IRIS Metals looking to unlock Kookynie’s bonanza gold potential

Pic: John W Banagan / Stone via Getty Images

Following a successful $7 million raising, cornerstoned by an entity associated with successful resource entrepreneur and investor, Levi Mochkin, IRIS Metals, is due to list on the ASX this Thursday. It has great expectations for its tenement holding in the exciting yet underexplored Kookynie gold district, which has a reputation for hosting high grade gold.

IRIS has painstakingly aggregated a land package previously been owned by numerous prospectors into the third largest landholding in the central mineralised corridor of Kookynie.

It isn’t hard to see why it has done so.

Kookynie has a history of gold production with over 600,000oz produced at high grades since the 1890s including notable names such as Cosmopolitan (350,000oz at 15g/t), Champion (33,000oz at 17g/t), Batavia (23,000oz at 30g/t) and Altona (18,800oz at 20g/t).

Significantly, these mines were all discovered in areas of outcrop, leaving much of the ground open for exploration using modern technology, techniques and geological interpretations.

This has been successfully proven by its neighbours with recent drilling by Metalicity (ASX:MCT) and Carnavale (ASX:CAV) returning bonanza gold grades within a week of each other.

Corporate Activity

Metalicity’s move to consolidate ownership of its Kookynie and Yundamindra projects through an all-scrip acquisition bid for its JV partner, Nex Metals (ASX:NME), just serves to underscore this attractiveness.

Other local operators include the Alkane Resources (ASX:ALK)-backed Genesis Minerals (ASX:GMD), which holds the 1.6Moz Ulysses gold project.

Promising Ground

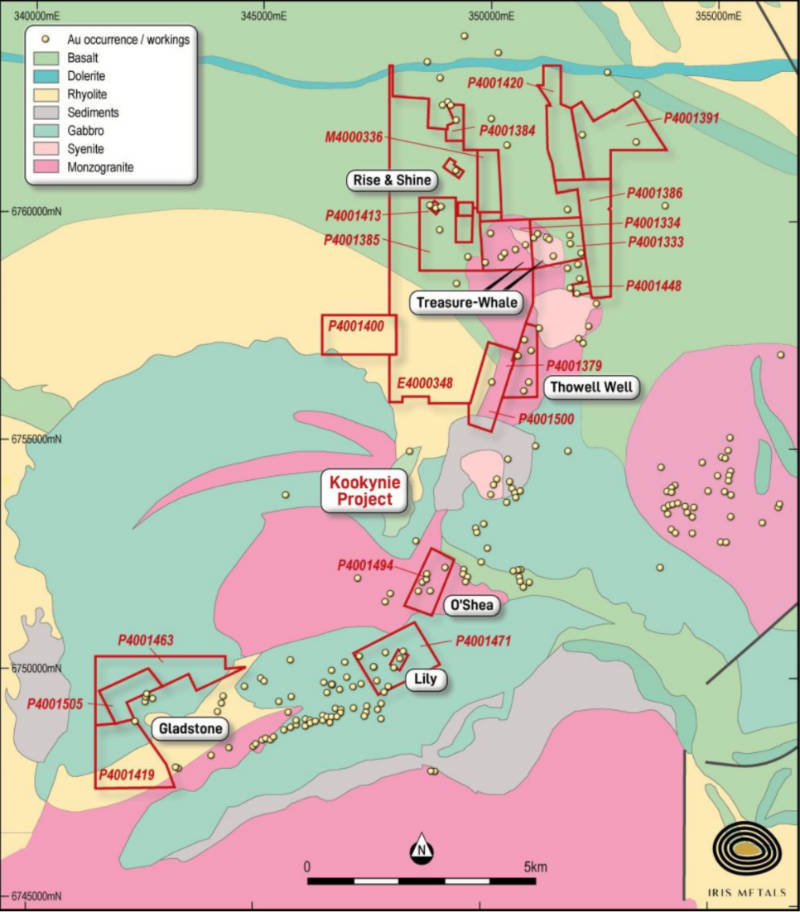

IRIS’ tenements cover approximately 35.5sqkm across 20 prospecting leases, two exploration leases and one mining lease within the central corridor in the heart of Kookynie.

It includes high priority advanced targets with known mineralisation along with the continuation of mineralised structures that remain untested under transported cover, which includes multiple historical mine sites that remain largely untested below 50m such as Rise & Shine, Treasure, Whale and Lily.

This is all in line with the company’s rationale for why it consolidated the ground. Executive director, Tal Paneth, told Stockhead, “We believe that with the methodical application of modern exploration techniques to this historically high grade goldfield, we have the potential to discover the feeder systems and mineralised structures that the old timers missed.”

“We have the benefit of being able to apply the latest exploration techniques to ground that hasn’t been drilled for almost 30 years,” he noted.

Historical drill hits are certainly encouraging, with the Rise & Shine prospect including a 17m intercept grading 2.09 grams per tonne (g/t) gold from 28m while Lily included a 10m zone at 8.07g/t gold from 20m.

Paneth added that historical hits at Rise & Shine highlighted the diversity of mineralisation at Kookynie.

“Rise & Shine had historic hits including 4m at 10.06g/t almost from surface which haven’t been tested at depth. The Lily deposit had known historical gold production at a grade of 63.79g/t gold, which is phenomenally high.”

“We are looking forward to methodically exploring our Kookynie tenure, utilising the latest techniques to fully understand the styles of mineralisation ,” he added.

Kookynie Gold Exploration

Given this substantial potential, it is anticipated IRIS will be kicking off a Reverse Circulation (RC) drill program shortly after listing, targeting walk-up targets at Rise & Shine and Lily, as well as the Treasure and Whale prospects with the aim of bringing them into JORC compliance.

