Hot Chili re-rate continues with game-changing Cortadera

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: Things are happening very quickly for Hot Chili, and its recent acquisition of a second large copper project in Chile is turning out to be a real game-changer.

Earlier this year Hot Chili (ASX: HCH) managed to pull off the deal of a lifetime – and the company’s “best kept secret” – to secure the acquisition of a previously privately owned major copper-gold discovery.

Hot Chili, which has some big investor names behind it like Rick Rule from Sprott and Sydney-based Taurus Funds Management, is up 305 per cent since the start of the year.

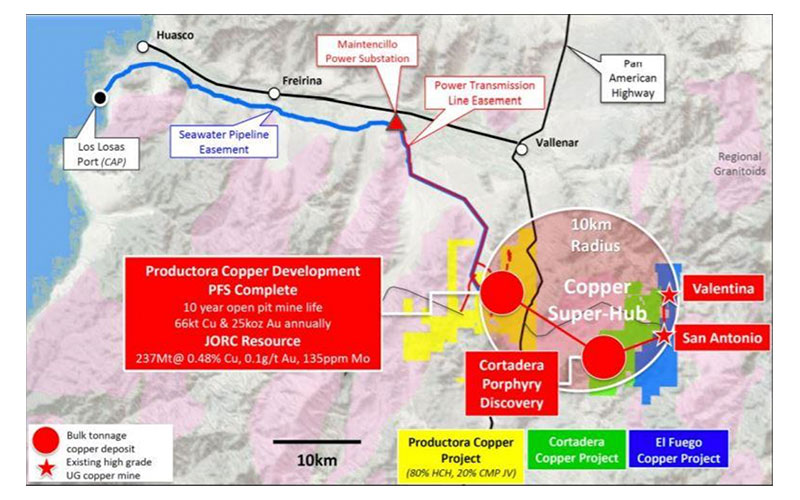

Now the company is rapidly advancing towards its dream of taking two Tier 2 discoveries and combining them to create one potentially massive Tier 1 deposit.

While the company knew the Cortadera project was a lucrative find, Hot Chili wasn’t expecting it to be just as good as it is proving to be.

“We started to appreciate that the deposit was a lot larger than what we had first thought,” managing director Christian Easterday told Stockhead.

“The first extensional hole hit a very wide intersection of mineralised porphyry a lot further north than what we expected, and we realised the shape of the main porphyry was oriented differently, which of course opened up the growth potential for that large porphyry centre.”

The world’s largest, most profitable copper mines are open pit porphyry deposits and enable a project to be developed as a low to mid‐cost operator over a very long potential mine life.

Record hit

During initial drilling, Hot Chili drilled a vertical hole into the main porphyry at Cortadera to test whether the grade got better at depth.

What the company ended up with was an intersection that ranks in the top 50 copper-gold porphyry hits ever recorded globally.

But more importantly, within that 750m intercept was a 188m zone running close to 1 per cent copper and 0.5 grams per tonne (g/t) gold.

Porphyries typically range from 100 million to 5 billion tonnes, but at lower grades of between 0.2 per cent and less than 1 per cent copper.

In this case, hitting a grade of 1 per cent copper is considered high-grade.

“To put that into context, that is almost identical to the combined copper-gold grade of Cascabel’s high-grade zone that’s underpinned SolGold’s Alpala deposit,” Easterday said.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

SolGold has transformed itself from a sub-$100m market cap to an over $1 billion company on the success of its Cascabel copper-gold project in Ecuador.

The company was even caught in the middle of a tug-of-war between majors BHP (ASX:BHP) and Newcrest Mining (ASX:NCM), which were both vying for a stake in the massive Cascabel project.

The difference though is that while SolGold’s high-grade zone starts at a depth of about 700m with limited open pit inventory, Hot Chili’s high grades start at 500m and do have a large open pit resource base, de-risking any potential underground development

“Obviously with a grade like that, and certainly at the depth we’ve hit it at, what we’ve just done is turn this large consolidation play from not just a larger scale open-pit proposition, we’ve now completely changed the game,” Easterday said.

“We’re sitting on something that truly has all the hall-marks of something very significant.”

Heads above the rest

Easterday said a combined development that leveraged central processing and infrastructure for the Productora and Cortadera deposits was now possible, transforming Hot Chili into a potential Tier 1 producer and one of the very few large ASX-listed developers of the red metal.

The company’s goal is to develop a large open pit operation capable of producing around 100,000 tonnes of copper and 100,000 ounces of gold a year.

“We’re not very far from being able to put together a combined inventory that is going to underpin our plans and leave us head and shoulders above anything on the ASX in terms of copper and gold resource inventory,” Easterday said.

“Not least of all, the grades we just hit are in the same sort of category as the grades coming out of Cadia Ridgeway from Newcrest over on the east coast of Australia, and up there with the some of the best grades coming out of SolGold and some of the world’s largest scale block cave underground mines.”

Fielding interest

Unsurprisingly, Hot Chili’s success at Cortadera and Productora has caught the eye of several interested parties.

The company has appointed an advisor to handle talks regarding potential funding for the Cortadera acquisition and further exploration over its big landholding.

“At this stage we’re very busy getting ready for drill rigs to start turning again soon and undoubtedly the large high-grade zone is going to be a key focus,” Easterday said.

Hot Chili has also appointed independent consultant AMC to start preparing a maiden resource estimation for Cortadera.

The project’s very first resource could be out within the next three months, possibly sooner.

This story was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.