Impact Minerals PFS confirms Lake Hope as low-cost HPA project with strong economics

Impact Minerals’ PFS has outlined the attractive economics of Lake Hope HPA project. Pic: Getty Images

- Impact Minerals’ Lake Hope PFS has extremely attractive economics for a standalone production of 10,000tpa HPA

- Key takeaways include modest capex of $259m, cash flow of $170m per annum, NPV of $1.17bn and IRR of 47%

- Work will now start on a DFS which will include construction of a pilot plant to produce samples for offtake discussions

Special Report: Impact Minerals has released a pre-feasibility study that outlines the “exceptionally” strong economics of its Lake Hope high purity alumina project in Western Australia.

The results, which align with those from an earlier scoping study, envision Lake Hope as a standalone project capable of producing HPA at a steady-state rate of 10,000tpa following a two-year ramp-up period.

High-quality HPA is in strong demand for its use in lithium-ion batteries as a battery separator, as well as the production of synthetic sapphire glass and LEDs.

Using a relatively conservative commodity price estimate of US$22,000/t – significantly lower than recent forecasts of more than US$25,000/t from 2026 onwards, Impact Minerals (ASX:IPT) expects Lake Hope to generate cash flows of $170m per annum over its 33 year mine life.

This will deliver post-tax net present value (at a conservative 10% discount rate) and internal rate of return, both measures of profitability, of $1.17bn and 47% respectively.

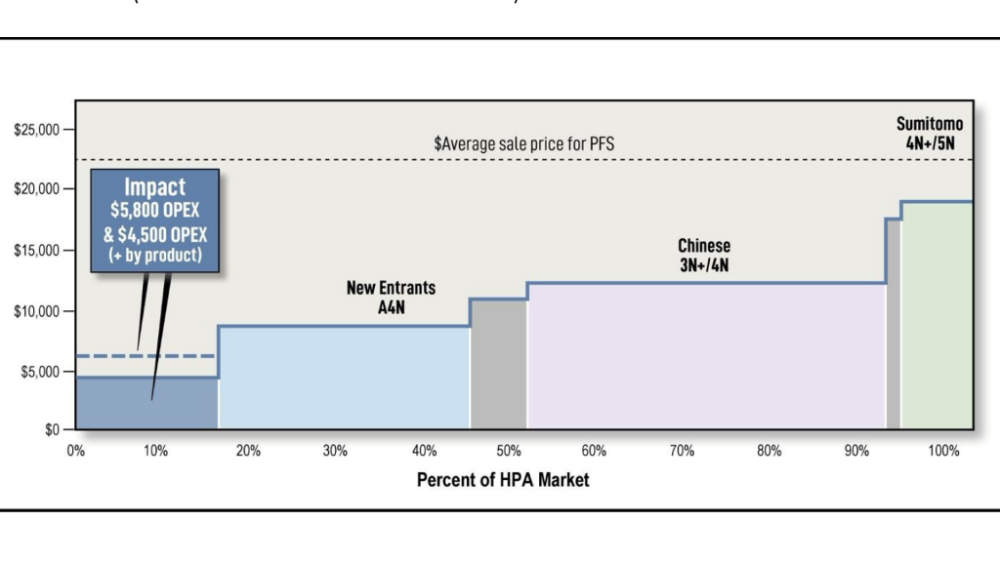

Initial capex is estimated at $259m, less than half of its peers (e.g. ASX:A4N) with payback of 2.2 years while operating costs excluding by-products is estimated at $9,452/t (US$5,860), improving to $7,105/t (US$4,400) when by-products are included.

Significantly, this places Lake Hope amongst the lowest cost producers of HPA globally, an achievement made possible by the unique characteristics of the deposit.

The company will now issue 120m shares – escrowed for 12 months – to the vendor of Lake Hope to exercise its option to acquire an 80% interest in Playa One Pty Ltd, which owns the Lake Hope assets and intellectual property – including two patents for metallurgical processes.

“The Lake Hope PFS clearly demonstrates that Impact Minerals is now on the cusp of delivering a significant, low-cost and highly scalable HPA project,” managing director Dr Mike Jones said.

“In just over two short years since acquiring the rights to the project, we have proven that Lake Hope’s unique natural feedstock, combined with a straight-forward flowsheet, offers one of the most capital-efficient and environmentally responsible pathways to high-purity alumina production globally.