This will be followed by the results of aeromagnetic data to identify new structures in addition to those already mapped, as all existing structures that have been mapped were found by prospectors from outcropping mineralisation.

The company will then conduct further drilling that could test potential new targets identified by geophysics.

Contracting geologist Andrew Wood, told Stockhead that the initial drilling will be testing low-hanging fruit.

“Looking at the historical data, I think it is highly encouraging. It does speak of high grades and it will be quite exciting to see what comes of this program,” he added.

Non-executive chairman Simon Lill, also the chairman of Pilbara trendsetter De Grey Mining (ASX:DEG), noted that IRIS was hopeful of finding a Ulysses-style deposit when the past prospectivity and recent successes of its neighbours was taken into consideration.

The historical high grade and proximity to “hungry” mills in the region mean that the company could easily and quickly become self-funding should it have similar exploration success to that of the old timers and neighbouring companies.

Leonora Projects

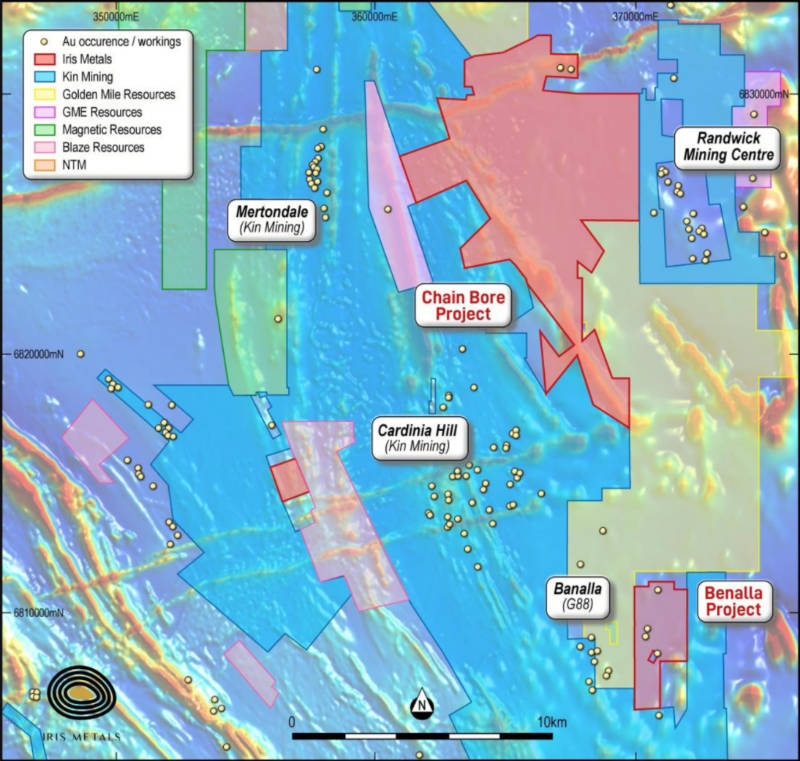

While Kookynie is the current focus of IRIS’ attention, the company also holds the Chain Bore and Little Dipper projects in the Leonora province, which has seen a fair bit of consolidation recently.

Chain Bore is located east of Kin Mining’s (ASX:KIN) successful operations in the area and hosts a number of significant historical gold hits while Little Dipper was last explored by Jubilee Gold Mines/Sir Samuel Mines in the mid-1990s and has been controlled by private prospectors ever since.

The Little Dipper Project sits to the Eastern border of Golden Mile Resources’ (ASX: G88) Benalla Wanghi Project from which they reported in March of this year an AC interval of [email protected]/t Au from 48m, including [email protected]/t from 61m. IRIS believes it has the potential to host the along-strike continuation of this project.

“We have historical hits that are very similar to what our neighbours are achieving regionally,” Paneth explained.

“Chain Bore had historical gold hits of 30m at 2.14g/t with splits at 2m at 15g/t and 7m at 4g/t. They were all from surface and have not seen decent or recent drilling.

“Little Dipper, had historical hits up to 5m at 12.5g/t gold close to surface. We are excited to unlock and see what the depth potential may hold.”

Aeromagnetic data has also been carried out over the Leonora projects with the company planning to carry out aircore drilling in October to provide a clearer understanding of their potential.

Regional Consolidation

There has been much corporate activity in Leonora in recent times. Dacian Gold (ASX:DCN) and NTM completed a merger via a scheme of arrangement in November 2020 with the merged group having a combined value of approximately $280 Million at the time.

Recently, and perhaps more significantly, St. Barbara Limited (ASX:SBM) has started executing on their strategic planning objectives as part of their “Leonora Province Plan,” acquiring a 19.78% interest in Kin Mining for total consideration of $25.3 million in July, 2021.

Attractive Capital Structure

The Company’s Top 20 shareholding report accounts for in excess of 80% of the 87.5 million issued capital. The IRIS capital structure is intended to provide shareholders with maximum leverage to exploration success.

The Company is also fortunate to have attracted Nasdaq Securities Australia Pty Ltd as a substantial shareholder. Nasdaq is a Mochkin Family entity, associated with successful resource entrepreneur and long time investor Levi Mochkin, a recently retired director of Piedmont Lithium Limited (ASX:PLL) and non-executive director of Odyssey Gold Limited (ASX:ODY).

Directors and management also have a large shareholding, ensuring an alignment of interests with shareholders.

ASX Listing

IRIS Metals has already wrapped up its initial public offering with shareholders subscribing for $7m worth of shares priced at 20c each.

Shares in the company are expected to start trading on September 23.

This article was developed in collaboration with IRIS Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.