Hot Chili is raising $29.9m as studies ramp up on massive Costa Fuego copper project

Mining

Mining

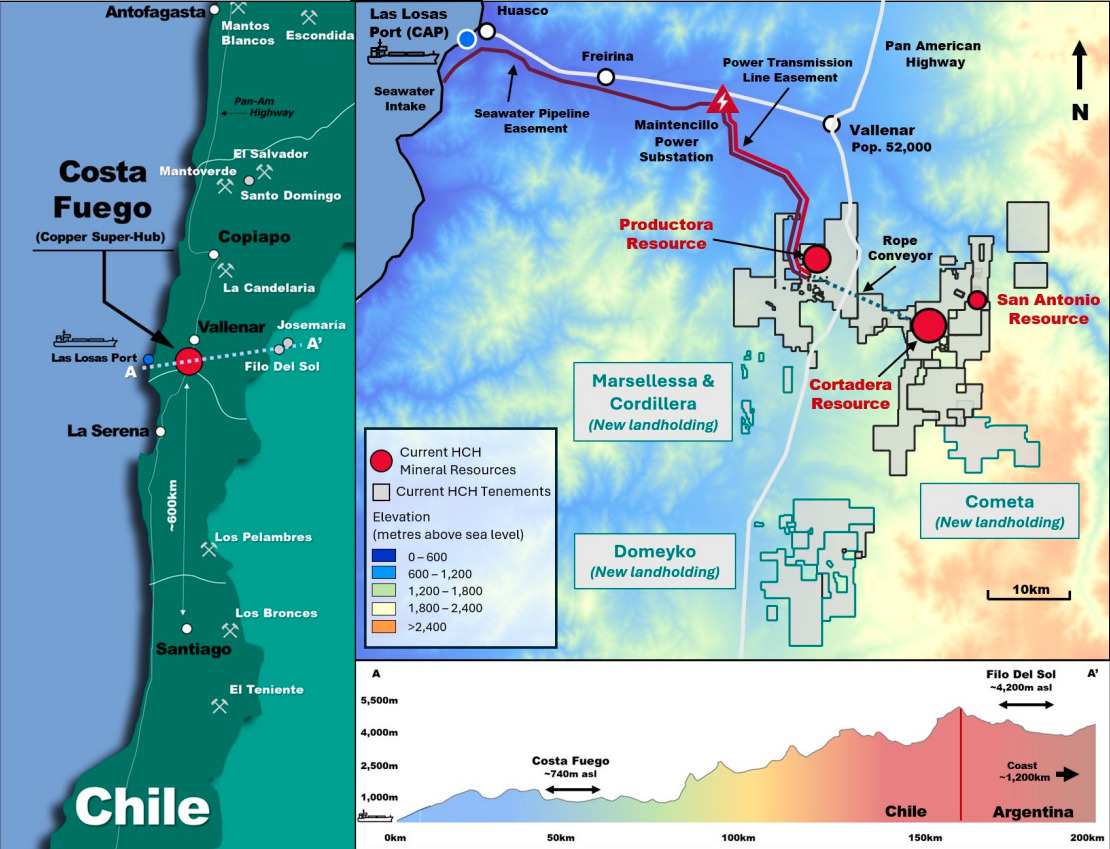

Special Report: Hot Chili is raising up to $29.9m through a private placement and share purchase plan to accelerate development of its meaty 798Mt Costa Fuego copper-gold project in Chile.

Australian, Canadian and overseas institutional investors along with existing shareholders demonstrated their confidence in the company’s assets by quickly snapping up the $24.9 million shares priced at $1 each under the private placement.

The company has good reason to be confident.

In the past two years, Hot Chili (ASX:HCH) has built Costa Fuego into a low-risk, low-cost and long-life copper-gold project with a current indicated resource of 798Mt at 0.45% copper equivalent, or contained resources of 2.9Mt copper, 2.6Moz gold, 12.9Moz silver and 68,000t molybdenum.

Indicated resources grant enough certainty for the company to start mine planning and also serve as a platform for a maiden reserve estimate for the upcoming pre-feasibility study.

HCH has already executed a five-year MoU deal with the nearby port to evaluate bulk tonnage loading alternatives for copper concentrate from Costa Fuego that would include a ‘take or pay volume’ clause based on at least 80% of the project’s future annual concentrate production.

The company is also exploring the potential to develop a water supply network in the Huasco valley region – one of the driest places in the world.

The placement is part of a broader capital raising that includes a share purchase plan offering existing shareholders the opportunity to subscribe for up to $30,000 worth of shares to raise up to $5m.

Taken together, the $29.9m capital raising ensures that HCH is fully funded to deliver the following key milestones in the growth and development of Costa Fuego:

It will also increase the company’s s trading liquidity on the TSX Venture exchange.

“We control large-scale assets in two of the most critical commodities of our time – copper and water – with two of the most desirable attributes – low-risk and near-term,” Hot Chili managing director Christian Easterday said.

“The company has been receiving increasing interest from potential strategic funding parties in its advanced Costa Fuego copper-gold development and its recently announced water supply studies.

“This interest, in combination with a rising copper price environment, provides confidence to accelerate the Company’s growth and development plans while preserving control of these assets for our shareholders.”

Easterday is bullish the world is currently witnessing the early stages of a new copper price cycle, with a valuation of US$9,910/t on the LME at the time of writing.

Three-month contract prices rose around 18% in April alone, with a $60bn bid by BHP for Anglo American demonstrating the dearth of significant new copper developments in the global pipeline.

“The placement and share purchase plan maintain the company’s strategic funding optionality, while ensuring Costa Fuego remains one of a limited number of globally significant copper developments, not owned by a major mining company, that could deliver meaningful new copper supply this decade,” Easterday said.

“Market conditions are indicative of the initial stages of a new copper price cycle being driven by a lack of new supply. The company is now well funded to take advantage of controlling the right assets at the right time in the right place.”

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.