IPO Watch: Golden Horse gallops in with extensive Southern Cross tenure

Golden Horse Minerals is looking to list on the ASX with an extensive tenure in WA's Southern Cross region. Pic: Getty Images

The Southern Cross greenstone belt is a prolific region in Western Australia that is well known for hosting large historical and current gold operations.

Historical examples include the Fraser’s gold mine just 1km south of the Southern Cross township that produced over 3Mt of ore grading an average of 5.5g/t gold before it was abandoned.

Current operations include Ramelius Resources’ (ASX:RMS) Edna May gold mine that includes a 2.9Mtpa conventional carbon-in-leach processing plant and the under-utilised 2.2Mtpa Marvel Loch processing plant.

Despite having produced gold from over 150 deposits, the region hasn’t seen much application of modern exploration techniques and drilling since most of the historical mines closed in the 1980s and ’90s.

However, this sorry state of affairs could be changing before too long, if Golden Horse Minerals has anything to say about it. And, as the company looks to list on the ASX under the proposed ticker GHM through a $16m initial public offering priced at 25c per share, which could be expanded to $18m if there’s sufficient demand, it just might.

Unrivalled tenure

Speaking to Stockhead, managing director Nicholas Anderson said that the lack of modern exploration was due to the previously fragmented nature of belt with lots of different owners.

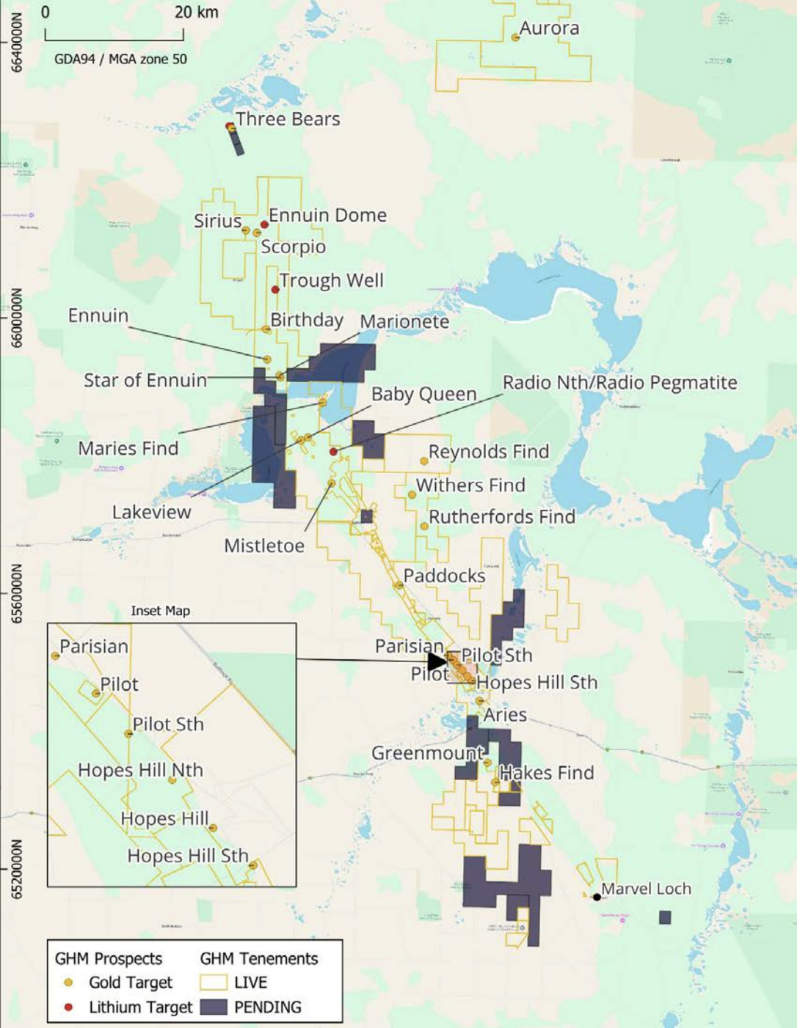

To combat this, the company has steadily made more than a dozen small to reasonable size transactions with small owners such as prospectors through to billion-dollar sized companies over the past 24 months to build the largest known consolidation of tenure over the Southern Cross greenstone belt in history.

It is also the first time that a single company has controlled tenements over the majority of the belt north of Southern Cross town.

“We have more than 100km of the greenstone belt strike and 1500km2 of tenure,” Anderson said.

“I like the tenure personally because the historical production has graded north of 2g/t and pushing 5-6g/t.

Historical gold potential

And it is not just ground that the company has consolidated.

While no resources or ore reserves have been defined by the company, its tenure does includes a number of historical mine workings.

Anderson highlighted the Hopes Hill district just north of Southern Cross town as the main focus of the company’s initial attention.

The district includes the Hopes Hill and Pilot open pits that produced more than 216,000oz and 54,000oz of gold respectively.

“There’s a lot of historical data, it is all very shallow and there are big strikes there such as 4m at 19.56g/ in drill holes that haven’t been followed up,” Anderson said.

“Our geologists and teams strongly believe that these gold trends continue at depth and along strike, which we can see from the data we have got.

“There is a genuine opportunity to go and build a high-grade resource in a very short period of time.”

He added that the belt is “littered” with old workings that line up when they are mapped, which clearly indicates that a trend is present.

The company’s Southern Cross project also benefit from excellent access by road, rail and air and proximity to operating gold processing facilities which could offer toll treatment opportunities.

IPO proceeds to fund exploration

Given this potential, Anderson is understandably keen to get boots on the ground, noting that Golden Horse was aiming to funnel as much of the IPO proceeds into drilling, surveys and other exploration-related activities as possible.

“We are going to have an RC rig running on that Hopes Hill district for 12 months starting February 2025, that will give consistent news flow out to the market as results come in,” he said.

“Then we will have a second rig targeting a number of other opportunities up and down our tenure.

“We have more than 15 small drill-ready targets apart from our main target at the Hopes Hill district.”

Other work that the company is considering include geochem surveys both within Hopes Hill and the broader tenure, EM surveys and downhole EM.

“We are weighing whether we can get a small piece of that done before Christmas, including possibly a small drill campaign over 10 days to test our safety and systems to get our currently deskbound geos back into the field for a little bit before we start our big program at the end of January,” Anderson added.

With the company having already completed a front-end bookbuild with institutional demand, he also expressed confidence about the IPO, noting that strong interest had already been received.

“The sophisticated investor bookbuild has been heavily oversubscribed, demonstrating the market’s strong belief in the team and the projects”

The IPO, which opens on November 5, will close on November 15 and shares are expected to start trading from December 2.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.