How many mining projects have an ~79pc internal rate of return? Barely any

Mining

Mining

Corella Resources has unleashed a monstrous scoping study highlighting two highly attractive – and mutually exclusive – development scenarios for its Tampu high priority alumina project in WA’s Wheatbelt region.

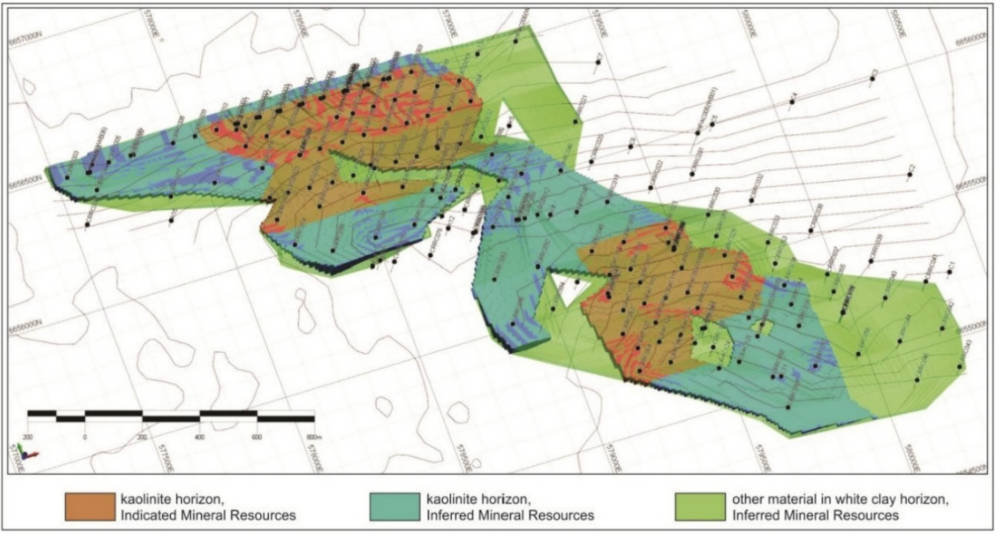

Tampu has a kaolin resource of 24.7Mt, half of which is suitable for use as high purity alumina (HPA) feedstock.

HPA is used in high-tech applications such as smartphones, LEDs and lithium-ion batteries, and sells for between US$15,000/t-US$25,000/t (AUD$23,300/t-$AUD38,850) for the benchmark 99.99% (4N) purity stuff.

While it was traditionally produced from aluminium metal, HPA is increasingly produced from kaolin at a lower cost and environmental impact.

Initial testing by Corella Resources (ASX:CR9) has proved that Tampu mineralisation is suitable for producing a very high purity 5N (99.999%) HPA suitable for the battery and LED sectors.

There is plenty of potential for the company to grow resources Tampu as the resource is open in all directions and currently covers less than 0.15% of its total landholding and extends to a depth of just 4m from surface.

Tampu also benefits from excellent existing infrastructure including a recently acquired mining storage facility and proximity to rail infrastructure and port facilities.

Results from the scoping study, which investigated two mutually exclusive scenarios of either a wholly kaolin project with production of 200,000tpa or a 40,000tpa HPA production project, has revealed that both are capable of delivering highly-attractive economics.

The kaolin scenario is project to deliver pre-tax net present value (NPV) and internal rate of return (IRR) – both measures of profitability – of $1.18bn and 78.8% respectively with payback in just 1.6 years.

Generally speaking, the higher an internal rate of return, the more desirable an investment.

It is a good way for investors to assess determine the investment return of various companies and their assets.

In this case a ~79% IRR is massive, far exceeding the IRR of most mining projects on the ASX.

Meanwhile, the HPA option also has the potential for significant returns with NPV and IRR of $4.62bn and 53.8% respectively while payback is expected in 2.3 years.

Capex is estimated at just $121.5m for the kaolin operation and $735.5m for HPA production while the resource is sufficient for a long 58-year mine life.

CR9 says the results support the acceleration towards a feasibility study, which is expected to start in January 2024.

This will examine the exact product mix and phase scheduling including capex for all product types.

Chief executive officer, Jess Maddren, who stepped into the lead role in August, said she was thrilled by the immense potential of Tampu for shareholders, potential customers and the local community.

“The exceptional quality of the Tampu project, when compared to established global kaolin operations, underscores our confidence in pursuing the transition from a promising discovery to a fully operational mining venture,” she said.

“We are continuing to engage with the local community and explore opportunities for collaborative, sustainable growth as we strive to establish a multigenerational operation with minimal environmental impact.”

Scaled up 100kg kaolin to HPA production is currently in progress by the Dalian University of Technology for further offtake discussions as well as flowsheet and pilot plant development.

Metallurgical test programs to develop the precursor kaolin plant flowsheet are also underway.

CR9 intends to start extraction from a test pit in Q2 2024. Samples from this program will be used for product offtake discussions.

Its upcoming feasibility study will be focused on the processing of HPA precursor kaolin, along with an in-depth examination of product mix and mining operations.

This is aimed at expediting operations and cashflow, with subsequent HPA studies and the launch of a pilot plant following in short order.

The study will also consider a phased approach for capital allocation, potentially beginning with the precursor kaolin plant before progressing to the HPA plant, which will mitigate risks involved with reaching the ultimate goal of producing HPA.

This article was developed in collaboration with Corella Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.