Investors are fleeing currency for the safety of gold – which ASX small caps can benefit?

Investors are turning from currency to gold. Via Getty Images.

- US bonds to be in oversupply, pushing their value lower, causing investors to exit to bullion

- People attached to the economics of conflict see gold as a safe haven

- Embargoed countries such as Russia are using gold to replace the dollar

- US rates forecast to come down, pushing USD lower and gold higher

Humanity’s propensity for war, incompetent central banking practices and the love of shiny things has bullion on the up once more, pegged to hit new highs over the next 12 months, says a recent Sprott analysis.

The ongoing Russia-Ukraine and spiralling Israel-Palestine conflicts are pushing investors out of currency and back into the safety of gold.

Russia, for example, can use gold to replace the dollar when making transactions with other countries to circumvent Western trade sanctions – as we laid out here back in June.

The open-ended potential of current violence between Israel and Hamas also reinforces a geopolitical rationale for gold exposure, yet a compelling investment case would exist independent of those developments.

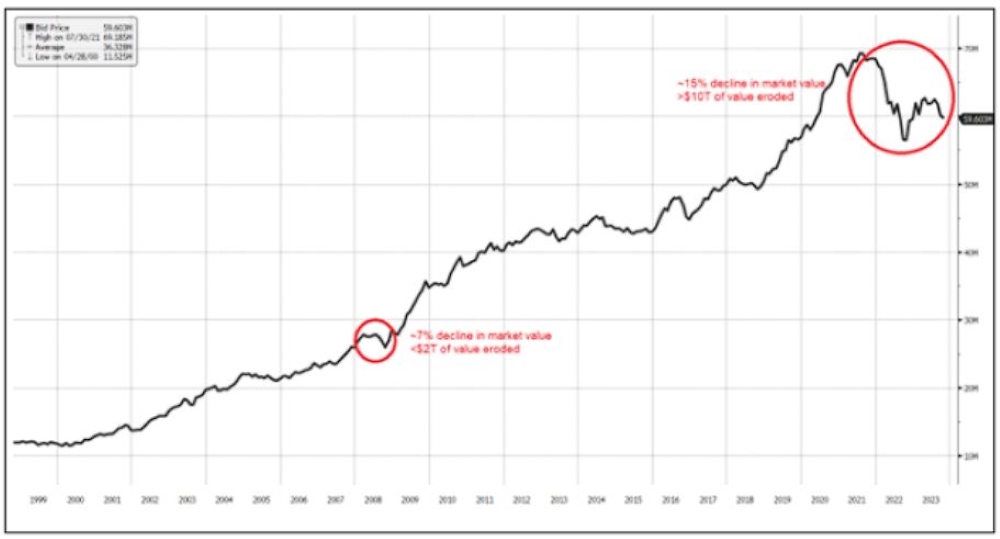

Primarily however, it’s America’s insane US$33 trillion debt and inflation reaching its peak with the Fed-induced squeeze on liquidity, Sprott says, that is going to drive gold prices higher for longer after severe corrections in precious metals in the last couple of years kept growth in its value subdued.

There are many more market and geopolitical ructions in play and they’ve all gotten us to the point where gold is set to make a remarkable comeback once again – and for investors, we’ve sourced out a few interesting and near-term producing ASX small caps ready to ride the wave. But first:

US monetary disorder

To abort the consequences of a full-blown deflation – similar to the aftermath of the GFC – Sprott says Fed policy must revert to warp-speed money creation sooner rather than later to finance emergency election year fiscal spending measures.

Sentiment that the US is courting trouble was echoed by former Federal Reserve Governor Kevin Warsh, speaking to the Wall Street Journal earlier this year.

“The federal government is 43% larger than it was four years ago, and its reach is expanding mightily,” Warsh says.

“The coming supply of Treasury securities required to fund US government deficits will likely be substantially larger than official estimates.”

Warsh believes Treasury debt will demand higher yields, at least until something breaks in the economy.

“First, on the supply side. The government currently funds US$33 trillion of outstanding debt at an average interest rate of about 2.9%.

“Funding costs on the growing debt burden are forecast to average only a fraction of a percentage point higher over the next 10 years, according to the Congressional Budget Office.

“If the Fed’s recent rosy economic forecasts for growth and inflation are wrong and a recession ensues, there will be a gusher of new debt.

“Every additional 1-point increase in interest rates will add more than $2.5 trillion of expense in the next decade.”

Debt purchasers have fled

Warsh also reckons the four largest purchasers of Treasury debt since the GFC were price-insensitive.

“They were buying Treasury debt for policy reasons – economic, geopolitical or regulatory. Price didn’t matter. How fortunate.

“These buyers, however, have largely exited the market. The Fed bought about a quarter of all Treasury debt in the past decade but warns that its Treasury holdings will shrink for at least another year.”

He warns that China, another massive buyer in recent years, is unlikely to sell its existing holdings at a loss.

