History on its side as Victory Goldfields lines up Cue gold targets

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Western Australia’s Cue region has been a gold hotspot for more than a century. Victory Goldfields, a soon-to-be-ASX listed gold explorer, hopes to build on its storied narrative.

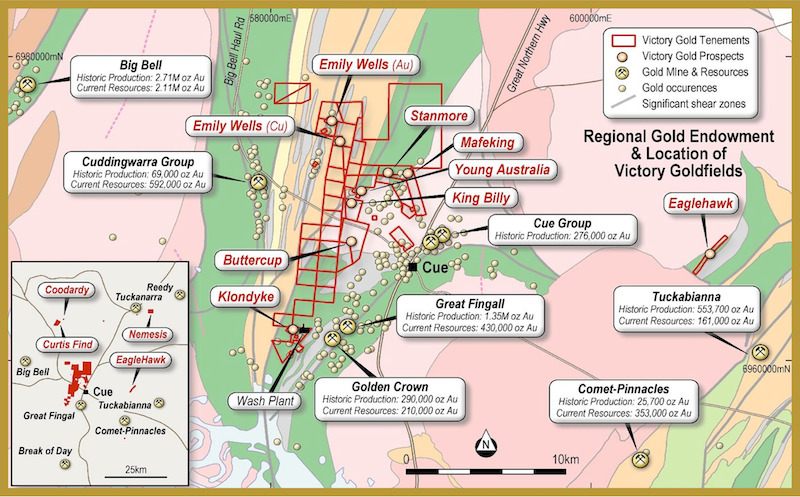

Working in Victory Goldfields’ (to be ASX: 1VG) favour is a combination of a highly promising tenement portfolio – 46 granted and seven applications – in which 52 historic gold mines of varied scale, output and design are located.

Many of those mines are more than 100 years old with limited modern follow up exploration work carried out on them.

While some are well known to those in the region, Victory Goldfields’ consolidation of a largely contiguous tenement package represents the first time all these separate pieces have come together as one.

Here’s what that looks like.

Victory Goldfields executive chairman Trevor Matthews said the tenement package presented a huge opportunity for the explorer to hit the ground running.

“On some of the prospects within the tenements there’s been historical drilling, with some very high-grade intersections,” he said.

“Like a lot of work in the region though, it’s shallow drilling and shallow mines – the underground mines are generally more than 100 years old, back in the times of prospectors who just didn’t have the technology to go deeper than 30-40m.

“Despite that, the production records on some of these mines are great. We’re talking average grades of up to 100 grams per tonne being mined near surface.”

Understandably given that context, the early plan is to go in and infill drill where historical results warrant it.

Victory Goldfields has prioritised three drill-ready targets – the Coodardy, Emily Wells and Eaglehawk prospects. All have program of work approvals, and the company is already sourcing its rigs and preparing for drilling so it can hit the ground running.

Spicy gold trio (and more)

Coodardy, Emily Wells and Eaglehawk are each enticing for their own reasons, and Victory Goldfields intends to get diamond rigs out to follow up its leads.

