Investors exit lithium stocks as heavyweight sparks oversupply fears

Lithium stocks opened the week in the red after Chilean heavyweight SQM said it would ramp up production to meet rising demand from the electric vehicle market.

Fears of oversupply have sparked a move to the exit door in almost two-thirds of junior ASX-listed lithium stocks over the past week.

Of 36 lithium-related ASX stocks tracked by Stockhead, 22 lost ground, four were steady and 10 were ahead between January 15 and 22.

See our full list below.

SQM revealed that it would increase lithium production by four to six times after it got the greenlight from the Chilean government last week.

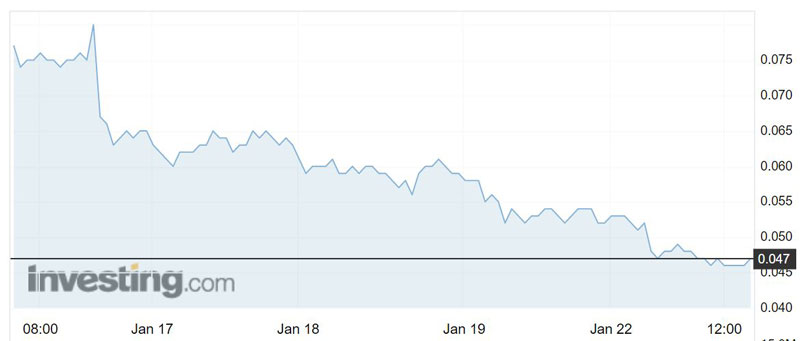

PepinNini Lithium (ASX:PNN) bore the brunt of the sell-down, with its share price tumbling 39 per cent to 4.7c, followed by Reedy Lagoon Corporation (ASX:RLC), which lost 30 per cent to close Monday out at 4.2c.

Last week PepinNini confirmed it had uncovered thick lithium sequences in recent drilling at its Rincon project in Argentina. Reedy, meanwhile, has started drilling for lithium brine at its Columbus Salt Marsh project in Nevada.

Although the sell-off was across the board globally, Australian stocks would have been particularly hard hit with a number of explorers getting closer to production.

A lot of Australian players are trying to capitalise on the expected increase in lithium demand, Patersons Securities analyst Cam Hardie told Stockhead.

“So that’s going to have an impact on them.”

Lithium is among the favoured battery metals, with demand driven by electronics and the electric vehicle uprising that is forecast to reach over 500 million vehicles by 2040 from 2 million currently.

Oversupply concerns stall lithium rally

However, currently overshadowing the excitement surrounding lithium demand is the forecast that SQM’s extra production will force lithium into oversupply by 2020.

“Obviously when you get news like that it has an impact on the market more broadly and concerns around what it will do to price,” Mr Hardie said.

“I think what we would need to see for that to reverse is some feeling around the demand being still there and possibly larger than what it is.

“We would need to get some more comfort around the market being able to absorb this supply that’s going to come on from SQM.”

| ASX code | Name | Change Jan 15-22 | Price Jan 22 | Price Jan 15 | Market Cap |

