Hot Chili’s new option deal reduces payments from US$11m at the Costa Fuego copper hub for 2024

The new El Fuego Option will also increase the company’s ownership from 90% to 100% at the San Antonio, Valentina and Santiago Z privately-owned landholdings. Pic via Getty Images

- Three options due for exercise in 2024 have now been terminated and replaced with one new option agreement

- Hot Chili’s new deal, named the ‘El Fuego Option’ covers the San Antonio, Valentina and Santiago Z privately-owned landholdings

- Updates on growth drilling, resource upgrades and water conceptual studies are expected in the near term

Special Report: Hot Chili has materially improved the terms of the El Fuego option agreement to acquire landholdings as part of the company’s Costa Fuego copper-gold project in Chile.

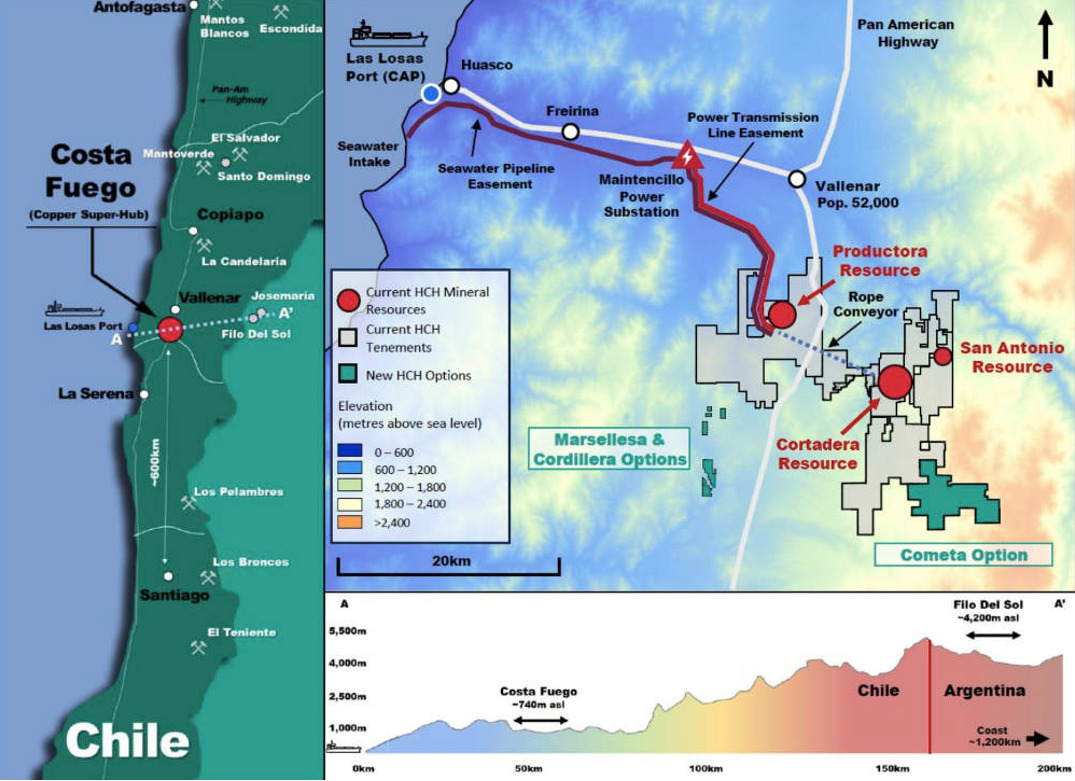

Hot Chili’s (ASX:HCH) 725Mt Costa Fuego project is rapidly emerging as one of the few projects in the world capable of delivering meaningful new copper supply that isn’t controlled by a major.

A recent PEA – the equivalent of a scoping study – estimated the US$1.05bn project would be capable of producing 112,000t of copper equivalent (95,000t of copper and 49,000oz of gold) per annum over 14-years of a 16-year mine life.

Over this time, it would deliver revenue and free cash flow of US$13.52bn and US$3.28bn, respectively.

HCH is now looking to increase its resource base to support an increase in Costa Fuego’s copper production profile to 150,000tpa ahead of its pre-feasibility study, which is expected to be delivered in the first half of 2024.

A new deal

HCH has now renegotiated terms over the El Fuego option which covers the San Antonio, Valentina, and Santiago Z privately owned landholdings along the eastern extent of the Costa Fuego project.

The new deal – originally due to exercise next year – will now be exercised in September 2026 with a revitalised agreement which comes with better terms for HCH.

Improvements to the deal include:

- A material reduction to HCH’s option payments due in 2024 from US$11m to US$1m;

- An increase to HCH’s ownership from 90% to 100%, subject to the exercise of the option;

- Extends the option expiry from 2024 to 2026 in exchange for payments of US$4.3m over the next three years

Strength of local partnerships in Chile

HCH managing director Christian Easterday says the option re-negotiation is further confirmation of the strength of the company’s local partnerships in Chile.

“Alignment of local partners has been a key element of our consolidation strategy for Costa Fuego,” he says.

“The El Fuego Option allows the company to focus its balance sheet on exploration and growth of our mineral resource as opposed to property payments.

“Our near-term focus on increasing value per share and leverage to future copper price for our shareholders centres around enhancing Costa Fuego’s mineral resource and potential economics in advance of a planned pre-feasibility study.”

Easterday says the company is “actively” evaluating the region for consolidation opportunities and expects to see further success on this front as it looks to up-scale Costa Fuego’s potential study scale towards a 150kt per annum copper development from its current 95kt per annum copper metal production scale.

Updates on growth drilling, resource upgrades and water conceptual studies are also expected shortly.

Acquisition delivers pipeline of opportunities

HCH announced the move to acquire two nearby copper mine areas that have never been drill tested before – despite previously reaching production – around 10km from the planned central processing hub at Costa Fuego.

The latest option agreements to acquire the Marsellesa and Cordillera copper mine areas are part of the company’s strategy to increase resources.

Both mine areas have been privately held and historically exploited for shallow copper oxide and copper sulphide material but have never previously been drill tested.

Marsellesa measures 400x200m with mine workings exposing multiple zones of shallow-dipping, strata-bound (manto-style) copper mineralisation.

The smaller Cordillera mine workings expose new, outcropping porphyry copper mineralisation with well-developed stockwork and sheeted A and B style porphyry veining.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.