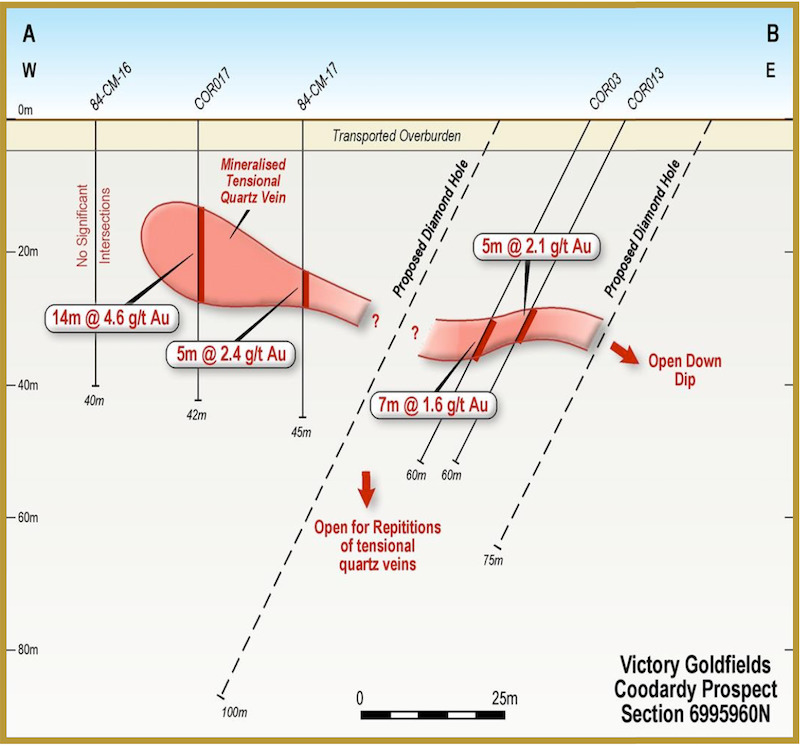

Coodardy is expected to be the first of the prospects to be tackled, with a two-phase program of 24 diamond drill holes planned for a total 3430m as part of a resource definition program.

Previous drilling on the prospect returned intersections including 14m at 4.6 grams per tonne gold and 13m at 3.46g/t.

“That’s really more of an infill program,” Matthews said.

“We’re drilling to close up the spacing between some of the historical drill holes and looking to test at depth – down to 100m.”

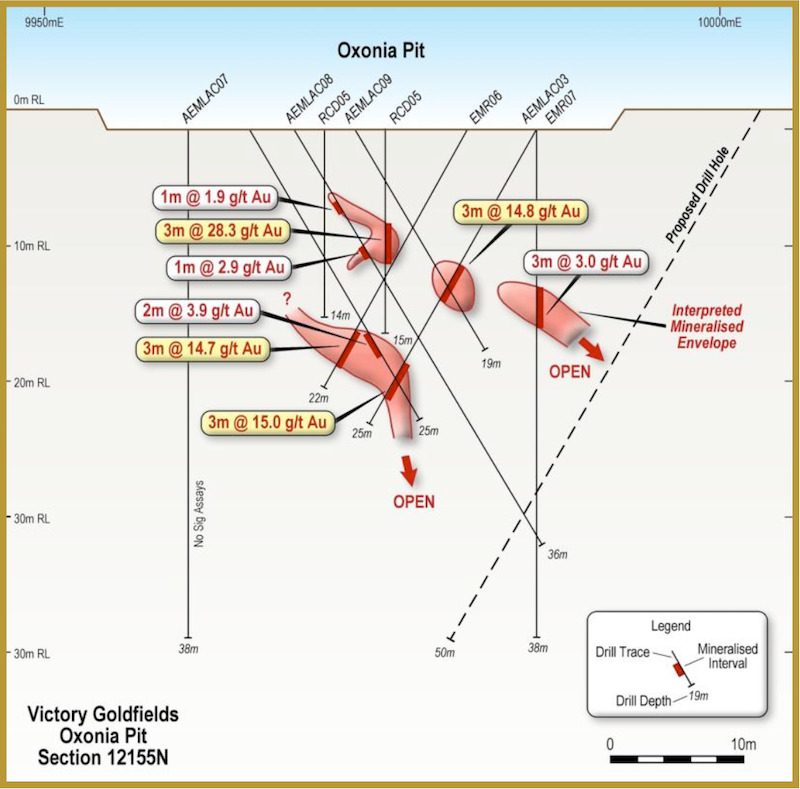

At Emily Wells, more than 600m of gold soil anomalies have been recorded northward from the historic Oxonia open pit.

Historical drilling within the pit returned intersections including 6m at 17g/t gold, 10m at 2.2g/t gold, and 3m at 28.3g/t gold.

Victory Goldfields plans to drill 16 reverse circulation holes for 1800m at the prospect, with a further six diamond holes for 900m also planned.

“We’ve done some soil geochem work to the north which has shown substantial gold anomalies on the surface, and we’ve submitted an application for the tenement north of that,” Matthews said.