|---|---|---|---|---|---|

| DMI | DEMPSEY MINERALS | 0.447368421053 | 0.11 | 0.076 | 4283550 |

| BOA | BOADICEA RESOURCES | 0.4375 | 0.23 | 0.16 | 11263025 |

| HNR | HANNANS | 0.352941176471 | 0.023 | 0.017 | 49403552 |

| ADN | ANDROMEDA METALS | 0.142857142857 | 0.008 | 0.007 | 7136221 |

| PSC | PROSPECT RESOURCES | 0.137931034483 | 0.066 | 0.058 | 104268336 |

| MZZ | MATADOR MINING LIMITED | 0.111111111111 | 0.4 | 0.36 | 9540000 |

| PM1 | PURE MINERALS | 0.0952380952381 | 0.023 | 0.021 | 6495097.5 |

| MQR | MARQUEE RESOURCES | 0.0566037735849 | 0.56 | 0.53 | 12480000 |

| ADV | ARDIDEN | 0.04 | 0.026 | 0.025 | 31394918 |

| SRK | STRIKE RESOURCES | 0.0140845070423 | 0.072 | 0.071 | 10900070 |

| AOU | AUROCH MINERALS | 0 | 0.1 | 0.1 | 8709606 |

| CHK | COHIBA MINERALS | 0 | 0.013 | 0.013 | 5667318.5 |

| ESR | ESTRELLA RESOURCES | 0 | 0.023 | 0.023 | 9873516 |

| PSM | PENINSULA MINES | 0 | 0.015 | 0.015 | 10427079 |

| ARE | ARGONAUT RESOURCES NL | -0.0322580645161 | 0.03 | 0.031 | 37500704 |

| NLI | NOVO LITIO | -0.0344827586207 | 0.056 | 0.058 | 21252016 |

| CAZ | CAZALY RESOURCES | -0.0408163265306 | 0.047 | 0.049 | 9208757 |

| EUR | EUROPEAN LITHIUM | -0.0625 | 0.225 | 0.24 | 130733888 |

| KSN | KINGSTON RESOURCES | -0.0769230769231 | 0.024 | 0.026 | 26243624 |

| DTM | DART MINING NL | -0.0833333333333 | 0.011 | 0.012 | 6989407 |

| PLL | PIEDMONT LITHIUM | -0.121951219512 | 0.18 | 0.205 | 102495616 |

| KTA | KRAKATOA RESOURCES | -0.148148148148 | 0.046 | 0.054 | 5000000 |

| LI3 | LITHIUM CONSOLIDATED MINERAL | -0.151515151515 | 0.14 | 0.165 | 12596097 |

| MTC | METALSTECH | -0.175438596491 | 0.235 | 0.285 | 23843670 |

| TAW | TAWANA RESOURCES | -0.189189189189 | 0.45 | 0.555 | 242389184 |

| MCT | METALICITY | -0.189655172414 | 0.047 | 0.058 | 24619518 |

| LKE | LAKE RESOURCES | -0.211538461538 | 0.205 | 0.26 | 51401464 |

| AGY | ARGOSY MINERALS | -0.212765957447 | 0.37 | 0.47 | 370801088 |

| LPD | LEPIDICO | -0.215189873418 | 0.062 | 0.079 | 187201360 |

| CGM | COUGAR METALS | -0.230769230769 | 0.01 | 0.013 | 10095830 |

| SYA | SAYONA MINING | -0.247619047619 | 0.079 | 0.105 | 135704304 |

| NVA | NOVA MINERALS | -0.271186440678 | 0.043 | 0.059 | 39154048 |

| JDR | JADAR LITHIUM | -0.285714285714 | 0.025 | 0.035 | 11296386 |

| LPI | LITHIUM POWER INTERNATIONAL | -0.288 | 0.445 | 0.625 | 130356952 |

| RLC | REEDY LAGOON | -0.3 | 0.042 | 0.06 | 19900764 |

| PNN | PEPINNINI LITHIUM | -0.38961038961 | 0.047 | 0.077 | 26518372 |

While the drop in price presents a good buying opportunity for investors, Mr Hardie suggests favouring companies with good projects, cash in the bank and a good management team.

“It’s like any sector that has a really good run, it’s going to come down to the quality names within the sector that will be good to be in and recover accordingly,” he said.

“Those names should recover and survive this, but it’s the ones that are spruiking a story that may never eventuate or are high-cost producers that will be the ones most impacted and ultimately, in the long-term game of it, they’re the ones that won’t survive.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

“It will be the low-cost producers that will see it through with good management and good balance sheets.”

Sayona Mining (ASX:SYA) has had a good run in recent months, with its share price hitting a new 52-week high of 12c earlier in January.

Over the course of the past week, Sayona has slipped back to 8.4c, but is still well above the 52-week low of 1c it bottomed at in October last year.

The company is currently undertaking a phase three drilling program to expand the lithium resource at its Authier project in Canada.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.