IPO Watch: $100 million BMC Minerals IPO tests appetite for miners with Canadian silver offering

Investor hunger for mining IPOs is getting stronger, with BMC Minerals launching a $100m offer. Pic: Getty Images

- IPO opportunities are getting bigger, with BMC Minerals launching a $100m ASX float

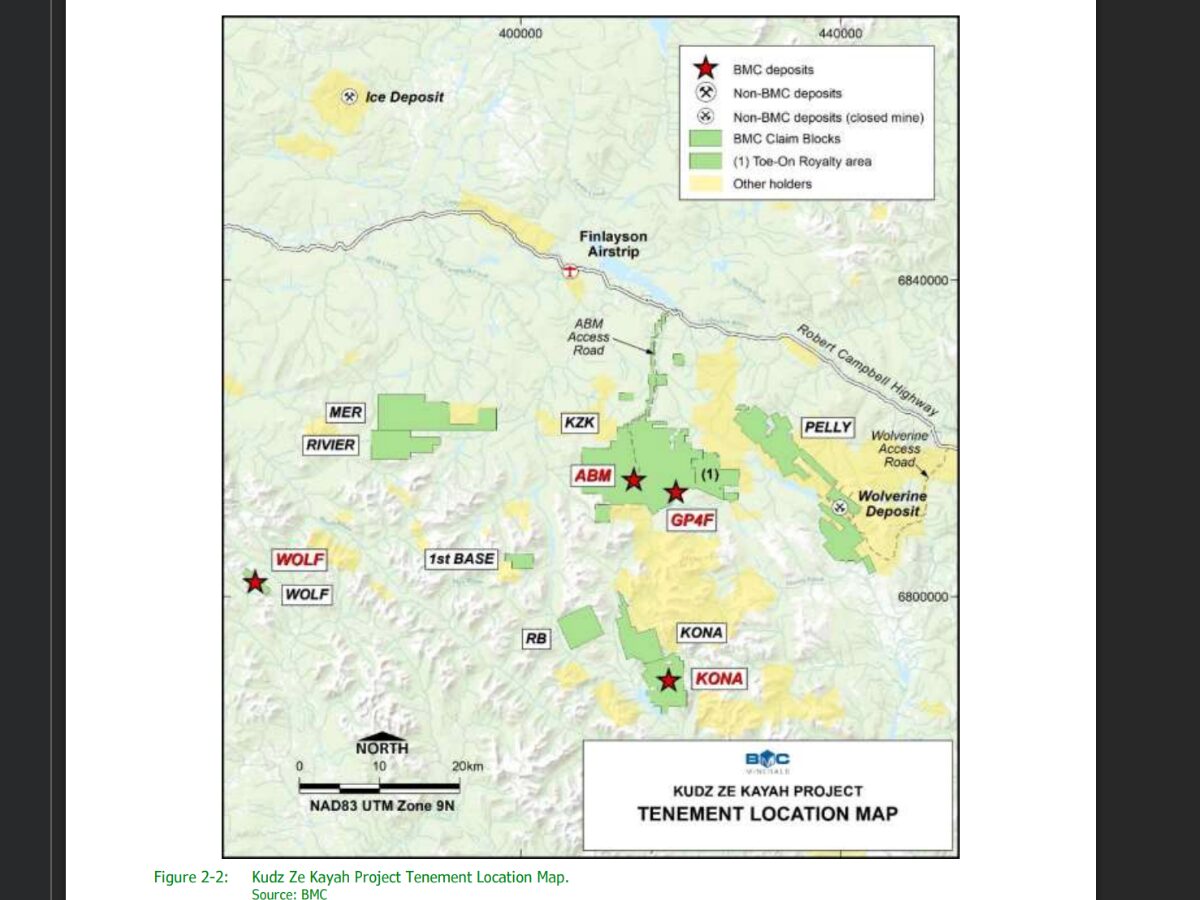

- Plan is to develop Canada’s largest standalone silver and zinc mine at KZK in the Yukon

- Barrenjoey, Argonaut and Morgans on board to bring former Teck asset to public markets

After a decade tucked away from prying eyes, a mine which could grow into Canada’s largest standalone silver and zinc producer is heading for the ASX boards in a $100 million IPO.

Priced at between $1.90-2.30, the float of BMC Minerals is one of the biggest to make a run for Sydney’s bourse at a time that a modern day gold rush is inspiring a revival in the IPO market.

A handful of Aussie investors already have exposure to the Kudz Ze Kayah project, once owned by copper and zinc giant Teck Resources, via a large stake controlled by Melbourne’s Victor Smorgon Group since 2023.

It will emerge with a 7.7-8.1% stake after contributing to the upcoming offer, third behind financier Orion and 87.5% holder GNRI, the London-based private equity firm spun out of Barclays a decade ago.

GNRI’s stake will be diluted to between 63.8-66.9%, depending on the final price of the offer, with 43,478,261 to 52,631,579 CDIs to be issued to participants in the offer.

Now after 11 years in the shadows and with US$150m tipped into the project by private hands, the owners of the Kudz Ze Kayah mine are ready to thrust the project in Canada’s Yukon into the limelight.