“There’s some extensive opportunities based around pretty close to a kilometre of potential to the north from the Oxonia pit.”

Eaglehawk is another standout prospect, with numerous high-grade intercepts including reports of 5m at 18.2g/t gold to the end of a hole and 7m at 3.2g/t gold.

A two-phase program of 21 diamond holes for 2140m will test lode continuity and contribute to a resource definition program.

“Eaglehawk has been a producing underground mine, but again it’s pretty shallow to around 40m,” Matthews said.

“We see some great opportunities there.”

Remarkably, the three priority prospects are just a small part of the overall package of land, which spans 73.88km2.

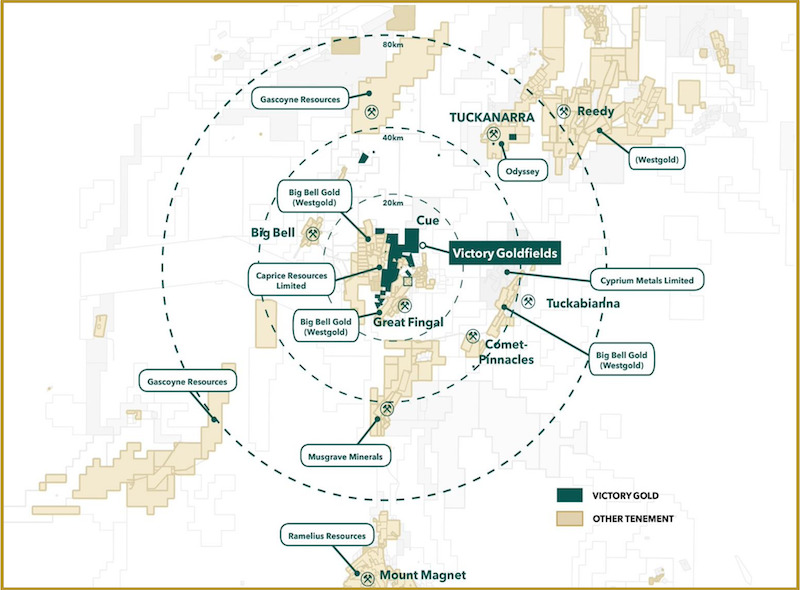

Among these is the Nemesis prospect within the Tuckanarra project, which sits adjacent to the work being carried out by Odyssey Gold (ASX:ODY) at the promising Bottle Dump project.

“They’ve been getting some good results and that has been trending eastwards onto our tenement, so we’ve elevated Nemesis up to one of our priority targets which we’ll go and do some early work on as well,” Matthews said.

It would be remiss to speak of the promise at Bottle Dump without touching on the region more broadly. Many of the names on this map speak for themselves.

From Westgold (ASX:WGX) to Ramelius (ASX:RMS), to Gascoyne (ASX:GCY), to Musgrave (ASX:MGV) and its joint venture work with Evolution Mining (ASX:EVN) – the regional map reads like a who’s who of Australian gold.

Matthews said it was fantastic for Victory Goldfields to be able to make its own mark.

“Cue has been getting a lot of attention lately, and we are now joining that story and looking forward to getting into our programs and achieving exploration success on our targets,” he said.

Having built up good relationships in the region, Victory Goldfields intends to look at further acquisition and JV opportunities post-listing.

A rare RTO opportunity

Listing through the shell of Hughes Drilling, Victory Goldfields will hit the market with a tight capital structure and a market capitalisation of around $9.5 million and an enterprise value of close to $4.4 million.

“Relatively speaking, when you look at our tenement package and the advanced nature of some of our projects we have based on historical drilling and some of the other work, I think that makes us a good value stock,” Matthews said.

The company raised $5 million recently and intends for around 75% of that raise to go into the ground or cover tenement management costs.

With 6400m of diamond drilling and 1800m of RC drilling planned for its first six months of ASX-listed life, Victory Goldfields is a name you’ll likely be reading and hearing for some time to come.

This article was developed in collaboration with Victory Goldfields, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.