Inflation remains a principal risk to the mining cycle but ASX explorers are well-placed to perform

Pic: Thomas Barwick/ Stone/ Getty Images

You know the market is picking up when a large number of small cap ASX-listed exploration and development companies commit to presenting at a top Australian conference.

More than 40 high-growth resource companies have gathered at this years’ Resources Rising Star’s conference on Queensland’s Gold Coast to present in line with this year’s theme of “Be on the Right Side of the Boom”.

The biggest names in the hottest commodities including nickel, copper, lithium as well as a host of leading ASX-listed gold companies, ranging from early-stage explorers through to project developers and well-established producers will present on their plans for the remaining of the year.

How much of a permanent mark will inflation leave?

Kicking off the presentations, keynote speaker and Lion Selection Group investment manager Hedley Widdup said the principal risk to the mining cycle right now is inflation, and its effect on the broader equity market.

“The hardest hit sector has been technology and that is the reason why things like the NASDAQ have fallen so heavily in the US.

“In the environment that we are in, cashflows and comparing those to valuations of companies have been a key focus of investors and that is one of the principal reasons that these companies have suffered,” he said.

“The Australian market is almost neutral – about negative 4 per cent in calendar year 2022 – and the resources sector is on the strong side, up 10 per cent this year based on the key Australian indices.”

The big question, however, is inflation. And while that’s not a big reveal, the question flying around economic circles is – how much of a permanent mark will inflation leave on the global economy?

Inflation breakout – ‘as significant as COVID crash’

Yes, the world is no stranger to bad news – heck, over the last 13 years we’ve dealt with Donald Trump, Covid-19, the European debt crisis, Arab Spring, the Hong Kong riots, ISIS, climate change and the California wildfires.

“Any one of these could have had a material impact on the market,” Widdup said.

“But this inflation breakout, and what it has caused in the equity market so far, is as significant as the Covid crash – at least in terms of magnitude.”

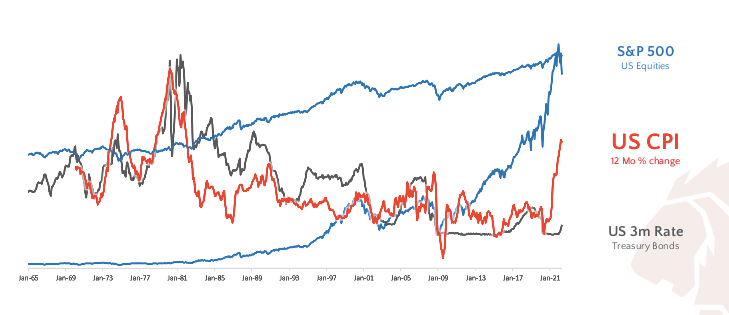

The US CPI has seen the biggest spike since the 1980s. “This is a challenging thing to be vetted against,” Widdup said.

How are miners placed?

Let’s take a bit of a health check.

According to Widdup, the ASX 200 resources index in 2022 is staring to tickle the peaks of 2008 and 2011.

“The yield of resources stocks has typically reached a peak and spiked when there’s a bust on; the reason it does is because the minuscule yield is boosted by falling equity values,” he said.

“What we have seen in the last six years – 2016 to present – is the opposite.

“We have been going through the building stages of a boom and now we are in the thick of it, seeing the dividend yield of miners growing and growing to the point now where it out-yields every other sector on the ASX,” he said.

