Ionic’s got all the rare earths stuff that makes magnets so attractive

Picture: Getty Images

Rare earths, particularly those used for manufacturing magnets, are increasingly valuable as the globe transitions towards net zero emissions and Ionic has the inside track towards becoming a major supplier.

While much of the attention has been on battery metals such as lithium, there is growing realisation that the magnet rare earths such as neodymium, praseodymium, dysprosium and terbium are even more important in a strategic sense to due to their use for producing the right magnets that drive electric vehicles and make offshore wind turbines.

The issue for most of the world is that the majority of the most accessible and cost effective sources of the magnet rare earths are ionic adsorption clay (IAC) deposits, located in southern China and Myanmar.

These IAC deposits are very different from the typical hard rock projects that investors in Australia are certainly more familiar with and feature rare earth minerals that have already broken down, mobilising the rare earth elements, which are then adsorbed, or bonded, with the alumino-silicate clays.

Speaking to Stockhead, Ionic Rare Earths (ASX:IXR) managing director Tim Harrison said that this unique mineralisation type could be easily mined using low capital mining and processing methods which can then be cheaply precipitated into a product that is free of radionuclides – radioactive material – and can in turn be processed into individual rare earth elements at low cost.

“The advantages of the IAC and the unique appeal is that you can actually produce the full basket of rare earth elements that you want (specifically the magnet rare earths) for a very low capital outlay initially,” he added.

And Harrison is intimately familiar with IAC-style rare earths projects given that his company’s flagship Makuutu project in Uganda is one of very few such projects with world-class scale outside China and Myanmar.

Big rare earths potential

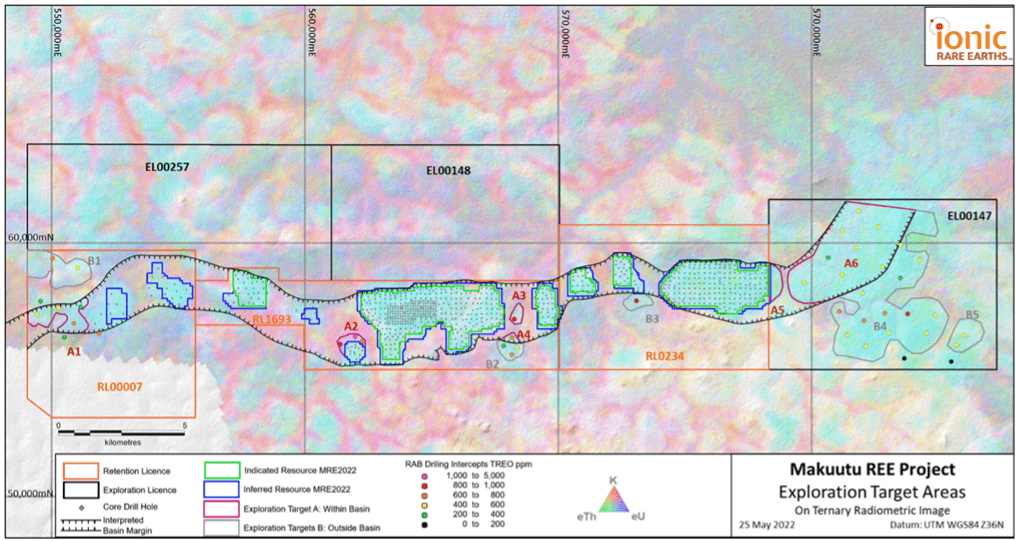

Makuutu currently has a resource of 532 million tonnes grading 640 parts per million (ppm) total rare earth oxides (TREO) following a recent 70% upgrade in resources.

Importantly, higher confidence Indicated Resources now makes up about 76% of the total resource – or 404Mt at 670ppm TREO – which Harrison noted would form the base for the completion of a feasibility study and to define a maiden ore reserve estimate in the next 3 months.

“We can only do that with Indicated or better resources, so we actually now have a substantially larger resource for us to underpin the feasibility study, when we think about what that could potentially mean in full for the project,” he added.

“It is likely that the feasibility study will now consider a larger, potentially faster, ramp-up and a significantly longer life than what was announced in the Scoping Study last year.

“It basically puts us in a great position now to define a very robust project, and from that also start to think about our ability to define what a downstream supply chain would likely look like coming from Makuutu.”

This substantial resource and its location in east Africa is perfectly positioned to fuel the global hunger for magnet rare earths.

“We are in the situation where groups globally … the US and Europe, the UK, Japan, India, are all looking at their ability to manufacture domestic EVs, source materials in new supply chains, which need to be built,” Harrison noted.

