How HIPO Resources bought Ukrainian tech that could double electric car range

Lithium explorer HIPO Resources announced recently it was buying into a Ukrainian battery venture that promises to double the driving range of electric cars.

HIPO (ASX:HIP) is paying $500,000 for 25 per cent of Next-Battery with an option to buy another 10 per cent later on for $1 million.

The response from investors was surprise, scepticism, and excitement.

The excitement was from investors hopeful that their stock had hit on The Next Big Thing.

The scepticism was from investors burned by LWP Technologies (ASX:LWP), another company which invested in a Russian battery technology that turned out not to exist at all.

But they are nothing like LWP, say HIPO chairman Maurice Feilich and Benton Wilcoxon, the owner of Next-Battery which is a subsidiary of his NextMetals business.

“Next-Battery’s 6-12 month development plan is to demonstrate a (minimum) 100 per cent increase in the specific energy of its commercial battery prototype, which could potentially double the EV [electric vehicle] driving range, assuming the same weight of battery,” the company said last week.

The technology also “would double the time between charges for mobile phones and all electronic applications”.

Mr Feilich told Stockhead he had reviewed studies and had an offshore independent expert review the technology, although he would not say who that was.

He has not met the development team but has met Mr Wilcoxon, whose relationship with Ukrainian tech goes back to the 1980s.

Mr Wilcoxon says they’ll have a prototype up in six to 12 months.

Desktop experiment and a $500,000 bet

The technology is a conductive film on which metals such a lithium and cobalt can be built up in a lattice structure in nano-layers.

That film is placed on the cathode (the positive electrode) and increases the surface area.

That increase the volume of electrons that can move to the cathode, which increases the energy density of the battery, and therefore make batteries last longer and more powerful.

They claim it can double the energy density of a lithium ion battery.

- Subscribe to our daily newsletter

- Bookmark this link forsmall cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

But HIPO is buying a concept, not a tested technology.

Mr Wilcoxon says the films are produced and can be made en masse, and they are now testing what kind of nanostructure will work best.

But it hasn’t yet been tested on a cathode, or in a completed battery.

HIPO’s $500,000 is a bet that once the parts are put together and tested over the next five to seven months, it does what Mr Wilcoxon believes it will do.

“We’re 100 per cent confident it will work because not inventing a new battery per se, we’re not testing a new chemistry,” he said, when asked why he was confident they would succeed where other battery companies had failed.

Brains in Ukraine

The Next-Battery technology comes from the Institute of Material Science in Ukraine, according to Mr Wilcoxon.

He says they have been making films for semiconductors for decades as well as electrodes for batteries, and before Christmas last year they began thinking about how to put the two together.

There are “about 10 top guys” in the team but Mr Wilcoxon will not name them until they file patents in the next three months.

“Ukraine is an interesting place because it has a huge history of scientific institutions. It was the largest collection in the former Soviet Union of scientific institutions…. [but today] the economy is not very good.

“There’s a war going on to the east of us with Russia, and basically the scientists are paid a fraction of what they’re paid in the west,” he said.

“The point is that if you wouldn’t take very much to try to poach a couple of the scientists.”

Evolution?

Mr Wilcoxon says HIPO approached him, although Mr Feilich says they were introduced by mutual associates.

Mr Feilich says the deal is part of a wider move to broaden the company from just resources after a restructure that started in February to ditch niche projects, pay down debt, and buy an option over a lithium and cobalt project next to AVZ’s in the Democratic Republic of Congo.

HIPO is a $5.7 million company with $1.7 million in cash in the bank at the end of June.

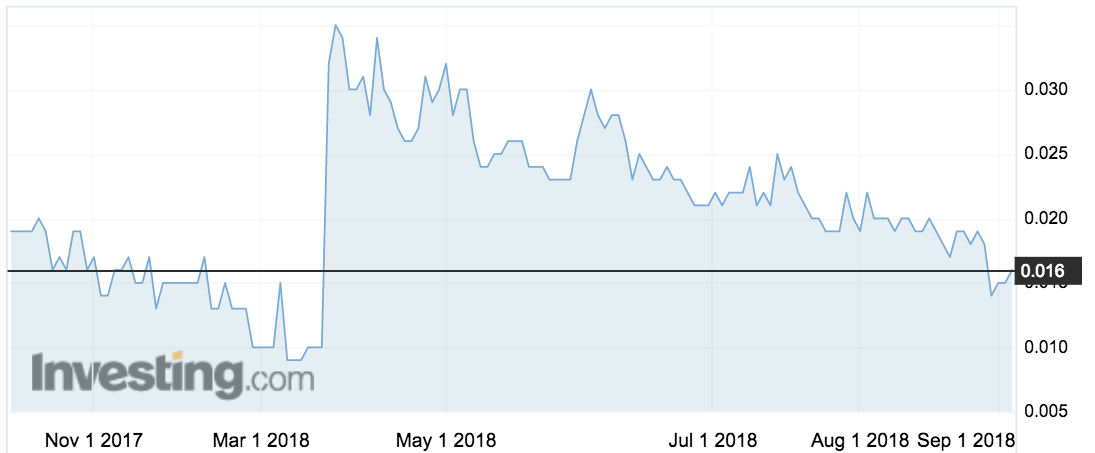

Its shares closed up 7 per cent on Tuesday to hit 1.6c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.