Hot Chili jumps 6pc on Chilean copper buy

Image: Getty.

Hot Chili sizzled on the Aussie bourse on Tuesday after news it would push ahead with its Chilean growth strategy by earning up to 70 per cent in a high-grade copper and gold project called “Lulu”.

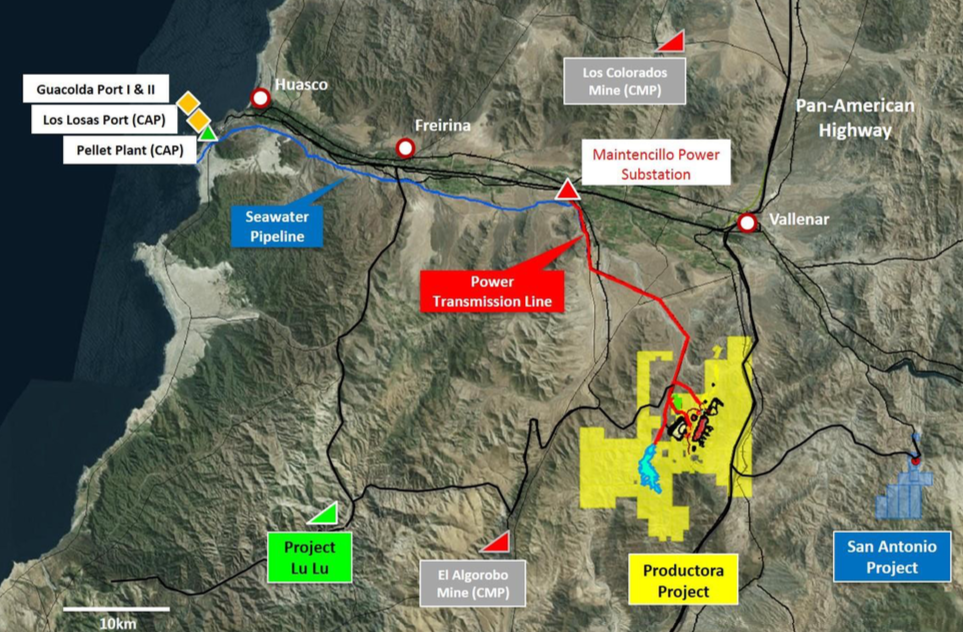

Lulu, which lies within 30km distance of the company’s Productora copper project, includes two leases covering 40 hectares and hasn’t previously been drill-tested.

Lulu “represents the direct extension of one of the regions highest grade substantial underground mines”, Hot Chili told investors.

The stock finished Tuesday 6 per cent higher at 3.7c.

Under the deal Hot Chili can earn a 70 per cent stake in Lulu over a four-year period. The private seller will receive $US2.45 million over staged yearly payments with $75,000 already paid when deal was signed.

The owner will also be able to mine up to 50,000 tonnes of ore per year at Lulu for three years.

Productora copper project in relation to the San Antonio and Lulu satellite projects. Image: Hot Chilli

Hot Chili is also seeking to buy a 90 per cent stake in the San Antonio project which lies 20km tucking distance from Productora. This is another highly prospective landholding, privately held for several decades and hasn’t seen much recent exploration or drill testing.

The company expects to execute a formal agreement over San Antonio shortly.

Both projects form part of Hot Chili’s strategy to transform Productora into a higher margin and larger scale copper operating centre.

“Both projects represent excellent opportunities to unlock higher grade production potential within trucking distance of Productora’s planned large-scale, low-cost processing facilities, the company said.

Results from surface reconnaissance sampling at both projects are due shortly.

Hot Chili has cash in bank of around $1.2 million at end of September quarter and market cap of around $21 million.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.