“If they are not available, it greatly changes the way which I think governments will have to think about trying to achieve their targets around reducing their carbon footprint and being able to deliver policies on net zero carbon by 2050.

“I think the biggest challenge going forward is producing enough of the full spectrum of magnet rare earths. What I think is happening at the moment is – certainly in the EV space – a lot of the EV manufacturers are really starting to understand the constraints around the supply dynamic,and probably moving a little bit faster than the wind turbine OEMs.

“It is a very interesting dynamic as you have two specific demands that are growing at such accelerated speeds – we have seen EV sales in the US surpassing 5% of the market, and by all my reading I understand the projections on the adoption of EVs in the US has been at a faster rate than what had been previously forecast.

“Given the lag it takes in developing rare earths mines, or any mine for that matter, it is a real challenge in trying to bring on enough of the right rare earth element, the magnet rare earths, to help with a fraction of that demand.”

There is also plenty of potential for further growth at Makuutu with Ionic having estimated an exploration target of between 216Mt and 535Mt grading 400ppm to 600ppm TREO, which Harrison said gave a bit of flavour of how much potential upside remains.

The company also has a new exploration licence to the northwest, which could host even more mineralisation.

“I am quite confident that based upon the resource we have defined to date, plus the exploration target, and beyond that the exploration potential at Makuutu, we are likely to have a multi-generational asset in Uganda producing both magnet and heavy rare earths for a very long time,” Harrison explained.

Ionic’s focus on producing baskets of rare earths focused on those used for magnets is also expected to deliver greater value compared to more generic baskets.

“Some REEs have substantially more value and more importance in their ability to facilitate and enable new technologies,” he added.

“It is really focusing on those rare earths that are very hard to find or where China has a substantial advantage, and those rare earths are the magnet and heavy rare earths, and that advantage comes from their access to IAC.”

Africa the right location

Harrison also noted that investors needed to start getting more comfortable with countries and jurisdictions that they weren’t previously exposed to because companies had to move to where the assets are.

“What we have seen over the course of the last 12-18 months is major global mining companies moving into jurisdictions where they previously wouldn’t have entered because they are chasing the better assets,” he added.

“You have to go where the assets are and that in itself greatly underlines why we are in Uganda. Makuutu is a fantastic asset and we have got very good support within Uganda, we have very good engagement over the course of the last three years through COVID from the Ugandan government and departments who are very supportive of its development.

“We see Uganda as being a very attractive future jurisdiction for exploration and project development.”

It certainly helps that the company has a large team engaging with local stakeholders – the Busoga Kingdom, ministries and government departments over the last two years which has been looking at creating employment and business opportunities for the locals.

Harrison explained that the company will prioritise local content and was aiming to have a residential project with predominantly Ugandan employment, which will greatly improve standards and quality of life across the four districts which Makuutu is located in.

Forward planning

Ionic has a busy schedule ahead of it with Harrison noting that till now, the company has been busy working through a number of things internally.

Part of this is digesting its April acquisition of UK rare earths separation and magnet recycling tech firm Seren Technologies, which has developed processes for the separation and recovery of REEs from mining ore concentrates and spent permanent magnets since its founding in 2015.

“We have been busy integrating Seren into Ionic and looking at some work programs there to help position Seren Technologies for growth,” Harrison noted.

“We are looking at some significant growth in that area over the next couple of years, we are looking at accelerating a demonstration plant to be able to produce meaningful amounts of magnet rare earths – separated and refined to high purity oxides.”

Over the next six months, the company aims to start and complete the next round of piloting with a view to constructing a demonstration plant that will start operations early in 2023.

Ionic has also been busy working through the Feasibility Study for Makuutu with community and stakeholder engagement along with working through local hearings on the environmental and social impact assessment in a bid to secure the necessary approvals.

The company is looking to examine the exploration target to get an indication of potential upside and is hoping to be able to mobilise a drill rig later this year to test its new exploration licence.

“That along with the feasibility study, will be key components along with the land access agreements, which we are working with local stakeholders now to submit a mining licence application in Uganda by the end of October this year,” Harrison explained.

“And based upon that mining licence application, we are hopeful of having the mining licence early in 2023, ideally being in a position where we can make a final investment decision probably mid-2023.

“We are anticipating to be in production by 2024 because of the nature and type of near-surface mineralisation, which means we can move very quickly into production.

“We are also looking at doing some demonstration plant activity in Uganda early next year which will help us significantly accelerate our ramp-up and work towards de-risking the project.”

Downstream activity is progressing as well with the company completing a Scoping Study on the refinery, due to be released to the market later this year.

This article was developed in collaboration with Ionic Rare Earths, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.