Investors flock to Resolution Minerals as the appetite for good gold stocks continues

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: Resolution more than filled its $3.6m bookbuild within minutes of going to market, indicating investor interest is still strong for gold stocks with promising projects.

Alaska-focused explorer Resolution Minerals (ASX:RML) has no shortage of interest in its placement to institutional and sophisticated investors to raise $3.6m at 7c per share.

“What we saw was the book was very strongly bid into,” managing director Duncan Chessell told Stockhead.

“We actually got over $10m bid within only a couple of hours of going to the market with that, so that was pretty encouraging.”

Leading North American gold fund, Palisades Goldcorp, is a cornerstone investor in the placement.

“Palisades Goldcorp’s strategic investment is a strong endorsement of the upside value they currently see in relation to Resolution’s 64North project located in the well-endowed Tintina gold province, home to Alaska’s giant size gold deposits such as Fort Knox, Donlin, Pogo and Livengood,” Chessell said.

Resolution is also giving existing shareholders the opportunity to take up more shares via a $1m share purchase plan, also being done at 7c per share – which is very close to the company’s current share price.

Finding good value gold stocks

With the current run in the gold price, which this week hit an eight-year high at above $US1,800/oz, gold stock valuations have also headed north.

This has seen several successful capital raisings completed in the gold exploration space as investors try to get into good value stocks, which the experts say are getting much harder to find.

“We’re seeing a lot of capital raises for investors wanting to get involved in leverage to the upside on the gold price, which seems to just be heading upwards and upwards,” Chessell said.

With junior resource equities valued at generational lows, Palisades believes the sector is on the cusp of a major bull market move. It is amassing significant stakes in undervalued companies and assets with the goal of generating superior returns.

The fresh cash injection will put Resolution firmly on track to earn its 30 per cent stake in the 64North project, which is already showing clear evidence of the same host rock as Northern Star Resources’ (ASX:NST) neighbouring 10-million-ounce Pogo gold mine in Alaska.

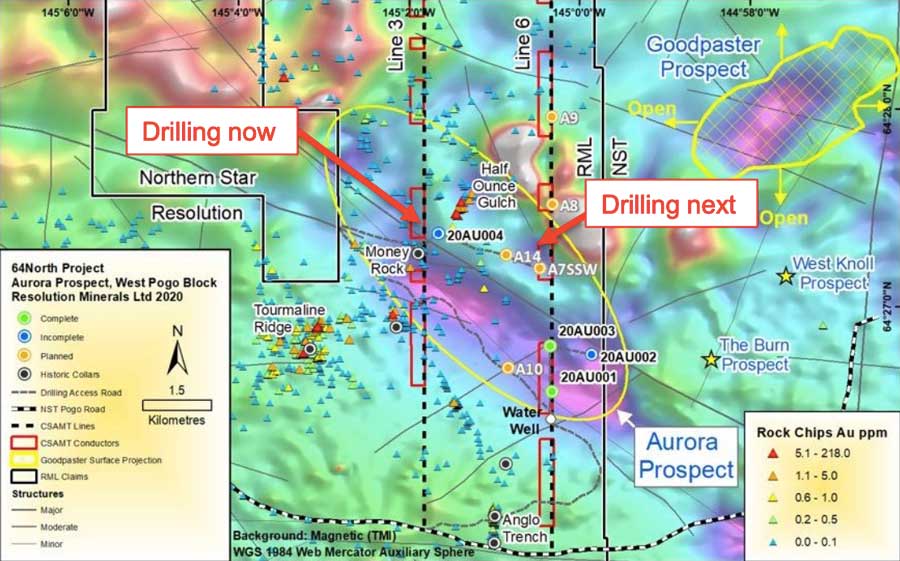

The window of opportunity for Resolution is right now, with the Alaskan weather perfect for the company to do more work on the ground. The company plans to do more drilling on the West Pogo block immediately adjacent to the Pogo mine.

The focus of the drilling is the Aurora and Echo prospects.

The Aurora prospect is a large-scale, high-priority target zone (2km x 5km), with host rocks, surface geochemistry, structures and a geophysical signature that make it a look-alike to Northern Star’s Goodpaster prospect and Pogo gold mine.

The extra cash will also allow Resolution to undertake regional exploration to meet its first-year $1m commitment under the earn-in.

“There’s two prospects in that regional space, Boundary and E1, where the majority of the funds will go,” Chessell said.

“That’s part of triggering that first year earn-in commitment to Millrock, the vendor of the project.”

This article was developed in collaboration with Resolution Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.