Hyperion Metals’ Taso Arima on the company’s plans to become a major zero carbon titanium producer

Pic: Getty

Hyperion Metals (ASX:HYM) – formerly Tao Commodities – is up ~720% since announcing plans to acquire the ‘Titan’ titanium minerals sands and rare earths project in the US.

Titan is not just going to be a major US titanium minerals project.

Hyperion also plans to go downstream to produce low-to-zero carbon, low-cost titanium powders for the space exploration, aerospace, electric vehicle, and defence sectors.

Right now, the US sources almost all its primary titanium metal requirements from Japan, with the world’s other major producers being adversarial nations like Russia and China.

Hyperion’s plan hinges on a game-changing tech called ‘HAMR’ which the company believes has the potential to make the current Kroll process – both toxic and expensive – obsolete.

CEO & managing director Taso Arima explains why investors should get excited about Hyperion and the titanium thematic.

How did the idea for Hyperion come about?

“In 2016, I teamed up with Lamont Leatherman to start Piedmont Lithium (ASX:PLL) here in the States,” Arima says.

“I only stepped off the board 3 or 4 weeks ago, and so was successful in taking it through to what it is today. It has been a great accomplishment.

“Two years ago, we started thinking ‘what else do we want to focus on in the critical minerals space?’

“It has always been known that the US has significant potential for mineral sands.

“Lamont and I began looking at opportunities in the ‘Mississippi Embayment’ [a low lying, sediment filled basin in south central USA] and came across what is now the ‘Titan’ project.

“As COVID began last year I was driving 14 hours from New York City to the town of Camden, Tennessee to negotiate with landowners over the initial parcels that now make up the Titan project.

“We now have approximately 6000 acres and will continue to add to that.”

What makes the project stand out from other heavy minerals sands projects?

“This area has always been known for its good assemblage of rutile, zircon, and high titanium dioxide content. It also has quite a bit of rare earths (as monazite) for a mineral sands project,” Arima says.

“Then there’s the exceptional grade and the thickness of the deposit.

“With 40m to 50m intersection of mineral sands, we can potentially pick up a lot of tonnes in a relatively small footprint.

“The 6000-acre project area we have right now is going to hopefully give us a significant resource that will sit up there in terms of scale.

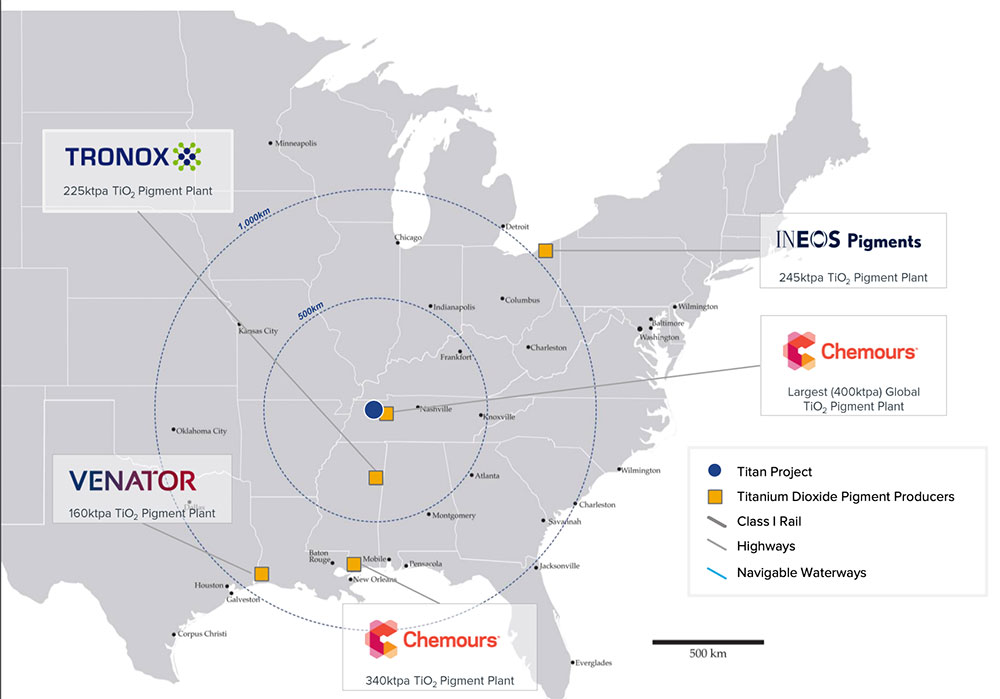

“There’s potential for world-class scale out here. It is an untapped province in an area with amazing infrastructure – another reason this project stands out.

“It’s not just infrastructure like roads, power, and water; skilled labour is also easily accessible. And the end market is right there as well, right on our doorstep.”

[Titan is just 15km from one of the largest pigment plants in the world, owned by NYSE-listed Chemours (NYSE:CC).]

“We see infrastructure as being as important as a mineral resource itself,” Arima says.

“We have the potential for all the benefits of a great resource and no need to build out that expensive infrastructure like road, power plants, camps.

“We believe we have the opportunity to take a phased approach to development without having to spend large amounts of capital upfront on infrastructure.

“Just look at other critical minerals project around the world. When they don’t have exisiting infrastructure, the projects need to produce at very large tonnages to achieve required returns on capital.

“Even then, it is typically lack of infrastructure which kills large projects.

