Ionic? You betcha – Alvo has the minerals to prove up Bluebush into a world-class REE project

All eyes are on Alvo Minerals after it confirmed Bluebush as an ionic REE project. Pic via Getty Images.

Special Report: With tenements adjacent to the only known Tier 1, ionic clay-hosted rare earths (REE) project under construction outside China – the monster 911Mt @ 1,200ppm TREO Serra Verde deposit – Alvo Minerals now has its own, confirmed, ionic deposit.

Having only signed on to a purchase option for the tenure in June this year, rare earths hunter Alvo Minerals (ASX:ALV) has confirmed its Bluebush REE project is an ion-adsorption (ionic) clay-hosted rare earth deposit – next door to and along strike of Serra Verde.

ALV is also advancing its Palma VMS project on the other side of the town of Palmeiropolis in Brazil, where it’s on the prowl for copper and base metals.

Ionic deposits are currently the easiest and most lucrative to extract, process and sell. We’ll get to that soon.

The importance of being ionic

Stemming from its prolific economic boom in the ‘80s, China has become a powerhouse of production, processing, refining and manufacturing of REEs into essential products used the world over.

China’s hegemony over these rare elements has been known for quite some time – especially the pricier and extremely vital magnetic rare earth oxides (MREO), used in a range of high techs from everyday smartphones to military technologies. These include dysprosium, terbium, neodymium and praseodymium.

Still, there has been little investment by nations outside China due to the Middle Kingdom’s dominance of supply and beneficiation which has resulted in global rare earth prices depressed for more than a decade, flattening incentives to explore and develop new deposits.

Boasting an exceptionally high purity compared to hard rock REE deposits, ionic, clay-hosted rare earth deposits are predominantly near-surface (usually to depths of just 10m) and can be extracted quite simply using pH levels of ~4 (that’s the same pH as wine!) in cheaper, more environmentally-friendly leach methods – meaning lower capex and higher returns.

The keys to unlocking Bluebush

Alvo managing director Rob Smakman told Stockhead last month that proving up a rare earths resource is a complicated endeavour. Still, with the right setting, right approach and the right people, REE projects can turn into high-return mining operations.

“You can have clay-hosted REE projects but often they’re not easy to extract. That’s where the ionic process comes in – a simpler extraction technique that is pivotal for capital expenditure metrics to get these types of projects off the ground,” Smakman says.

“While they definitely help, it’s often not all about the grades themselves, it’s about the size of the deposit and its extractability. You’d rather have a large, low-grade deposit that’s easy to extract than vice versa.

“We have said from when we acquired Bluebush that there were three things we wanted to clearly demonstrate during the due diligence period: scale, grade, and ionic clay (adsorption) mineralisation.”

Ionic deposit confirmed

What Alvo set out to prove was that Bluebush’s surficial saprolites were the highly-valued ionic clay type that reaps high percentages of REEs – particularly the MREOs.

Since signing the binding six-month purchase option for the Bluebush tenements, Alvo’s early works have included sampling and drilling based on interpreted historical data.