“Frankly, it’s the best polymetallic project that I’ve seen in my career, it’s a real unicorn. It’s high-grade, five commodities: silver, zinc, copper, gold and lead and they’re all very high grade,” BMC CEO and managing director Michael McClelland told Stockhead.

“It’s got very strong project economics, we’re looking at a NPV of US$835 million at a 7% discount rate. That’s a two-year payback.

“And that’s based on our feasibility study with commodity price inputs which were from September 2023. So if you roll that up into spot, the NPV goes up to about US$2 billion with just over a one year payback.”

Size and scale

KZK is no underground labyrinth – at least not in its early years, which will be characterised by low strip open pit mining. Underground extraction will kick in from year five at the deeper portion of the Krakatoa Zone.

The feeling is this could get much more extensive, though at current prices and with 89% of the material coming from open pits with a strip ratio of 9.9:1, KZK is likely to be very economic.

The project, west of the shuttered Wolverine zinc mine, was progressed by Cominco in the 1990s but forgotten after Teck’s takeover, which enabled the Canadian behemoth to acquire the world class Red Dog zinc mine over the border in Alaska.

It’s full name is derived from the local language of the Kaska Nation. The mine had been approved in April 2024, only for the Yukon Government to be told by the courts to consult again with representatives of the Kaska Nation in December due to omissions in its process.

It’s understood the company expects the crucial Decision Document to be attained, which will allow the regulatory phase to continue.

In the past 10 years, BMC has drilled out the aforementioned Krakatoa and the larger ABM Zone, as well as the separate copper rich Kona deposit, taking the total KZK resource from just under 13Mt to 27.9Mt, 71% of it in the higher-confidence indicated category.

A reserve at ABM of 15.7Mt at a grade of 138g/t silver, 1.3g/t gold, 0.9% copper, 5.8% zinc and 1.7% lead will underpin a project churning out 32.2Moz of silver equivalent metal a year at an all in sustaining cost of US$11.72/oz AgEq.

Driven by electrification, renewable energy and safe haven investing, copper, silver and gold prices were sitting around record highs as the prospectus was lodged overnight Monday.

Gold is near US$4100/oz, with silver knocking on the door of US$50/oz and copper at US$10,700/t, having briefly crossed US$11,000/t in the wake of major supply shocks in recent weeks. Zinc, too, has been bubbling away, lifting close to 20% from its 2025 lows in April.

Offtake deals have shown how in demand any major source of these commodities is right now.

The first five years is essentially underpinned by supply contracts. Glencore gets all the copper and half of the zinc, with its major trading competitor Trafigura mopping up 40% of the zinc – the balance split between Asian refiners Korea Zinc and Sumitomo.

Trafigura will also buy 78% of the precious metals concentrate, with the other 22% going to MRI.

“I should note that during ramp up they are required to pay for the concentrate, so even if it’s below spec, they’re still going to pay us for it,” McLelland said.

“Just to put it into context for you, KZK is going to be Canada’s largest silver producer and zinc producer out of one mine and a top 15 copper producer.

“So it’s got a lot of size and scale for the territory.”

Brokers on board

Barrenjoey is coordinating the IPO, with Argonaut and Morgans also on board as joint lead managers to connect to the retail market.

The company’s dart towards the ASX boards comes just months after the appointment of Stephen Michael as non-exec chair.

The former Macquarie and RBC mining analyst has developed a reputation for selling tough stories, righting the ship and packaging WA uranium explorer Vimy Resources and Pilbara iron ore developer Red Hawk Mining for sale to Deep Yellow (ASX:DYL) and Fortescue (ASX:FMG) in recent years.

BMC is altogether different. It arrives with a cleaner slate and, should permitting progress smoothly, a clearer path to a standalone development.

Based on study numbers to date, McLelland thinks it will cost around US$500m to bring KZK to market – 50,000m of drilling is planned with around 12-18 months of time set aside for permitting and dusting off project economics in a new feasibility study.

If it’s in a position to make FID in 2027, then KZK could be selling metal to Glencore and Trafigura from 2029.

Orion Resource Partners will also pick up its 8.6-9.6% stake via the conversion of a convertible loan outside of the $100m raising, among the largest non-gold mining floats since the $527m IPO of 29Metals (ASX:29M) in 2021. On admission BMC will have an indicative market cap of $529.3- $610.5 million.

The only mining IPO larger so far this year was the $120m dual-listing of African gold miner Robex Resources Inc (ASX:RXR), which came over from Canada’s TSX, though a ~$300m raising is anticipated in the coming months for Robert Friedland-backed iron ore hopeful Ivanhoe Atlantic.

If nothing else, it shows appetite to take risks is well and truly re-emerging in the mining sector as tailwinds for precious and base metals pick up pace.

Smaller IPOs have become regular events in recent weeks, powered by bullion’s dominant 2025 price run.

After almost no mining IPOs through the first half of the year, Dealogic data to early November shows they make up 10 of the 16 companies have listed on the ASX since July 1. Overall there were just six IPOs of any kind up to this point in FY25, and only 24 for the full year.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.