinese futures will resume at midday AEDT.

In what may have implications for both spot and iron ore futures on Wednesday, a Brazilian court ordered on Tuesday that operations at Vale’s Brucutu iron ore complex will be allowed to resume, according to reports from Reuters.

Operations at Brucutu had been suspended since early February following a deadly mining accident at a separate facility operated by Vale.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.