“Don’t expect Chinese leadership to do the US any favours by showing up in size at the next Treasury auction [and] Japan’s domestic growth profile is the most robust in decades – the lion’s share of its excess savings will stay closer to home.

“And after the banking debacle in March catalysed by Silicon Valley Bank, the largest banks — firmly overseen by their regulators — are no longer keen to load up on ‘risk-free’ long-dated Treasury bonds.”

So, where does gold fit in?

Sprott is of the view that gold is at a turning point and expects a trend reversal soon.

“Gold miners represent a perpetual call on monetary disorder but are valued seemingly in total disregard of that optionality,” says its analysis.

“Many producers are trading at free cash-flow yields of high single digits or more, sport strong balance sheets and are (incredible as it may seem) well-managed businesses.

“Relative to the gold price, precious metals mining stocks have underperformed, as shown by the ratio of gold mining stocks (HUI) to the gold price.

“Our view is that there is potential for a significant mean reversion trade in mining stocks.

“We believe that the trigger for mean reversion would be for gold to trade decisively above the psychological threshold of US$2,000/oz, which until now has been a ceiling and a signal for algorithmic traders to short the metal.”

Patience is a virtue

Sprott says over the past 10 years, investing in gold mining stocks based on the rationale of unavoidable monetary disorder has been frustrating and humbling.

“Still, monetary and macroeconomic developments since the 2011 peak in the gold price have been invariably encouraging to those who pay close attention.

“Hardcore battered and bruised gold stock investors have not journeyed this long for a measly 10%-20% rise in the gold price, although that would be a nice start.

“With a little more patience, we expect the payoff from the past two decades of incompetent central banking to be multiples of that measure.”

Turning point

“Despite the battering of gold and precious metals stocks during the last two weeks of September, gold managed an increase of 1.35% through the first nine months of 2023,” Sprott says.

“We believe the severe correction in precious metals is near exhaustion and expect gold to trade at new highs over the next 12 months.

“We reason that the Federal Reserve’s ‘higher for longer’ stance is unsustainable as it will trigger a general credit deflation and a steep election-year recession.”

Sprott market strategist Paul Wong paints the picture quite nicely.

“Gold’s end-of-quarter weakness synched with that in equities and bonds. In a history repeats/rhymes manner of last year, the sharp rise in the US dollar (USD)/yields is draining systematic liquidity, inflicting pain on virtually all asset classes except volatility,” Wong says.

Gold juniors ready to ride the price wave

Bringing together key infrastructure and consolidating its >1Moz gold deposits across its Menzies and Laverton gold projects into one big operation is ASX small cap Brightstar Resources (ASX:BTR).

It has plans to refurbish its processing plant which is currently on care and maintenance and a recent scoping study outlines a $22m development cost capable of generating revenue of about $935m, with robust operating cashflow of $153m over an initial eight years.

Post-tax NPV and a pre-tax IRR – both measures of a project’s profitability – have been estimated at $103m (including ~$53m in accumulated tax losses) and 79% respectively.

“The Brightstar processing plant and related infrastructure represents a significant advantage from a time and cost perspective for Brightstar as we advance towards restart of mining operations at the Menzies and Laverton gold projects,” BTR MD Alex Rovira says.

“As outlined in the recently released scoping study, the ability to execute a low-cost refurbishment and expansion of the processing infrastructure is a key strategic advantage for the company that differentiates Brightstar from other aspiring WA gold explorers and developers.

“We are actively assessing opportunities to further increase the throughput of the mill to 1Mtpa to support an increased production profile at our Laverton gold project.

“The $60m value on an ‘as new’ basis for the existing processing and associated infrastructure represents a significant cost that we do not have to incur to build our mining operations, which in the context of continued challenging debt and equity capital markets is an important asset for our business.”

At its Green Bay project in copper-gold project in Newfoundland, Canada, AuTECO Minerals (ASX:AUT) is punching on with underground diamond drilling after raising $60m to complete the acquisition and fund expansion works.

The exploration program includes 700m of drilling focused on expanding Green Bay’s 39.2Mt @ 2.1% Cu resource.

The company has two gold-focused projects in Ontario too, the Sioux Lookout prospect and Pickle Crow project, the latter of which has a 2.8Moz @ a significant 7.2g/t Au resource.

Assays from further sampling at Sioux are on their way after results of up to 73.6g/t were identified in early stage exploration activities.

Back in WA and gold producer Beacon Minerals (ASX:BCN) is focused on its Jaurdi gold mine and Mt Dimer gold project near Southern Cross, where it produced a total of 7,157oz during the quarter and has plans to commence mining operations at its Macphersons deposit.

It currently has a 14,000oz forward contract to sell at a whopping $3,080/oz.

Last month it acquired the Mt Dimer tenements from Aurumin for $3.5m with the strategy of increasing mine life for current operations at Jaurdi. This is on top of a September purchase of its Geko tenements nearby, which it plans to add to overall production.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

While Brightstar Resources is a Stockhead advertiser, they did not sponsor this article.

Parts of this article were sourced from Sprott Asset Management LP. www.sprott.com

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.