How do good projects ride the cycles? Here are some often overlooked aspects to lithium development

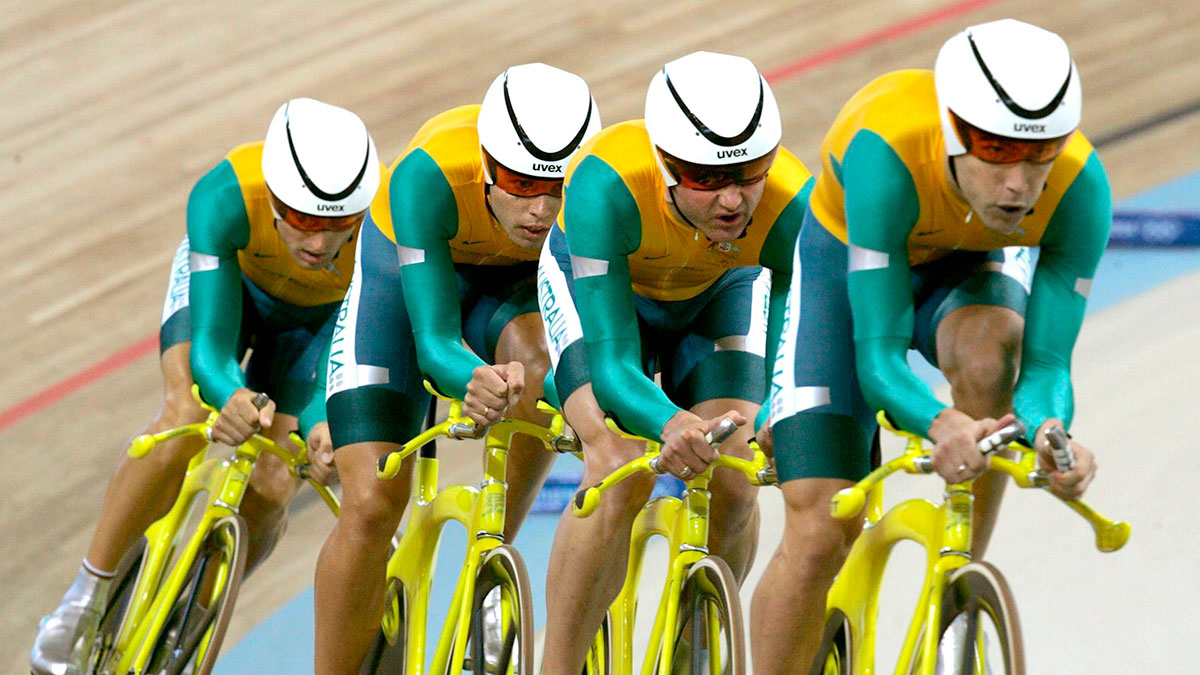

Pan Asia Metals’ projects are located in Thailand and Chile. Pic: via Getty Images.

- MinRes boss Chris Ellison says location and workforce are critical aspects often overlooked in the costs of lithium project development and operation

- Pan Asia Metals is focusing on location, cost environment, strategy and partnerships to underpin lithium project selection, development and success

- RK Lithium Project is situated in a very low cost environment and is well placed to meet demand from the rapidly growing EV and battery sector in SE Asia

- Tama Atacama lithium brine project benefits from its low altitude and location near all required infrastructure and workforce

Special Report: Mineral Resources’ Chris Ellison’s insights on costs and the workforce are invaluable for junior companies as they highlight critical aspects that are often missed in project development.

Mineral Resources is one of the world’s leading hard rock lithium spodumene producers.

Speaking at Mineral Resources’ (ASX:MIN) annual general meeting on 16 November 2023, executive chairman Chris Ellison noted the economic challenges of constructing lithium hydroxide plants in Australia, saying that without government support, even a company as successful as MIN could not afford to build them in WA.

Ellison also pointed out the often-overlooked problem of labour turnover and itinerancy in the local mining sector.

“The average turnover … [for mines] is around 15%, 20% … [and] trying to get a stable workforce on these chemical plants has been a huge problem,” he said.

Having the right mix for effective solutions

It’s one reason why Pan Asia Metals (ASX:PAM) is focused on a combination of project location, cost environment, strategy and partnerships to underpin its lithium project selection, positioning the company for success.

