In giant footsteps – Kingston shows a compelling hand at Misima

Pic: Tyler Stableford / Stone via Getty Images

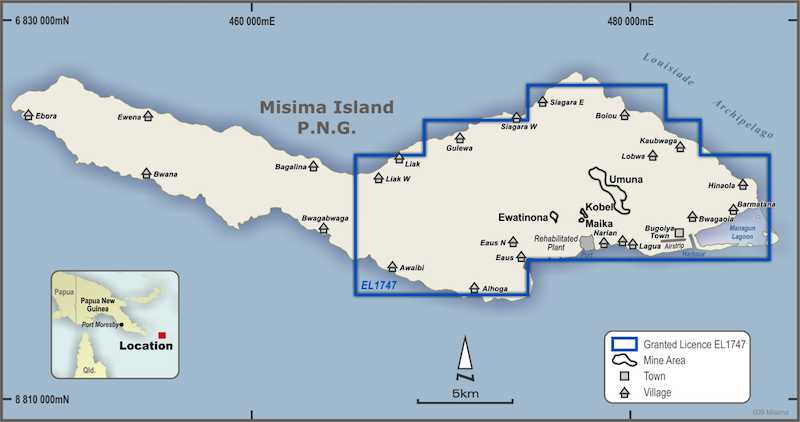

Special Report: Kingston Resources has taken a huge step in its work to capture the full potential of the historic Misima gold mine in Papua New Guinea, releasing a significant prefeasibility study (PFS) on the project this morning.

The PFS confirms the potential for Kingston Resources (ASX:KSN) to develop a technically robust, large-scale, long-life, low-cost operation delivering output of 130,000 ounces per annum of gold over a forecast 17-year mine life, with all-in sustaining costs of just $1159 per ounce.

The study outlines a rapid pathway towards the development of a substantial new operation in the footprint of what was once one of the region’s most successful gold mines.

The former Misima gold mine was previously run by North American giant Placer Pacific as a successful 5.5 million tonne per annum carbon-in-leach (CIL) open pit operation producing 230,000 ounces of gold per annum over 15 years.

Placer Pacific’s work on the project ended in the mid-2000s.

The PFS for the project’s resurrection by Kingston projects life-of-mine revenue of almost $5 billion, free cashflow of $1.5 billion, a pre-tax net present value of $822 million and an internal rate of return of 33% based on a gold price of US$1600 per ounce.

At the current spot gold price of US$1900, the net present value jumps to $1.28 billion and the internal rate of return to 48%. Kingston anticipates capital outlay of $283 million.

The proposed mining operation is based on a conventional CIL plant, fed by the project’s cornerstone Umuna open pit, as well as a starter pit at the nearby Ewatinona deposit.

Kingston has also released a maiden JORC probable ore reserve for Misima of 48.3 million tonnes at 0.9 grams per tonne gold for 1.35 million ounces, which will underpin the large-scale, long-life project.

The project’s global mineral resource was increased by 12.5% to 144Mt at 0.78g/t for 3.6 million ounces.

Kingston managing director Andrew Corbett said the release of the PFS was a huge milestone for the company.

“We are extremely excited to be able to report such strong results from our prefeasibility study, together with an impressive 1.35-million-ounce ore reserve and a further increase in our global mineral resource to 3.6 million ounces,” he said.

“This is a significant milestone for all stakeholders in the Misima gold project and represents a meaningful step towards our goal of becoming a substantial new mid-tier Asia-Pacific gold producer.”

Leveraging a strong history

The operating characteristics of Misima are already well understood, with Kingston holding all operational data from Placer Pacific’s historical Umuna open pit where production ended in 2004.

The PFS contemplates the re-development of the historical cooperation, which produced its 230,000 ounces over 15 years with operating costs in the lowest quartile of the global cost curve.

Kingston plans to construct a new 5.5Mtpa CIL treatment facility and infrastructure in the footprint of the historic mine, establishing a new standalone, long-life gold mining and processing operation.

Corbett said the scale and quality of the Misima reserve, combined with its simple geology and metallurgy and its extensive history provided a high degree of confidence in the project’s technical and commercial viability.

“We have benefitted enormously from the extensive historical datasets we have available, which provide a meaningful technical derisking of the proposed project development,” he said.

“The geology, the metallurgy, the processing flow sheet are all well-understood, giving us a huge degree of confidence in the quality of the PFS.

“Other key takeaways for investors include the relatively low capital intensity for a gold project of this scale and mine life, with forecast capital expenditure of A$283 million. Meanwhile, the compelling economic parameters speak for themselves.

“Underpinned by a 1.35 million ounce reserve, and with exceptional upside within the broader 3.6 million ounce mineral resource base, as well as from regional targets, we believe Misima represents one of the best undeveloped projects in the Asia-Pacific region.”

The best may be yet to come

Corbett said there was plenty of upside potential beyond the PFS and current resource and reserve numbers at Misima.

More exploration has been planned, and a definitive feasibility study is also on the horizon.

“We really see the PFS as a platform from which we will continue to unlock further value through targeted drilling programs that commenced recently,” he said.

“The focus of drilling is to identify additional near-surface ounces for the early years of the proposed mining operation.

“We are also planning a number of additional work programs that will feed into the DFS, which is planned to commence in Q1 2021.”

This article was developed in collaboration with Kingston Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.