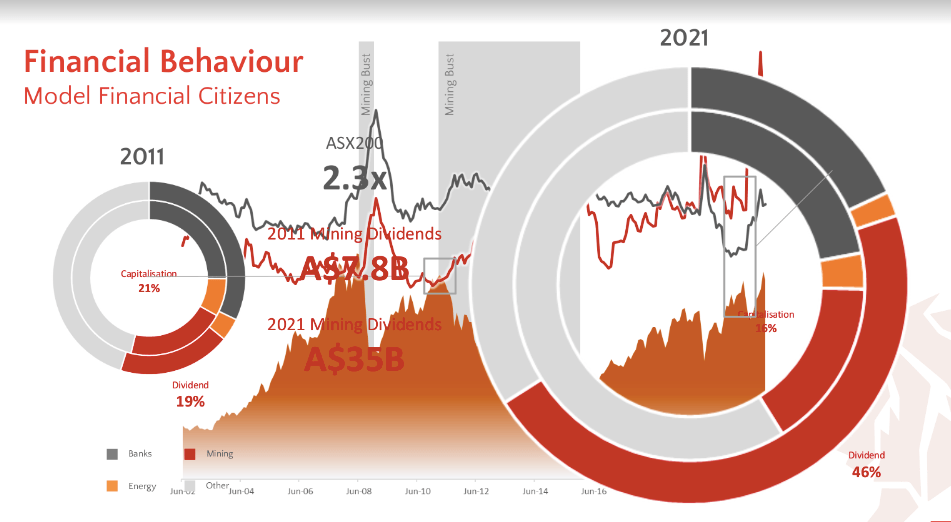

In 2011, miners made up roughly 21% of the capitalisation of the ASX200.

The ASX 200 has gone up 2.3 times in 10 years, now accounting for 46 per cent of the dividends paid out by the ASX 200 in calendar year 2021.

“That is a phenomenon which we haven’t seen before and leaves the sector in a remarkably good financial condition, particularly for the stage that we are in – in the boom,” Whiddup said.

“I think you could say this is the best financial condition the sector has ever been in and that positions mining quite uniquely in the current market.

“In terms of inflation, miners sit in a very strong position to perform through a weak equity market.”

Mining juniors

Miners make commodities, which are hard assets, and in times when inflation start to bite investors start to look for access to hard assets to put their money in. Precious metals is a big one, Widdup says.

“Explorers should be the beneficiaries of this market, uncertainty apart, while also suffering from it a bit.

Shifting from majors to juniors – for a health check, experts tend to analyse capital raising trends because when miners need to raise money, they can’t spend it.

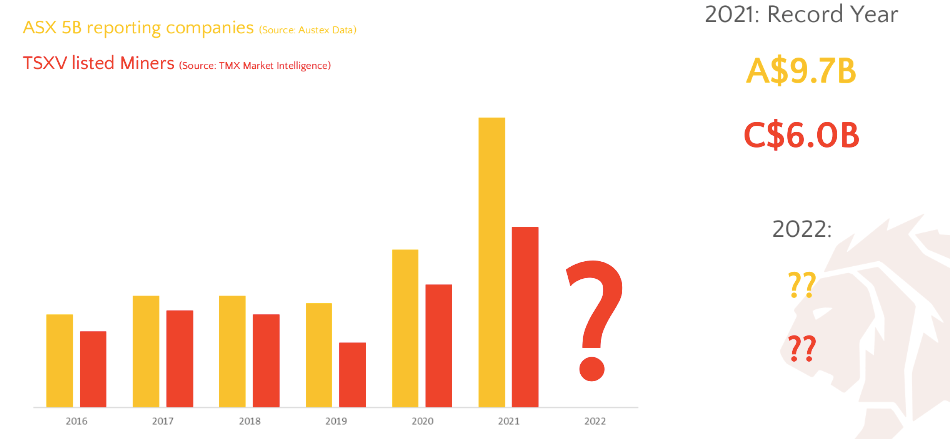

“Fundraising for the juniors in 2021 was an absolute record year, achieving the second largest number of IPOS for explorers onto the ASX since 2007,” Widdup said.

In the thick of a mining boom

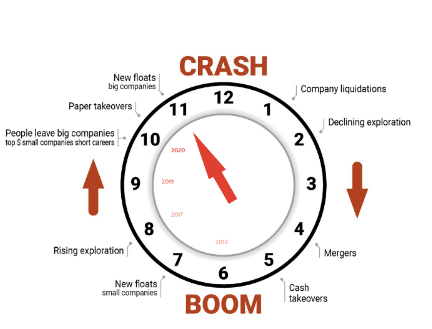

The Lion clock is used to encapsulate how Lion Selection Group see liquidity flowing in and out of the mining sector.

At midnight you have a crash, you go through a bust, and boom at 6 o’clock. One indication that a boom is starting is when activity measures tick up.

“We have wound right around to 11 o’clock now,” Widdup said.

“I’m confident we are at 11 because all liquidity indicators that show money flow into the sector have been hitting new records.

“The question now is where does the mining cycle play out from here?

“11’clock can last for years; it is the best time in the mining cycle because this is when the juniors really perform.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.