Horseshoe Metals expands Horseshoe Lights, identifies new copper-gold targets

Horseshoe Metals now has more ground to explore at Horseshoe Lights. Pic: Getty Images

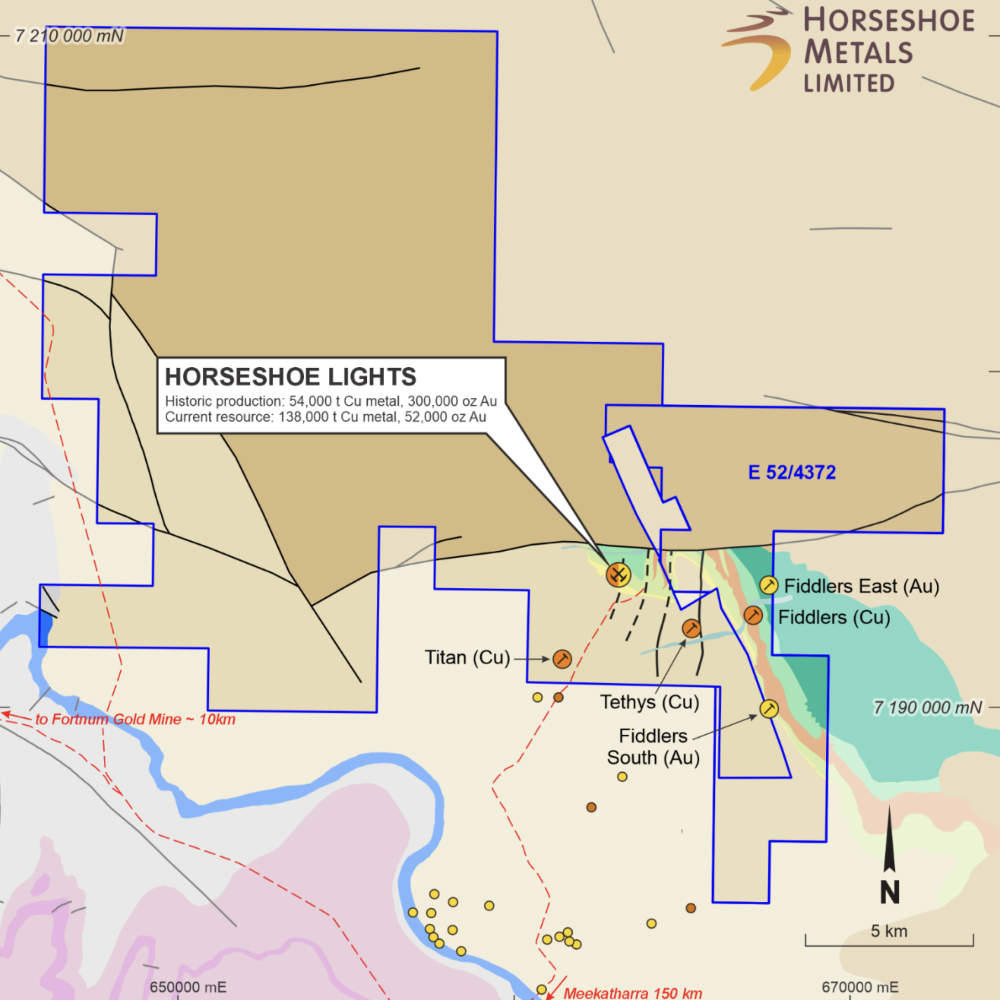

- Horseshoe Metals increases Horseshoe Lights acreage by 54km2 to 340km2 with grant of E52/4372

- New licence adds three new prospects that are prospective for copper and gold

- Review of historical data uncovers bedrock anomalies prospective for copper

Special Report: Horseshoe Metals has expanded the footprint of its Horseshoe Lights copper-gold project in WA’s Bryah Basin and has completed an initial review of historical regional exploration data.

The addition of the 57km2 E52/4372 licence at Horseshoe Lights adds the Fiddlers copper and Fiddlers East and Fiddlers South gold prospects to the company’s inventory.

Horseshoe Metals’ (ASX:HOR) review of historical rotary air blast-assisted geochemical sampling east and southeast of the Horseshoe Lights (HSL) has identified bedrock anomalies that have returned assays of up to 2588 parts per million (ppm) copper, which requires infill and extension work.

This also found that RAB drilling immediately east of the HSL mine has partly identified a copper anomaly at its eastern extremity where it was restricted by a tenement boundary.

The anomaly has returned copper grades of up to 649ppm copper and is adjacent to a fault structure interpreted to be parallel to the fault structure that hosts the Motters mineralisation on the east side of the HSL open pit.

Rock chip samples over the project area were also found to return values of up to 1480ppm copper and identified the Titan, Tethys, Fiddlers, Fiddlers East and Fiddlers South prospects.

A large proportion of the mapped jasperoids and quartz veins remain unsampled and require detailed evaluation.

Horseshoe Lights project

The now 340km2 HSL project is the original copper-gold VMS discovery in Bryah Basin and sits about 60km west of the third-party DeGrussa copper mine.

It previously produced 316,000oz of gold and 55,000t of copper and still hosts an in-situ resource of 128,000t copper at an average grade of 1%, a M15 stockpile resource of 2650t copper at 1.1% and a flotation tailings resource of 6800t copper at 0.48% and 15,300oz gold at 0.34g/t.

Earlier this year, HOR flagged plans to start sales of direct shipping ore sourced from existing high-grade stockpiles.

Looking ahead, the company plans to carry out a number of activities to further investigate the regional copper and gold targets.

This includes a site assessment of the auriferous quartz veins hosed in siltstone immediately west of the HSL copper deposit in December, rock chip sampling of outcropping quartz veins and jasperoids, and auger drilling supported soil geochemistry in areas of historical RAB drilling and extending into previously untested areas.

HOR also plans to carry out reverse circulation drilling of targets, acquire open-file magnetic data to aid in the delineation of additional targets, and conduct a further review of historical drill data to build a copper and gold mineralisation model.

This article was developed in collaboration with Horseshoe Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.