Improved project sale terms gives Impact big stake in advanced pre-IPO copper gold play

The sale of Commonwealth to Burrendong Minerals will impact WA exploration efforts. Pic via Getty Images.

- Impact has updated sale terms for its Commonwealth project to near-IPO explorer Burrendong Minerals

- A 49% interest will be retained in the project for potential upside

- Funds from sale be used on exploration efforts across WA high purity alumina, rare earths projects

Impact Minerals has updated the sale terms of its 75% interest in the Commonwealth gold-rich VMS project to Burrendong Minerals, a pre-IPO company with three advanced projects under its belt.

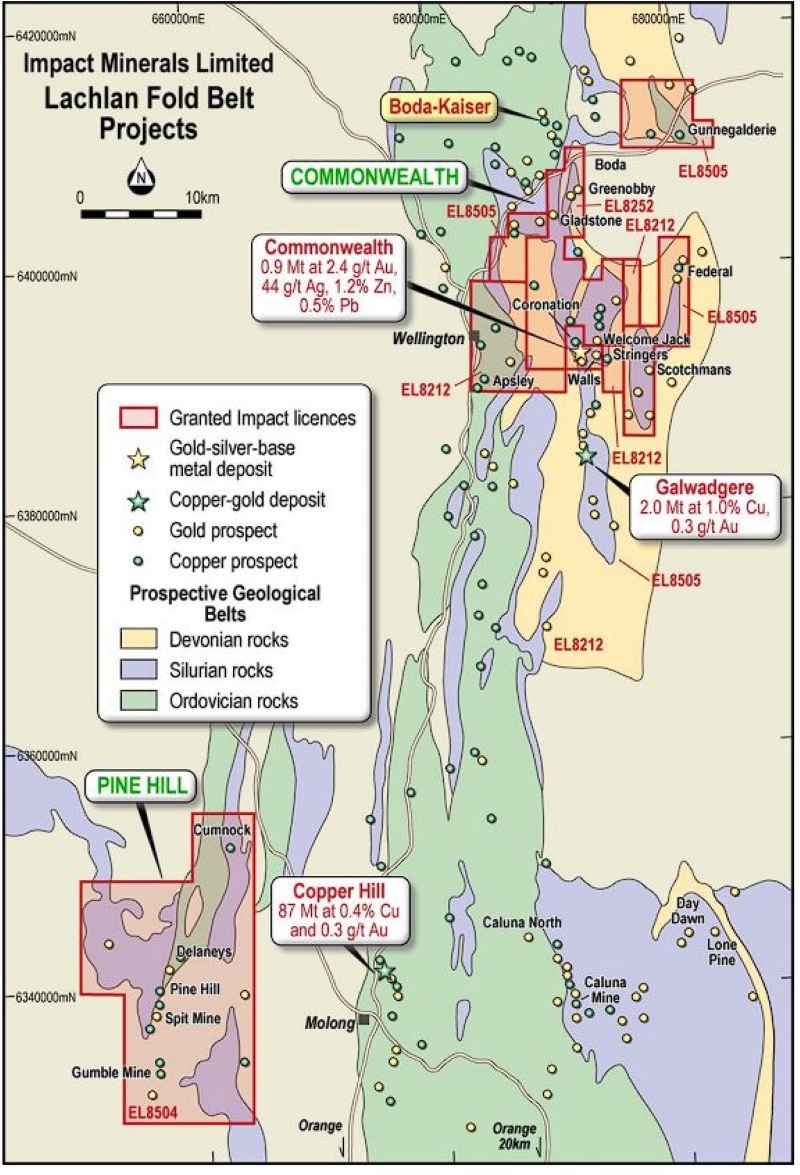

Located in the mineral-rich Lachlan Ford Belt in NSW, Impact Minerals (ASX:IPT) has deemed the highly-prospective Commonwealth project excess to requirements as it pivots from gold and concentrates its efforts on its high-purity alumina (HPA) and REE projects in WA.

Under the new terms IPT will retain a 49% interest in the project, with Burrendong paying an additional $325,000 cash and a 12.5% shareholding in the company, following a proposed IPO.

Burrendong has the option to acquire up to 75% of the project by sole funding the earlier of $5m of exploration or a decision to mine.

Burrendong now has three advanced projects in its portfolio after recently acquiring an option to purchase the 3.6Mt at 0.82% copper and 0.27g/t gold Galwadgere project from Sky Metals (ASX:SKY), just 7km along trend from Commonwealth.

Commonwealth: A 4moz Eskay Creek lookalike

IPT’s work at the project has already defined an inferred resource at the namesake Commonwealth deposit of 912,000t @ 2.4g/t for 88,000oz Au and 3.3Moz Ag, with zinc and lead credits.

All this metal is within 250 metres of the surface and has potential for bulk open pit mining. All resources are open at depth and along trend, IPT says.

IPT says the deposit is thought to have striking similarities with the world-class 4moz Au Eskay Creek volcanogenic massive sulphide (VMS) deposit in Canada.

Meanwhile, the Silica Hill deposit at the project has a maiden inferred 710,000t @ 88g/t Ag for 2.07Moz of silver at a 50g/t Ag cut-off grade, with 18,000oz Au.

The Lachlan Ford Belt is renowned for its varying types of world-class mines.

It has porphyry copper-gold deposits, such as the monstrous Cadia-Ridgeway mine that contains 25.6Moz Au and 4.9Mt Cu, epithermal gold such as the 4Moz Au Cowal mine; VMS deposits such as Woodlawn zinc-copper-gold project.

Benefitting in the upside

“These revised terms, should Burrendong list, will allow Impact to retain a larger percentage of the Commonwealth Project as well as being a shareholder in a company that could have three deposits containing a significant global resource under its belt, Commonwealth, Silica Hill and Galwadgere,” IPT managing director Dr Mike Jones says.

“These deposits all occur within the Lachlan Fold Belt, one of Australia’s most prolifically mineralised areas and host to the similar Woodlawn deposit, a world-class deposit currently under development.

“We look forward to supporting Burrendong as they progress towards their IPO”.

High Impact newsflow in WA

At the Lake Hope HPA project in the Yilgarn, Impact recently exercised an option to farm-in to earn an 80% interest by completing a preliminary feasibility study (PFS) and is currently working on a scoping study.

Arkun-Beau, east of Perth, has a large REE anomaly that Impact is currently investigating with surveys in progress across a number of target areas.

At Broken Hill, rock chip sampling has been completed and geophysical surveys show promising zinc-lead-copper mineralisation.

This article was developed in collaboration with Impact Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.