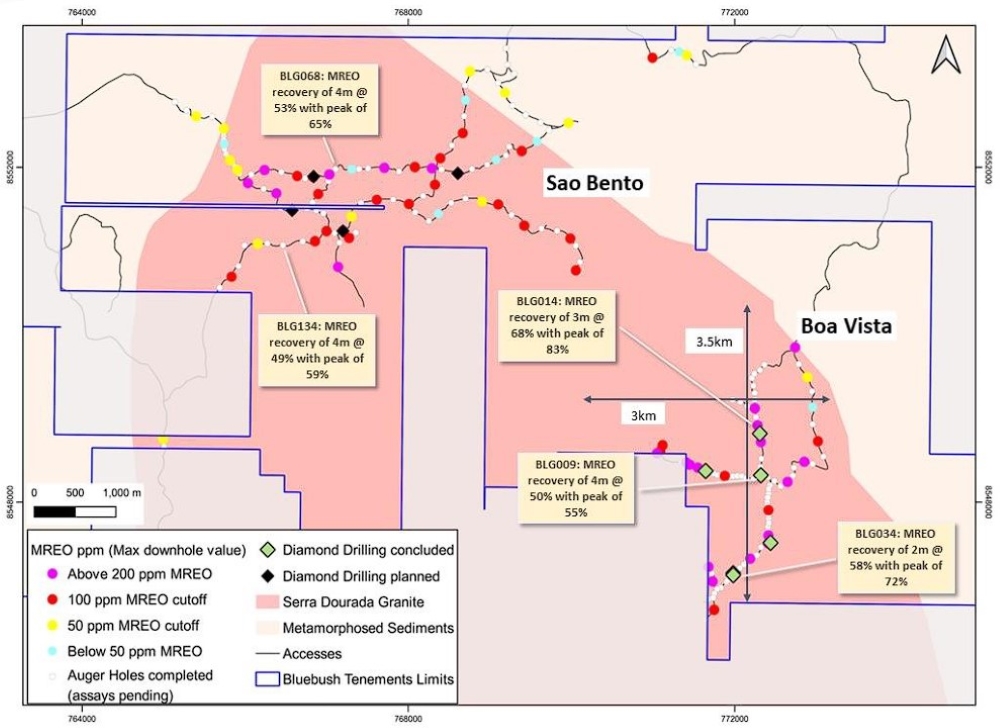

During the September quarter, a maiden auger drill program was conducted, with 210 holes completed for 1,683m across both the Boa Vista and Sao Bento prospects.

When Alvo reported up to 3,779ppm TREO (26% MREO), including 96ppm dysprosium and 16ppm terbium from auger drilling at the Boa Vista prospect, confidence started to grow.

Then, at the start of this month, ALV not only confirmed it had an ionic REE deposit, but further results from metallurgical testing showed “excellent extractions of REEs”, using ammonium sulphate solutions, with MREO recovery rates of:

- Neodymium (Nd): up to 89% averaging 60%

- Praseodymium (Pr): up to 86%, averaging 57%

- Dysprosium (Dy): up to 53%, averaging 37%

- Terbium (Tb): up to 69%, averaging 48%

- Total MREO (Nd,Pr,Dy +Tb): up to 83%, averaging 56%

Meanwhile, the best auger drilling results came in at a whopping 3m @ 3,415ppm TREO to end-of-hole.

The explorer’s initial observations from six recently drilled diamond holes have shown that the saprolite clay – which is known to host REE mineralisation – extends down to 28m.

Cores show the saprolite thickness has varied from a minimum of 9.4m in hole BLD006 to 28.3m in hole BLD004, with an average interval of clay intercepted at 18.3m.

This is much deeper than the average depth of 8.3m from auger drilling previously completed to across Bluebush.

BLD004 is just 4m away from augur hole BRL008, which delivered the “exceptional” MREO values of 6m @ 2,537ppm TREO (21% MREO), including 3m @ 3,415ppm TREO (24% MREO).

ALV says drilling is ongoing to test the extent of the mineralisation that is open in all directions.

“The results are outstanding for initial metallurgical testwork with individual samples of MREOs recovering up to 83%,” Smakman says.

“Our results released to date have demonstrated high grades of TREO and MREO near surface and over broad areas at both Boa Vista and Sao Bento prospects, covering the potential size and grade questions.

“The final, and possibly the most important factor, was establishing the presence of ionic clay adsorption hosted mineralisation. The testwork really shows this.

“With samples from over 130 auger and six diamond holes in the lab for analysis, regional exploration through handheld auger drilling and the initiation of the Loupe geophysical surveys, we expect there will be plenty to report leading into the end of CY2023 from the Bluebush ionic REE project.”

Palma VMS project

On the other side of the town of Palmeiropolis, ALV is advancing its Palma VMS project, where assay results came back from a brownfields discovery at C4, with intercepts up to 37m @ 1.9% CuEq or 4.6% ZnEq from 127m depth.

Mineralisation remains open at C4 and Alvo is looking to update the current resources at C1 and C3 of 4.6Mt @ 1% Cu, 3.9% Zn, 0.4% Pb and 20g/t Ag, which is due to be completed this quarter.

This article was developed in collaboration with Alvo Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.