Firstly, the company has a flexible approach to lithium sources and is open to considering brine, clay, mica (like lepidolite and zinnwaldite) or alumino-silicate (such as petalite and spodumene).

MD Paul Lock states it’s not just about grade, at the most basic level you also need to consider your cost environment and your metallurgy, and there is a whole raft of additional considerations which will influence project success. Being an ex Project Financier, Paul has seen first hand why projects succeed and fail, costs and location are two key considerations.

For example, its flagship 14.8Mt RK lithium project is lepidolite, which has been demonstrated to have a lower carbon emission intensity than other lithium sources.

Lithium carbonate and lithium hydroxide projects using lepidolite as their plant feedstock also have the potential to be placed near the bottom of the cost curve, as demonstrated by several operating lepidolite projects in China and ex-China projects with a DFS.

It also comes with a suite of by-products, which can include tin, tantalum, quartz and feldspar in the concentration phase, and caesium, rubidium, potassium, silica and gypsum in the lithium conversion phase that could deliver additional value. Further, due to its location the typical waste streams have the potential to become by-products, including the tailings which are >75% sand.

PAM also wants projects in cost-effective environments that are amenable for development beyond mining to mid-stream chemicals. For this to happen you really need to be near large industrial sectors with battery and EV manufacturing.

Project selection would consider various factors beyond just source and grade such as location, metallurgy, cost environment, labour availability, proximity to inputs, market access and the potential for partnerships.

PAM’s lithium assets in Thailand are at the epicentre of over half of the world’s vehicle production — in the perfect position to meet Asia’s burgeoning demand for battery metals.

The RK lepidolite project in Thailand. Pic: Supplied (PAM).

PAM has also reached agreements that could drive development of RK.

It has a non-binding MoU with IRPC Public Company Limited (IRPC), a subsidiary of the US$30B PTT Public Company Limited (PTT), Thailand’s national energy company 51% owned by the Thai Government, for a joint assessment for several linked components of the lithium-ion battery supply chain in Thailand, up until cathode active material production (CAM).

There’s also a deal with Vietnamese energy solutions provider VinES – a wholly-owned subsidiary of NASDAQ listed VinFast – to evaluate the construction of a standalone lithium conversion facility in an industrial zone close to VinES’s battery plant. Both VinES and VinFast are producing batteries and EVs.

Highlighting the advanced nature of the project, a pre-feasibility study is currently underway to provide a detailed look into the economics of building the project while work is ongoing at the RK Lithium Project to further increase and upgrade the current resource.

Importantly, and in line with PAM’’s objectives, these partnerships in Thailand and Vietnam bring relationships with large battery and EV producers, and the support of large balance sheets.

Lithium brines provide optionality

The more recent addition to PAM’s stable is the Tama Atacama lithium brine project in Chile, for which it had entered binding MoUs in July this year to acquire.

Again, it’s all about location; these projects are positioned ideally near crucial infrastructure, including transport, energy, ports and airports, and 75km from Iquique with a population of 200,000 and an established mining workforce.

Tama Atacama consists of seven block areas covering 1,600km2 – approximately 13% of the highly prized Pampa del Tamarugal Basin in the northern part of the Atacama Desert.

Surface sampling at the project has confirmed the presence of lithium with 57 of the 185 samples returning an average of 702ppm (parts per million) lithium andup to 2,200ppm lithium using a 250ppm lithium cutoff.

It also shows signs of elevated boron, potassium and magnesium while possessing salt crusts and clays with a similar geochemical signature as those found at Salar de Atacama.

Adding further interest, the project includes the Pink prospect that has potential for both lithium in clays and evaporite layers at or near surface and deeper lithium-rich brines from about 250-750m. This potential may extend across the project.

PAM’s Tama Atacama project in Chile. Pic: Supplied (PAM).

It is also located at ~900m AMSL, the lowest elevations in the Latin American brine peer group, which facilitates faster eveaporation, a more attractive working environment, as well as giving the company water replacement options such as the use of seawater to replace pumped and evaporated brines that are not available to other operators. The project is also located 75km by road from Chile’s largest salt export terminals, providing PAM an outlet for an otherwise difficult to deal with waste problem.

PAM is certainly not wasting time progressing its Chilean asset with reviews underway on historical activity and preparations ongoing for field programs with a focus on surface sampling.

It is also considering a geophysics program to define drilling targets and has already fielded interest from potential partners keen to secure future supplies.

This article was developed in collaboration with Pan Asia Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.