“The project’s strong margins, minimal carbon footprint and ability to deliver 4N product without critical reagents or complex processing provides us with a clear competitive advantage as the HPA market enters a phase of rapid growth.”

Lake Hope project

The ~238 km2 Lake Hope project encompasses several salt lakes stretching from Hyden to Norseman in southern WA, with the deposit consisting of high-grade aluminium clay minerals that sit in the upper strata of a playa lake.

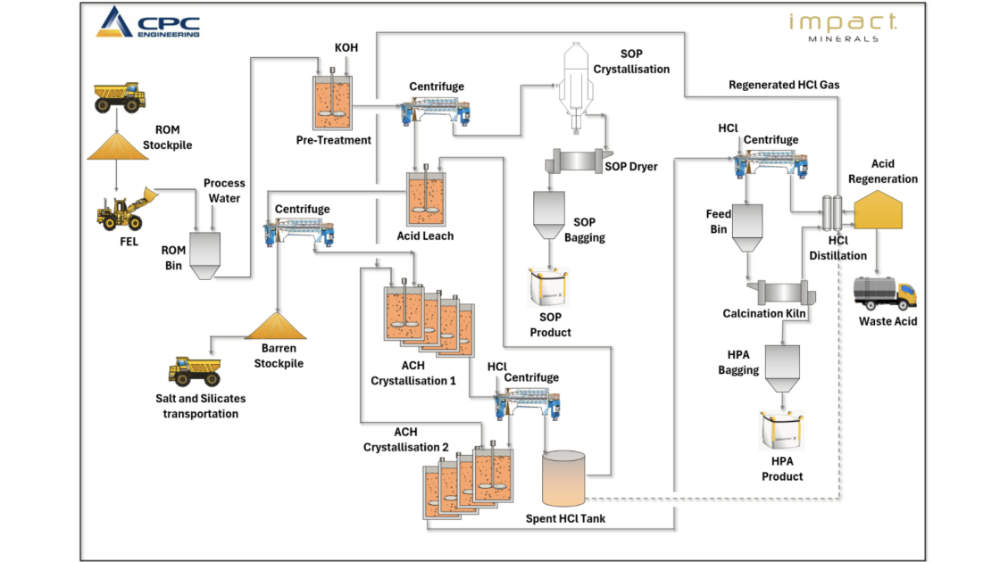

Its unique physical and chemical characteristics enable cost-effective mining and offsite metallurgical processing through an innovative acid leaching technique.

Lake Hope has a resource of 2.8Mt grading 25.1% alumina, or 700,000t of contained alumina. This contains an ore reserve of 1.7Mt at 26% alumina, or 450,000t of contained alumina.

Besides the planned HPA production, the project could also produce premium fertilised sulphate of potash as a by-product though the details of doing so have only been worked out at a scoping study level.

Under the current plan, ore will be mined at Lake Hope and transported to Kwinana, Perth, for processing.

Mining will be carried out on a campaign basis with ore stockpiled across a three month period.

A potential site for a refinery has been identified in Kwinana with ready access to required reagents and potential buyers for by-products.

IPT added the PFS did not consider integration with the HiPurA process, recently acquired by Impact with others, and whose acquisition could accelerate the company’s entry into the HPA market by several years, potentially enhancing the economics of the combined projects.

“Through our recent acquisition of a 50% interest in Alluminous Pty Ltd and the HiPurA® downstream processing technology we are now accelerating plans to seamlessly integrate Lake Hope feedstock with HiPurA’s potentially modular HPA production capacity,” Dr Jones noted.

“This unique model offers Impact the flexibility to scale production in line with market demand and customer qualification while minimising capital intensity and de-risking the path to early revenues.”

Next steps

IPT will now start work on a definitive feasibility study, which will include construction of a pilot plant to produce HPA samples at scale for discussions on offtake agreements.

This will be part funded by the recent $2.87m federal government grant received by the company in collaboration with CPC Engineering and Edith Cowan University.

“We believe very significant improvements to our flow sheet will emerge from that work,” Dr Jones said.

“At the same time, we will help fund and rapidly develop the HiPurA modular production pathway to establish near-term capacity and position Impact as a differentiated, vertically integrated supplier of high-purity alumina to the global market.”

This article was developed in collaboration with Impact Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.