“Just before Nemaska [a large lithium project in Canada] went bankrupt, a kitchen fire meant they had to send 400 people home.

“It cost them $30m or something ridiculous, all because of a kitchen fire. If a kitchen fire happened at Titan everyone goes to Burger King down the road.”

Will the Titan project live up to its name?

“We believe it has the potential to be huge. We are working to pick up more land, and I envisage there may eventually be multiple mines in the area, feeding one or two mineral separation plants,” Arima says.

“From there, our business strategy is to target supply into the US and European markets and then going further downstream into titanium metal production.”

Tell us about this disruptive processing tech.

“While picking up the project we also considered how Hyperion would parlay itself into the downstream titanium metals business,” Arima says.

“I was fascinated by the titanium metal situation, or lack thereof, here in the States.

“Timet [Titanium Metals Corp] had announced the closure of the Henderson sponge plant – the last titanium metal facility in the US in October last year.

“The process to make titanium sponge is very expensive and toxic. That’s where our new technology comes in.

“Hyperion’s mission is to not only produce titanium feedstocks, but to also become the leading low cost, zero carbon titanium producer for advanced industries like defence, aerospace, and the EV sector.

“Over the past few years Dr Zack Fang — a very well known, well respected metallurgist out of the University of Utah — had developed a cheaper, more environmentally friendly process to convert titanium mineral into titanium metal.

“A lot of test work was done. He took it from lab scale concept through to very large pilot scale furnace, where you can do 40kg batches at a time.

“After about a year of developing a relationship with Dr Fang, Hyperion were able to fully secure the exclusive licence for the technology.

“Now we want to take that pilot plant and put some more engineering around it with a plan to scale up the pilot facility, so it looks a lot more like a commercial plant.

“We are already having good conservations with industry, and potential commercial partners. The clear message from them is that they are going to need a lot more titanium metal.

“We want to be in aerospace, we want to be in defence, but we also want to approach other sectors like the mobility sector.

“Like pistons in a motor, or the battery pack casing in an EV — all these are things industry would do if titanium metals were cheaper and less toxic.

“If we can play our cards right, we can play a big role as some of these industries continue to advance.

“It’s exciting for us, especially now there is such a focus globally on sustainable minerals and metals production.”

If this cheaper, easier, and more environmentally friendly process works at scale will it make current processes obsolete?

“We believe that the potential is there. It is an elegant solution to the current problems associated with titanium metal processing,” Arima says.

“Not only does it have the potential to make the [incumbent] Kroll process obsolete, it may make industry rethink some components which are currently stainless steel but should be titanium.

“We would love to eat into those massive markets, which will be possible if titanium metal powders themselves can be produced at a price point equivalent on cost with a stainless-steel powder.

“With titanium there are also benefits around things like 3D printing because of its strength, corrosion resistance.

“The process is also applicable to other metals like tungsten, which we are going to be looking at soon.

“It is complete breakthrough technology, which changes the way we think about these high end, lightweight, structural metals.

“It’s easy to say we are going to do these things — but achieving them is another thing entirely. That’s why we want to build those partnerships and start testing now.

“Now is the time people are looking to put money into new tech like this.”

Are you aiming to be wholly integrated from the start, or are you going to start with the mining and work your way up to the titanium metals processing?

“Our plan is to start with the minerals business, which means we don’t have to plan to rush into profitability on the metals side,” Arima says.

“Over the next few years, we aim to be developing the minerals business, which we believe has the potential to make fantastic margins anyway.

“It means we don’t need to rush into the downstream processing — we can take our time to get it right.

“It is a two-step approach. We know exactly what we are doing on the mining side; it’s conventional, likely to be easy to get up and running.

“We are also coming into a market where prices are going up. It’s a great business to be in, and our integration will be a huge competitive advantage on the metals side.”

Would you call the rare earths (monazite) a by-product?

“I hate to think of it as a by-product because it is so important, but it is not our focus,” Arima says.

“Our focus is the titanium metals market – we’re the only ones doing it, which means we are well ahead of the curve.

“I think it is a market people will be talking about very soon.

“We plan to produce this [rare earths] monazite anyway, and we have a strong relationship with [US company] Energy Fuels which can process the monazite.

“Energy Fuels needs rare earths feedstock. We believe Titan could produce a significant amount of feedstock, shoring up a big chunk of rare earths supply in the US.”

What are the major rerating events for Titan over the next year?

“We have a maiden resource to put out, then scoping study and PFS on the minerals business,” Arima says.

“This is unlikely to be a one and done maiden resource – we believe that is has the potential for growth and upgrades as our land position increases over time.

“The minerals business has a lot of great announcements over the next 12 months.

“But the metals business is where it could get very exciting, especially if we can land a few of the large potential partners we are currently talking to.”

To summarise — why should investors get excited about Hyperion and the titanium thematic?

“Titanium is critical to industry, whether it be paints, pigments or aerospace/defence and other applications,” Arima says.

“Just like rare earths, production has become increasingly concentrated in adversarial countries like China and Russia.

“The West has lost the ability to make these sorts of metals and minerals.

“And as we see a global infrastructure drive off the back of COVID, titanium demand will rise, and prices will as well.

“There will be supply crunches, as we are expecting to see in the rare earths space. Supply will become a major issue.

“Being the only US-focused company using revolutionary breakthrough tech to develop zero carbon titanium metal is a huge advantage.

“We are right ahead of the curve, and we will be rewarded for that as we hit our milestones.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.