Horseshoe canters on commercialisation potential of Glenloth gold

HOR will see if the shoe fits for a quickfire commercialisation. Pic: Getty Images

- Horseshoe Metals open for access across the Glenloth gold project

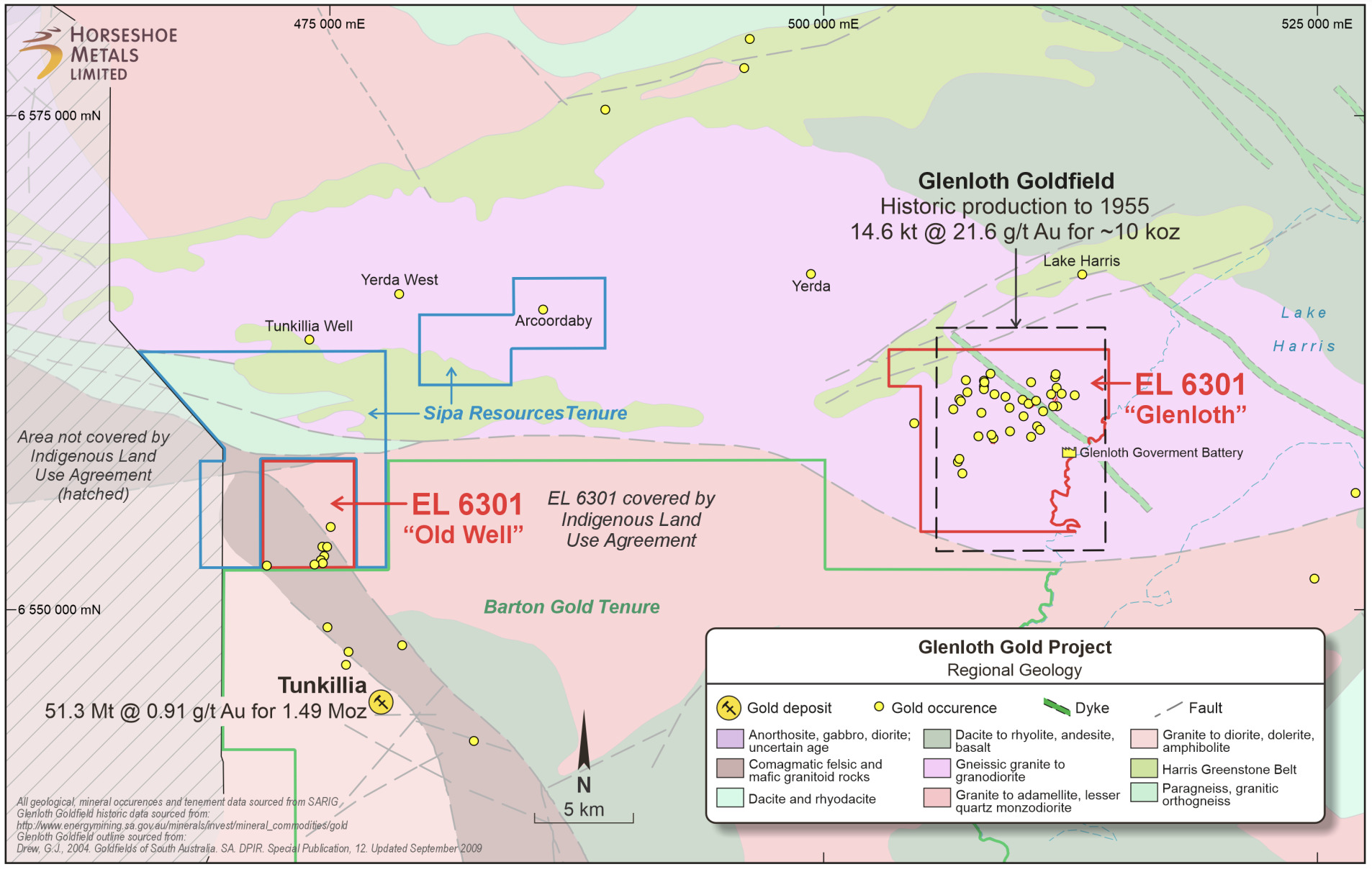

- Strategic review underway over Old Well target area along strike from 1.5Moz project

- Company will investigate commercialising the project with focus on its WA copper assets

Special Report: Horseshoe Metals has reached a native title agreement over its Glenloth gold project and is looking to advance an Old Well target area sitting along strike of a 1.5Moz project in South Australia.

The Native Title Mining Agreement covering the entirety of Glenloth was reached with the Gawler Ranges Aboriginal Corporation, allowing Horseshoe Metals (ASX:HOR) expanded access over the recently renewed lease.

Of particular interest is the Old Well target, sitting about 3km north and along strike of Barton Gold’s (ASX:BGD) Area 51 deposit at its 1.5Moz Tunkillia project.

Historic geochemical sampling confirmed extension of a prospective calcrete gold anomaly running through Old Well, beneath which wide-spaced drilling intersected significant gold mineralisation up to 8m at 0.71 g/t Au from 58m.

The old drilling was part of a larger regional program that Horseshoe believes was inadequate when balanced against the area’s prospectivity.

Glenloth largely sat idle on the end of the HOR portfolio through lesser demand for gold, but the company is now undergoing a strategic review to determine a quick pathway to commercialising the project.

To that end, Horseshoe will undergo a site assessment for drill access of selected targets, geological sampling and further review of historic data to help build a mineralisation model ahead of RC drill testing.

Copper cornerstone

Early results from Old Well will inform how much focus Horseshoe wants to place on Glenloth, but the bulk of its attention is likely to remain fixed on the prospect of early copper cash flow and exploration at its Horseshoe Lights project in Western Australia.

The company has flagged plans to begin sales from existing high-grade copper-gold stockpiles and investigate new targets 60km west of Sandfire Resources (ASX:SFR) DeGrussa copper mine.

Western Australia is less known for copper than other jurisdictions, but the Sandgroper State’s mineral abundance certainly doesn’t end with gold.

DeGrussa currently stands as the state’s biggest producer, and Rio Tinto and Sumitomo’s Winu project looks the part of a large-scale operation.

The big dogs of mining dominate the sector, and while junior goldies are enjoying time in the shine, copper explorers who kept the faith can now smell a long-promised boom on the horizon.

Horseshoe recently upped its West Australian acreage from 54km2 to 340km2, and plans to investigate the regional targets there in parallel with its strategic review of Glenloth.

This article was developed in collaboration with Horseshoe Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.